While the world’s attention has been focused on ECB this year, Sweden has kept a ‘low profile’. However, Sweden seems to be caught in the same persistent disinflation as the rest of the EU, Eurozone or not. What then distinguishes the Swedish Krona from the Euro?

According to Eurostat, Sweden’s real GDP year over year growth rate is 2.3% compared with the EU-28 real growth rate of 1.4%. Its per capita GDP in terms of EU28 purchasing power standards is 24% higher than the EU-28 average. Government (gross) debt is 43.9% of GDP, nearly half that of the EU-28 average of 86.8% of GDP. By the EU’s Harmonized Indices of Consumer Prices within the EU-28, the average annual inflation rate is 0.2%. Foreign investment activity is about 1.75 times the EU-28 average. As one might expect, Sweden’s longer term bond yields are somewhat suppressed by the ECB asset purchase program, and possibly as a safe haven asset; the ten year bond is currently yielding at 0.66%; Fitch AAA rated.

Guest post by Mike Scrive of Accendo Markets

The nation’s unemployment rate, although high at 7.9%, is lower than the EU-28 average of 10.2%; annual labor costs are about 1.5 times the EU-28 average. Sweden’s population comprises nearly 2% of the total EU-28 and income distribution is more equitable than the EU-28 average.

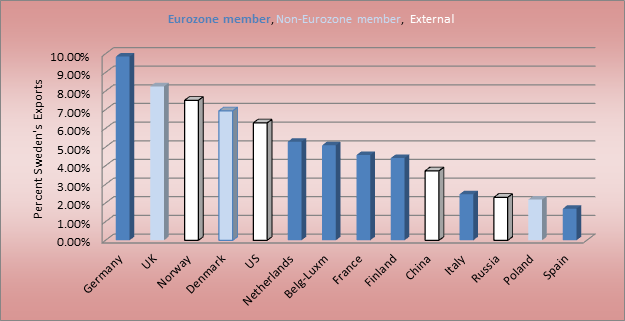

When it comes to trade, in 2014 Sweden recorded a positive balance of trade, globally at €1.328 billion; 68% of Sweden’s imports are from the EU-27 and 58.3% of exports to the EU-27. It’s worth noting that 61.8% of Sweden’s electricity production is from renewables: over 60% from wind and 1.9% from solar, hence a lower dependence on imported resources.

What it all amounts to is that Sweden’s economy is, in general, performing above the EU-28 average. A nine month EUR/SEK chart demonstrates the volatility of the Euro vs the Krona. In mid-February, the Krona traded at 9.6091 to the Euro, just before reversing to the low for 2015 at 9.11773 per Euro; a 5% gain. What seemed to have initiated the reversal were a step reduction of its benchmark repurchase agreement rate to -0.1 from 0.0% and the initiation of a £750 million asset purchase program. The extraordinary measures may have resulted from its persistent -0.3% annualized inflation rate.

In the Eurozone, the ECB was struggling with the Greek-EU impasse, at one point refusing to accept Greek sovereign debt as collateral. Also, sovereign bond yields in the top performing Eurozone economies were hovering around 0.0%. At issue was a question of sufficient bond liquidity ahead of the ECB’s asset purchase program. Lastly, in spite of all the problems, Germany’s economy expanded a greater than expected in Q4 at 0.7%. In general, the Eurozone grew at a Q4 0.3% pace. Within a few days, Sweden too would report a much greater than expected GDP expansion in Q4: 1.1% vs. 0.5% expectations, thus also making a positive contribution to the EU.

The reversal from the March low was likely in response to February’s positive CPI indications; up 0.1%. In what seemed to be a pre-emptive strike against deflation; Riksbank unexpectedly cut rates again, 18 March, to -0.25%. Governor Stefan Ingves cited the sharp strengthening of Krona vs. the Euro. The move seemed to work, as the Krona weakened nearly 3% from the low. From the 18 March through 23 July, EUR/SEK traded in a range of 9.2138 support to 9.3952 resistance.

However, the Crown was still too strong as far as Riksbank was concerned.

In mid- April Riksbank’s Governor Ingves publically voiced his concerns over the strengthened Krona. Further, he directly referred to the ECB asset purchase program: “...The ECB is operating extremely expansive monetary policies… …We don’t want our currency to appreciate too strongly and push import prices down. That speaks for negative interest rates …At the same time, the events in the euro zone have an influence on us and our exchange rates…” This is an important point to consider. Riksbank had already responded pre-emptively in March and instituted an asset purchase program one month prior to the commencement of the ECB asset purchase program. At the April policy meeting Riksbank announced an expansion of its asset purchase program and maintained its negative policy rate. Sweden’s economic data continued to improve. In April PMI had gained; a decline was expected. However, deflation concerns persisted with month over month CPI -0.2% and annualized -0.2%. Deputy Governor warned that the bank might act between meetings. Riksbank did indeed reduce its benchmark rates again, but did so at the regularly scheduled July meeting.

The Krona did weaken, rallied a bit and broke through support 9.3952 Krona by the end of July. New economic data didn’t disappoint, but nor did it encourage. Manufacturing PMI remained nearly flat and CPI remained flat to negative. It was at this time that ECB concerns shifted from Greek-EU impasse to the economic contraction in the Far East. It was at the end of August when ECB Vice president Constancio observed that the ECB asset purchase program was relatively small compared to previous US, UK and Japanese programs (relative to GDP) and that the bank would utilize its leverage if required.

The foregoing narrative points out that Sweden is one of the stronger of the EU economies which in large part depends on inter-EU trade. It has proven its determination to protect its trade partnership, through its defense of the Crown. The Crown does share something in common with the Euro: chronic disinflation. Both the ECB and Riksbank have implemented policies, separately, to reverse this ongoing trend.

Governor Stefan Ingves has stated and has acted accordingly to all three issues: currency strength, deflation and capital inflows. The point though is that Riksbank is far more nimble than the ECB. It’s far more complicated for the ECB to act decisively between meetings. Hence, any strengthening in the Krona below 9.3422 to the Euro should serve as an alert for unexpected Riksbank action.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”