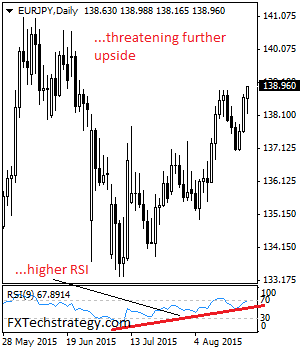

EURJPY: The cross extended its recovery on Thursday leaving risk of additional strength on the cards. While the 137.05 level remains as support, its short term uptrend remains intact. Resistance lies at the 139.50 level. Further out, resistance resides at the 140.00 level where a break if seen will threaten further upside towards the 140.50. … “EURJPY: Bullish, Maintains Short Term Uptrend”

Month: August 2015

Orbex Announces Financial Seminars in Malaysia

Cyprus based forex broker Orbex is expanding its reach and reaching out to financial investors in Malaysia. Here are details about these webinars from the official press release: Orbex is hosting the exclusive Malaysia Financial Investments Seminar 2015 taking place in Kuala Lumpur and Johor Bahru on the 6th and the 12th September respectively. The event … “Orbex Announces Financial Seminars in Malaysia”

Admiral Markets launches Trading Calculator

Traders often lack the data they real need to calculate their trades. Forex Broker Admiral Markets addresses this with a new trading calculator. Here is more information from the official press release: Admiral Markets is pleased to announce, the long awaited Trading Calculator, which will be available on our website on the 21st of August. The Forex & … “Admiral Markets launches Trading Calculator”

USD Yield Support Waning; How To Position? – BNPP

The US dollar has been struggling in the current risk off environment and this is also seen in the yields. How should we position? Here are some answers from BNP Paribas: Here is their view, courtesy of eFXnews: The USD continues to struggle against the G10 funders amid diminished expectations for a September rate hike … “USD Yield Support Waning; How To Position? – BNPP”

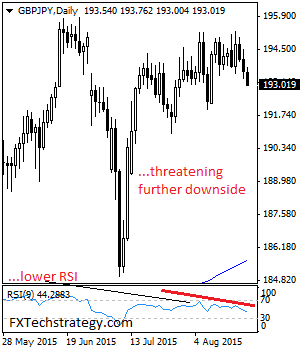

GBP/JPY: Bear Pressure Builds Up On The 191.93 Level

GBPJPY may be consolidating within its broader range but looks to weaken further towards the 191.93 zone. On the downside, support comes in at the 192.00 level where a violation will aim at the 191.00 level. A break below here will target the 190.00 level followed by the 189.00 level. Its daily RSI is bearish … “GBP/JPY: Bear Pressure Builds Up On The 191.93 Level”

Euro Jumps with Help of Fed Minutes & Greek Bailout

The euro jumped today against its most-traded counterparts, climbing more than 1 percent against the US dollar. Both domestic and overseas news contributed to the rally of the shared 19-nation currency. One of the major contributors to the euro’s strength was the weakness of the dollar. The greenback fell after the dovish Federal Reserve minutes, helping other currencies to rally. Yet this alone could not explain the surge of the euro, as it rallied not just … “Euro Jumps with Help of Fed Minutes & Greek Bailout”

US Dollar Remains Soft

The US dollar extended its weakness today following yesterday’s minutes of the Federal Reserve’s latest policy meeting. Economic reports from the United States were mixed today, but traders preferred to pay attention to the negative part of the data. Thursday’s US macroeconomic data did not give an edge to the dollar one way or the other. On one hand, jobless claims rose unexpectedly last week and the leading indicators demonstrated a surprise drop … “US Dollar Remains Soft”

Retail Sales Weigh on UK Pound

The latest retail sales data out of the United Kingdom has disappointed analysts and the pound is heading lower as a result. Concerns that the Bank of England won’t be ready to tighten monetary policy are weighing on the sterling. Sterling’s recent rally has been halted, thanks to the release of the most recent retail sales data. Even though retail sales increased from June to July, they didn’t increase as much as expected. On top … “Retail Sales Weigh on UK Pound”

Risk Aversion Weighs on Australian Dollar

Aussie is heading lower right now, thanks in large part to uncertainty and risk aversion. Lower stocks and commodity losses earlier are contributing to a lower Australian dollar right now. Earlier, commodities including gold and oil fell back. Even though both commodities are moving higher right now, commodity currencies like the Australian dollar remain spooked. Aussie is struggling right now, after seeing some … “Risk Aversion Weighs on Australian Dollar”

GBPUSD Facing Barrier around $1.5700

Talking Points British Pound has made a couple of attempts to clear $1.5700 against the US Dollar but failed. UK Retail Sales released by the National Statistics registered a rise of +0.1% in July 2015, which was lower compared with the forecast of a +0.4% increase. In terms of the yearly change, there was a … “GBPUSD Facing Barrier around $1.5700”