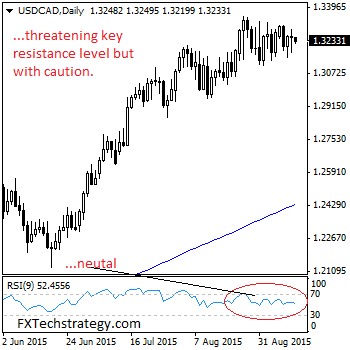

USDCAD: USDCAD remains in a consolidation mode having continued to trade in a range below its key resistance zone at 1.3352. A break either way must occur to trigger directional moves. Resistance resides at the 1.3300 level where a break will target the 1.3350 level. Further out, resistance comes in at the 1.3400 level where … “USDCAD: Consolidates Below Key Resistance Zone.”

Month: September 2015

NZ Dollar Backs Off After Rally

The New Zealand dollar attempted to rally today following yesterday’s big slump. The currency backed off after the initial gain and remained close to the opening level. Economic data from New Zealand was mixed, giving the kiwi no clear bias. On the positive side, the Business NZ Manufacturing Index improved in August, showing expansion of the manufacturing sector. On the negative side, food prices went into deflation last month. The New Zealand … “NZ Dollar Backs Off After Rally”

Japanese Yen Posed to End Week Among Losers

The Japanese yen paused its decline today but will likely end the week as the weakest among major currencies. The yen had limited support from Japanese macroeconomic data released during Friday’s trading. The BSI Manufacturing Index climbed 11.0 percent during the third quarter of this year, providing a surprise to analysts, most of whom were counting on decline. The positive report supported the currency but only to a limited degree. Traders … “Japanese Yen Posed to End Week Among Losers”

A Cheat Sheet For Trading The FX Market Right Now – BNPP

Less than a week before the all important Fed decision, and there seems to be a mix of tension and confusion in markets. What’s going on? The team at BNP Paribas try to explain: Here is their view, courtesy of eFXnews: Currency market participants have returned from their summer breaks to a challenging market environment … “A Cheat Sheet For Trading The FX Market Right Now – BNPP”

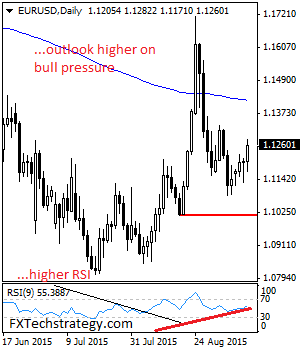

EURUSD: Bull Pressure Turns Risk Towards 1.1331 Level

EURUSD: EUR looks to strengthen further following a strong bullish offensive during Thursday trading session. A follow-through higher on that gain is expected to create scope for more recovery with eyes on its key resistance at 1.1331 level. Resistance is seen at 1.1300 level with a cut through here opening the door for more upside … “EURUSD: Bull Pressure Turns Risk Towards 1.1331 Level”

US Dollar Index Pulls Back as Euro Gains Ground

US dollar is pulling back today, now that the euro is gaining ground. Greenback is mostly lower against its major counterparts, and the weighting in the basket of currencies that make up the dollar index is bringing the US currency lower. The US dollar index is heading lower today, thanks in large part to a recovery from the euro. The 19-nation currency was lower earlier but is now gaining against … “US Dollar Index Pulls Back as Euro Gains Ground”

EUR/USD: Trading the UoM Consumer Index – Sep. 2015

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Here are all the details, and 5 possible outcomes for EUR/USD. Update: US consumer confidence misses with 85.7 … “EUR/USD: Trading the UoM Consumer Index – Sep. 2015”

Pound Gains on Bank of England Rate Hike Talk

Pound is heading higher today, thanks in large part to the latest talk of a rate hike from the Bank of England. Even though the latest manufacturing data was a bit weak, expectations that the BOE will need to raise rates soon is helping sterling against its major counterparts. Sterling is a bit higher today as speculation about a Bank of England rate hike continues. Policymakers remain mostly unshaken by concerns … “Pound Gains on Bank of England Rate Hike Talk”

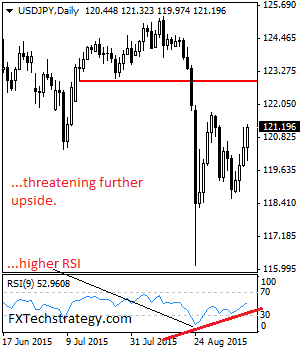

USDJPY Builds Up On Bullish Offensive

USDJPY: With earlier gains taken back and a bull pressure now seen, a move further higher towards the 122.00 level could occur. On the upside, resistance resides at the 122.00 level with a turn above here aiming at the 122.50 level. A break will target the 123.00 level. Further out, resistance comes in at the … “USDJPY Builds Up On Bullish Offensive”

Employment Data Rescues Australian Dollar

The Australian dollar rallied today on the back of Australia’s positive employment data, reversing the earlier decline that was threatening to bring the currency back to its multi-year lows. The seasonally adjusted estimate of Australian employment increased by 17,400 in August from the previous month — more than 3 times the forecast growth. The unemployment rate ticked down by 0.1 point to 6.2 percent, but this could be attributed to the lower participation rate. … “Employment Data Rescues Australian Dollar”