The Russian ruble sank on Monday against the US dollar and the euro but remained well above the all-time lows. On Tuesday, the currency retained weakness versus the dollar but moved a bit higher against the euro. The ruble sank 2.3 percent against the US currency and 4.1 percent versus the shared currency of the eurozone during the first trading session of the week. Yet Russian markets showed muted reaction to the news as they were mostly concerned … “Russian Ruble Sink on Monday”

Month: August 2015

Euro Surges During China’s Scare

The euro surged 2 percent against the US dollar and climbed against the Great Britain pound as well during Monday’s trading as Chinese shares plunged, dragging down stocks of other countries along with them. The currency was far less successful versus the Japanese yen, dropping more than 1 percent. China scared investors by another plunge of its stock market, driving speculators away from riskier assets. Yet … “Euro Surges During China’s Scare”

Shekel Gains vs. Dollar as Israeli Central Bank Prefers to Keep Rates Stable

The Israeli new shekel gained against the US dollar (but fell versus the euro) as the nation’s central bank refrained from cutting interest rates at today’s policy meeting even though Israel’s economy is struggling. The Bank of Israel maintained its key interest rate at 0.1 percent today. While such decision was in line with expectations of most market analysts, economists were criticizing the decision. For example, Eldad Tamir, … “Shekel Gains vs. Dollar as Israeli Central Bank Prefers to Keep Rates Stable”

South African Rand Touches Record Low

The trading week has started with a sharp rise in risk aversion as the meltdown of the Chinese stock market continued. Currencies of emerging economies suffered as a result, including the South African rand that has touched the all-time low during today’s trading session. The Shanghai Stock Exchange Composite Index dipped as much as 8.5 percent, causing rout of shares all around the world. It was followed by the drop of riskier currencies, like the rand. … “South African Rand Touches Record Low”

Global Jitters Don’t Help Canadian Dollar

Global stock market jitters aren’t helping the Canadian dollar today. Loonie is weakening against its major counterparts as stocks fall around the world and as oil prices continue to drop. All over the world stocks are falling. North American markets started this morning by plummeting. At one point the S&P/TSX dropped by more than 700 points, although some of those losses have been pared by now. In the United States, … “Global Jitters Don’t Help Canadian Dollar”

USD/JPY: Trading the Conference Board Consumer Confidence Index

The Conference Board Consumer Confidence Index is based on a monthly survey of about 5,000 households regarding their opinion of the economy. Its release always has a strong impact on market prices. A reading which is higher than expected is bullish for the US dollar. Here are all the details, and 5 possible outcomes for … “USD/JPY: Trading the Conference Board Consumer Confidence Index”

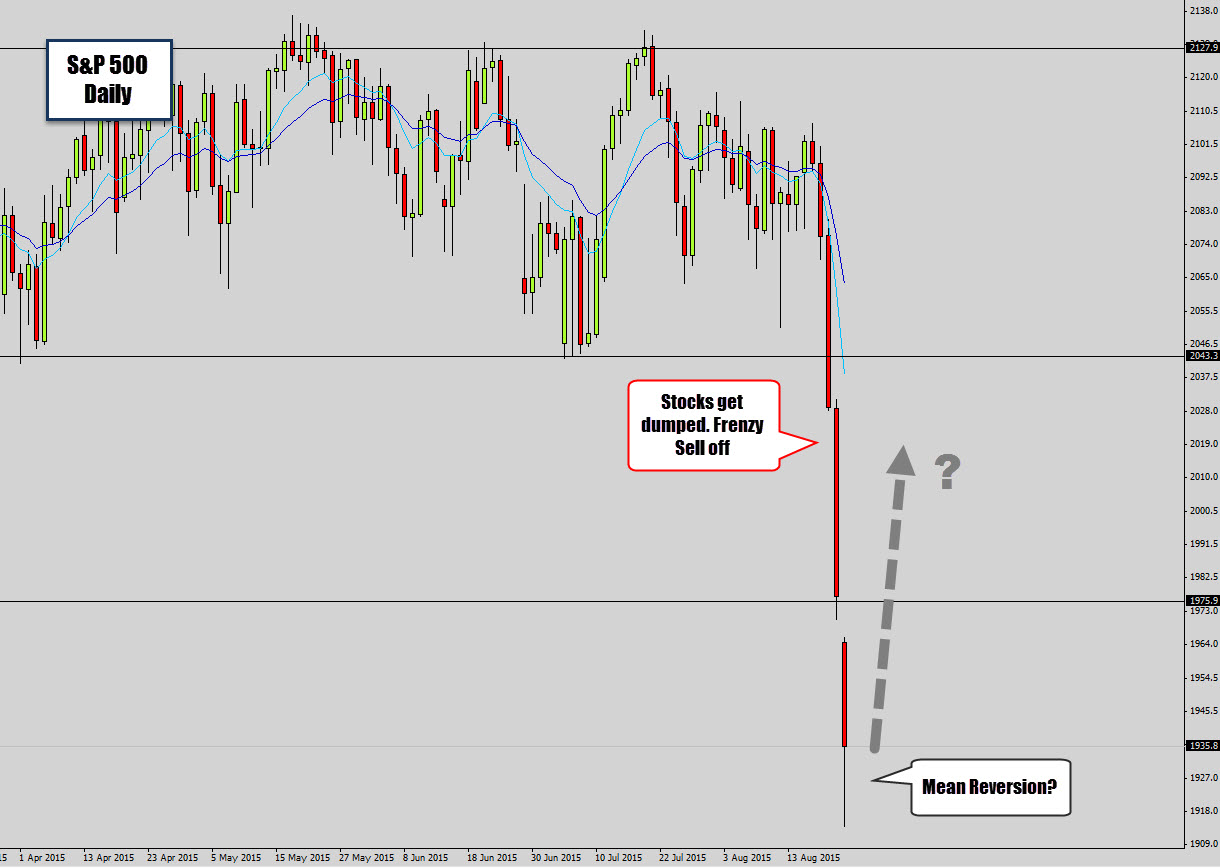

S&P Crashes After US Stocks Get Dumped – Mean

Traders were shocked by almost a mini market crash, what certainly looks like a very serious situation at least on the daily chart. We’ve had 3 days of intense selling as investors dump US stocks, causing the S&P, and the DOW to drop like a rock. Simple mean value analysis tell us that the market … “S&P Crashes After US Stocks Get Dumped – Mean”

EUR/USD Timeline: What Drivers At What Horizons? We stay

EUR/USD shot to higher ground, riding on 3 global worries. What will drive it next? The team at Danske explain all the moving parts and why they remain short: Here is their view, courtesy of eFXnews: The increasingly hesitant stance from the FOMC is challenging our long-held view that USD should continue to strengthen ahead … “EUR/USD Timeline: What Drivers At What Horizons? We stay”

EUR/GBP relief rally might continue, USD/CHF looks heavy; Gold

The summer markets imply that exaggerating moves might be seen in forex, notes Steven Woodcock, Senior FX Analyst at Plutus FX, as he joins Tip TV to share the outlook for EUR/GBP, USD/JPY, USD/CAD, USD/CHF and Gold. EUR/GBP seeing a relief rally Woodcock maintains his positive outlook on the cross, expecting a continuation of the … “EUR/GBP relief rally might continue, USD/CHF looks heavy; Gold”

Week of Fed Minutes Ends with Losses for US Dollar

The US dollar has started the past trading week with a rally but it did not last long. The currency reversed its movement rather quickly and was moving down for the most part of the week. The Federal Reserve’s policy minutes were the major contributor to the greenback’s weakness. The dollar started this week’s trading on a strong footing despite negative macroeconomic data. Yet the currency had troubles keeping its strong performance … “Week of Fed Minutes Ends with Losses for US Dollar”