How will the Fed decision impact the US dollar. It doesn’t depend solely on the rate hike. Here is the view from Credit Agricole, which also sees an upside for the USD against the euro and the yen: Here is their view, courtesy of eFXnews: The September FOMC decision is the main event this week … “Fed Up With The USD Or Not Just Yet? – Credit Agricole”

Month: September 2015

Fedilemma – all you need to know towards the critical

To hike or not to hike? The answer is coming and you should get ready. The September Fed decision is here and markets are holding their breath. We cover the Federal Reserve’s dilemma about a rate hike, potential market reaction and all the moving parts. We then cover the upcoming Greek elections and finish with Brazil. You are welcome … “Fedilemma – all you need to know towards the critical”

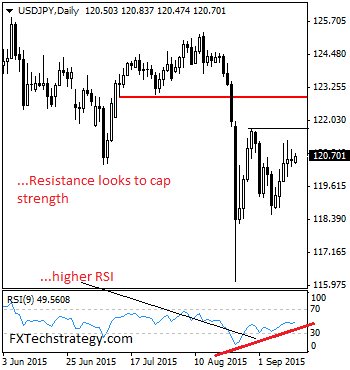

USDJPY: Resistance Looks To Cap Further Strength

USDJPY: The pair took back some of its previous week losses at the end of the week leaving risk to the upside. However, with price failure seen ahead of its key overhead resistance zone at 121.73/63 zone, we may see USDJPY weaken in the new week. On the upside, resistance resides at the 121.00 level … “USDJPY: Resistance Looks To Cap Further Strength”

EUR/USD: Trading The German ZEW Sep 2015

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 9:00 GMT. Indicator Background … “EUR/USD: Trading The German ZEW Sep 2015”

Overvalued and undervalued currencies – BofA Merrill

We often look at oversold and overbought conditions with currency pairs after significant moves. And what about the bigger picture? The team at Bank of America Merrill Lynch has some interesting observations for USD, EUR, AUD, NZD, CAD and more: Here is their view, courtesy of eFXnews: In a note to clients today, Bank of … “Overvalued and undervalued currencies – BofA Merrill”

Euro Higher vs. Dollar & Other Peers by Weekend

With all the talks about monetary tightening in the United States and quantitative easing in the eurozone, the euro was still rising against the US dollar. The euro’s performance against other currencies was also strong with the exception of the Great Britain pound. The shared 19-nation currency was rising against the greenback due to the improving risk sentiment and speculations that the Federal Reserve is not going to start monetary firming this month. Risk … “Euro Higher vs. Dollar & Other Peers by Weekend”

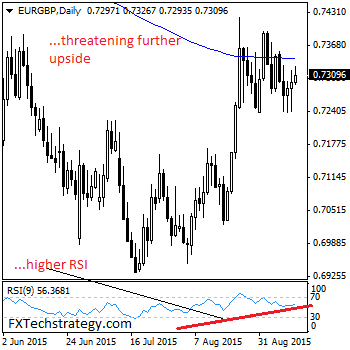

EURGBP Rejects Lower Prices, Holds Recovery Tone

EURGBP: With the cross printing a rejection candle on Thursday to close higher though marginally, it faces the risk of further upside pressure. On the upside, resistance lies at the 0.7350 level where a violation if seen will turn risk towards the 0.7400 level. Further out, the 0.7450 level comes in as the next upside … “EURGBP Rejects Lower Prices, Holds Recovery Tone”

US Dollar Heads Higher as Risk Aversion Take Hold

US dollar is heading higher as risk aversion appears in the market, and as commodities continue to struggle. There is a lot happening right now that points to a higher greenback, and it is little surprise that the US currency is once again moving higher against its major counterparts. US dollar is gaining ground today against its major counterparts, thanks in large part to much of what’s happening around … “US Dollar Heads Higher as Risk Aversion Take Hold”

EUR/USD might accelerate higher into FOMC rate decision, Buy

In today’s Tip TV Forex Forecast, Steven Woodcock, Senior Analyst at Plutus FX, offers the outlook for EUR/USD, USD/CAD, AUD/USD and USD/JPY. Good time to buy the greenback Woodcock remains a long term dollar bull and notes that the greenback is currently seeing a short-term pullback and it’s a good time to buy the USD. … “EUR/USD might accelerate higher into FOMC rate decision, Buy”

Euro Falters as Eurozone Leaders Talk About Unemployement

Euro is struggling again as eurozone leaders gather to talk about unemployment. Concerns that economic gains aren’t translating into jobs are weighing on policymakers and others. Of special concern is the disparity in joblessness between northern European countries and those in the south. Right now, eurozone leaders are meeting to discuss the challenges of unemployment in the eurozone. Even though the jobless rate is one of the lowest in three years, sitting at 10.9 per … “Euro Falters as Eurozone Leaders Talk About Unemployement”