GOLD: The commodity rallied strongly on Wednesday leaving risk of further upside on the cards. This price development leaves bulls on the offensive towards the 1,147.00/1,150.00 area. Support comes in at the 1,126.00 level where a break will aim at the 1,110.00 level. A cut through here will open the door for move lower towards … “GOLD: Rallies, Resumes Short Term Uptrend”

Month: August 2015

Crude Oil Prices Drag Canadian Dollar Down

The Canadian dollar sank yesterday and retained its weakness today as falling crude oil prices dragged the currency down along with them. The drop of the US dollar could have helped the loonie, but in practice it had a minimal impact if any at all. Crude oil continued to fall, trading below the $50 level. Prices dropped on Wednesday due to the unexpected buildup of US reserves that increased concerns about oversupply … “Crude Oil Prices Drag Canadian Dollar Down”

Dollar Weaker After Fed Minutes

The US dollar dropped yesterday after the release of the Federal Reserve policy minutes and continued to move lower today (though not against all major rivals). The report sent a confusing message to the markets, but most market participants considered it to be dovish. The Fed released the minutes of its July meeting yesterday. On one hand, they said that many policy makers thought the time for an interest rate lift-off is nearing: … “Dollar Weaker After Fed Minutes”

AUD/USD: Trading the Chinese Caixin PMI August 2015

Chinese Caixin Flash Manufacturing PMI is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in China, and a reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes … “AUD/USD: Trading the Chinese Caixin PMI August 2015”

September hike still on the cards after FOMC Minutes –

The FOMC minutes were released early and dealt a blow to the greenback on the lack of conviction for a rate hike. But could we have expected something really hawkish? The team at CIBC provides some answers: Here is their view, courtesy of eFXnews: The Fed couldn’t be THAT hawkish in July, or they would have raised … “September hike still on the cards after FOMC Minutes –”

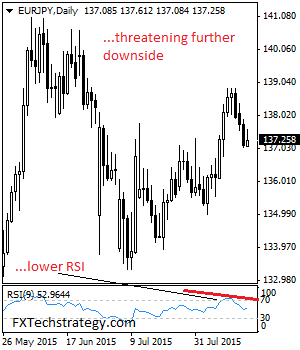

EURJPY: Set To Weaken Further Towards 136.50

EURJPY: The cross remains weak and vulnerable to the downside with eyes on its support located at the 136.50 level. On the downside, support comes in at the 136.50 level where a break will aim at the 136.00 level. A turn below here will target the 135.50 level with a breach turning spotlight on the … “EURJPY: Set To Weaken Further Towards 136.50”

Vietnam’s Central Bank Devalues Dong

The Vietnamese dong dropped today as Vietnam’s central bank devalued the currency for the third time this year. Nation’s policy makers weakened the currency in hopes to counter the fallout from Chinese economic slowdown and potential currency wars. The rapidly falling yuan can increase the already substantial trade deficit between Vietnam and China, and that prompted the State Bank of Vietnam to set the reference rate for the dong 1 percent lower and widen the range in which … “Vietnam’s Central Bank Devalues Dong”

China Drives New Zealand Dollar Lower

Economic data from New Zealand was not particularly positive today, but it was likely not the reason for the drop of the New Zealand dollar. News from China, the biggest trading partner of the South Pacific nation, was the driving force behind the decline. Both input and output New Zealand Producer Price Indexes fell last quarter, but the reading could not be considered really bad as the decline was … “China Drives New Zealand Dollar Lower”

Euro Heads Higher After German MPs Approve Greek Bailout

With Germany backing the latest bailout for Greece, the euro is heading higher today. There’s a lot to consider when it comes to the eurozone and the euro, and the latest bailout means that, for now, there will be no exit from the 19-nation currency union for Greece. Questions about whether or not German politicians would approve the latest Greek bailout have been swirling for weeks now. Those questions have been answered … “Euro Heads Higher After German MPs Approve Greek Bailout”

Canadian Dollar Remains Lukewarm

Canadian dollar remains lukewarm in Forex trading against its major counterparts today. There isn’t a whole lot to either push the loonie forward or drag it back, and it is mostly rangebound today. Even though Canadian Prime Minister Steven Harper recently insisted that there is room for solid growth for the economy, evidence of this growth isn’t likely to be immediately forthcoming. Instead, the Canadian economy seems … “Canadian Dollar Remains Lukewarm”