Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Sep 2015”

Month: September 2015

Optimistic Mood Lifts Canadian Dollar

The Canadian dollar rallied together with other commodity currencies today due to the uplifted mood of Forex traders. Now, speculators focus on the central bank’s policy meeting scheduled for tomorrow. Traders were speculating that the US central bank is not ready to start the cycle of monetary tightening just yet. Such talks bolstered prices for commodities and, by the same token, currencies related to raw materials. The loonie was one of them, … “Optimistic Mood Lifts Canadian Dollar”

Euro Moves Higher Against Dollar as Better News Helps Risk Appetite

Euro is gaining today as good news out of the eurozone provides a boost. Risk appetite is returning to the markets today, and euro is getting some help from that, even though lately the euro has been treated more like a safe haven. In recent weeks, the euro has been used to fund carry trades, with its low rate. Now, though, the 19-nation currency is getting a bit of a boost … “Euro Moves Higher Against Dollar as Better News Helps Risk Appetite”

Aussie Rallies in Face of Negative Economic Data

The Australian dollar climbed more than 1 percent against the US dollar and the Japanese yen. The currency rallied even as macroeconomic data from China and Australia itself was rather negative. The NAB Business Confidence index deteriorated slightly in August, falling from 4 to 1. China’s imports and exports declined in August, though this resulted in a better trade balance as imports dropped more than exports. Yet the Aussie rallied despite … “Aussie Rallies in Face of Negative Economic Data”

Yen Falls as Market Sentiment Strengthens

The Japanese yen dropped today even though economic data from Japan was better than economists’ expectations. Market analysts thought that the reason for the drop was the improvement of the traders’ sentiment. Japan’s gross domestic product contracted 0.3 percent in the second quarter of this year. It was not a very good reading by itself, but at least it was a tad better than the consensus forecast that had promised … “Yen Falls as Market Sentiment Strengthens”

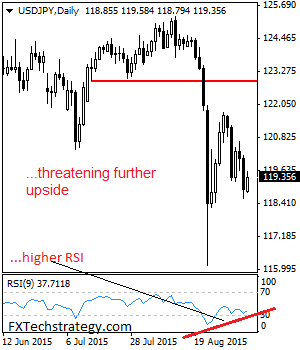

USDJPY Recovers Higher On Price Halt

USDJPY: With the pair halted its weakness to strengthen on Monday, it faces the risk of further move higher in the days ahead. On the upside, resistance resides at the 120.00 level with a turn above here aiming at the 120.50 level. A break will target the 121.00 level. Further out, resistance comes in at … “USDJPY Recovers Higher On Price Halt”

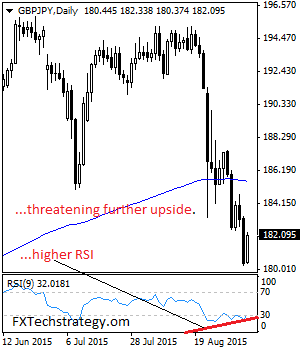

GBPJPY: Rallies Off 180.37 Zone, Set To Extend Strength.

GBPJPY: With the cross halting its weakness to trigger a rally during Monday trading session today, further bullish offensive is expected in the days ahead. This price action leaves room for more strength towards the 183.00 level followed by the 184.00 level. A cut through here will set the stage for a move further higher … “GBPJPY: Rallies Off 180.37 Zone, Set To Extend Strength.”

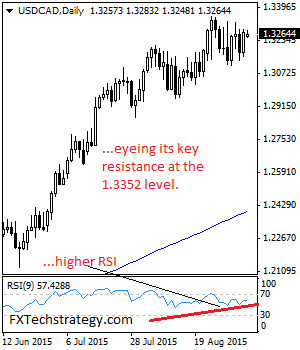

USDCAD Looks To Extend Bullishness, Eyes The 1.3352 Zone

USDCAD: With USDCAD closing higher the past week, it now eyes a recapture of its key resistance located at the 1.3352 level. This view is consistent with its broader bullishness now in place. Resistance resides at the 1.3352 level where a break will target the 1.3400 level. Further out, resistance comes in at the 1.3450 … “USDCAD Looks To Extend Bullishness, Eyes The 1.3352 Zone”

Draghi degrades the euro into a second tier safe haven

Draghi giveth and Draghi drageth away. The euro’s behavior in recent months is experiencing a change. ECB pushes EUR down The European Central Bank sent EUR/USD from the highs of nearly 1.40 in May 2014 to under 1.05 in March 2015. ECB president Mario Draghi first hinted of a negative rate in May 2014 and then acted … “Draghi degrades the euro into a second tier safe haven”

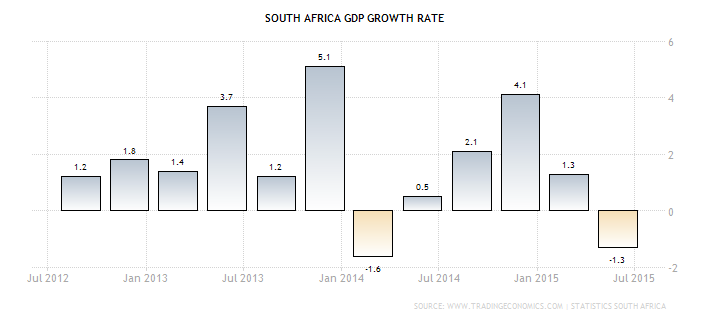

USD/ZAR: Out of Phase

BRIC was original acronym for the four emerging market nations of Brazil, Russia India and China. By 2010, the emerging market nation of South Africa showed so much promise the initial “S” was appended to BRIC, and thus henceforth known as BRICS. At the time, quarterly GDP growth was remarkable as demonstrated in the graph … “USD/ZAR: Out of Phase”