British Retail Sales is considered one of the most important economic indicators. A reading that is higher than the market forecast is bullish for the British pound. Update: UK Retail Sales only +0.1% – GBP slides Here are all the details, and 5 possible outcomes for GBP/USD. Published on Thursday at 8:30 GMT. Indicator Background Retail Sales is the primary … “GBP/USD: Trading the British Retail Sales Aug 2015”

Month: August 2015

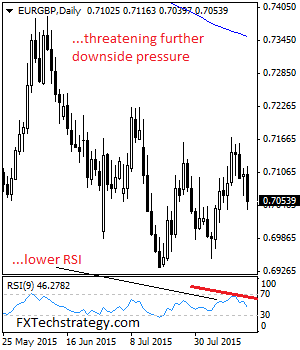

EURGBP: Declines, Extends Downside Pressure

EURGBP: With the cross extending its weakness on Tuesday, risk of further downside pressure is likely. This development leaves support standing at the 0.7050 level where a violation will turn focus to the 0.7000 level. A break below here will expose the 0.6950 level. Further down, support comes in at the 0.6900 level. Its daily … “EURGBP: Declines, Extends Downside Pressure”

Turkish Lira Holds Ground After Central Bank Maintains Interest Rates

The Turkish lira rose a little versus the US dollar and traded sideways against the euro following yesterday’s decision of the Turkish central bank to hold interest rates steady. The Central Bank of the Republic of Turkey decided to keep borrowing costs unchanged, including the benchmark overnight interest rate that remained at 10.75 percent. The central bank was talking about possibility of tighter monetary policy, but experts consider monetary tightening unlikely. Weak … “Turkish Lira Holds Ground After Central Bank Maintains Interest Rates”

Dollar Mixed After Housing Data

Today’s data from the United States was mildly supportive for the US currency, which has been also bolstered by the general risk-negative market sentiment. The dollar gained on the euro but fell versus the Great Britain pound and was flat against the Japanese yen. US housing data was a bit mixed as housing starts came out below expectations. Still, the indicator was at its highest level since October 2007. The strong … “Dollar Mixed After Housing Data”

Euro Could See Strength Down the Road

Now that the worst fears of the eurozone have been put to rest, there is some speculation that the 19-nation currency could return strength in the not-to-distant future, thanks in part to recovery in Spain and stability for Greece. For now, it appears that a measure of stability is returning to the eurozone. Another bailout package has been approved for Greece, and it appears that the country will remain in the eurozone for now. Indeed, even German officials … “Euro Could See Strength Down the Road”

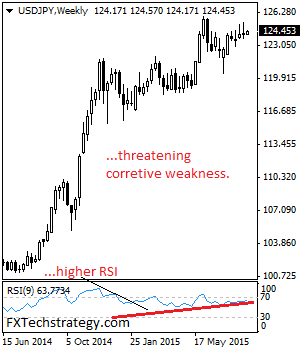

USDJPY: Susceptible, Faces Corrective Weakness Risk

USDJPY: Having capped its strength at the 1.2506 level to close marginally higher the past week, further corrective weakness is envisaged. On the upside, resistance resides at the 124.50 level with a turn above here aiming at the 125.00 level. A break will target the 125.50 level. Further out, resistance comes in at the 126.00 … “USDJPY: Susceptible, Faces Corrective Weakness Risk”

Yen Performs Better Thanks to Woes of Chinese Stock Market

The Japanese yen performed far better today than yesterday. The reason for this was another huge drop of Chinese stocks that drove investors to seek safe assets. The benchmark Shanghai Stock Exchange Composite Index sank more than 6 percent during the current trading session, reinforcing fears of slowdown of the world’s second biggest economy. The news prompted market participants to seek out safe options, like the yen and Swiss … “Yen Performs Better Thanks to Woes of Chinese Stock Market”

Pound Rises as Data Shows Growth of Consumer Prices

The Great Britain pound demonstrated a big jump today, touching the highest level in a month and a half following the release of inflation data. The report showed that consumer prices rose last month, albeit just marginally. The UK Consumer Prices Index was up 0.1 percent in July from a year ago. However small has been the growth, it was still better than the forecasts that promised no growth at all. … “Pound Rises as Data Shows Growth of Consumer Prices”

EUR/USD: Trading the US Core CPI August 2015

US Core CPI measures the change in the price of goods and services charged to consumers. A reading which is higher than the market forecast is bullish for the dollar. Update: US core inflation 1.8% y/y, monthly figures disappoint – USD rises after the initial dip Here are all the details, and 5 possible outcomes for … “EUR/USD: Trading the US Core CPI August 2015”

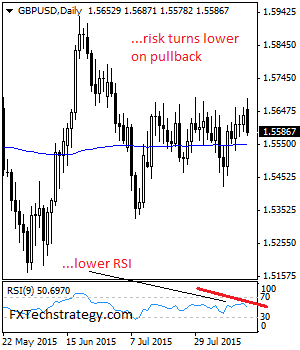

GBPUSD: Loses Upside Momentum, Weakens

GBPUSD: Having GBP reversed its Friday gains during Monday trading session, the risk is more weakness to occur. While holding below its cluster of resistance at the 1.5689/77 zone, further decline is likely towards the 1.5550 level where a break if seen will aim at the 1.5500 level. A turn below here will shift attention … “GBPUSD: Loses Upside Momentum, Weakens”