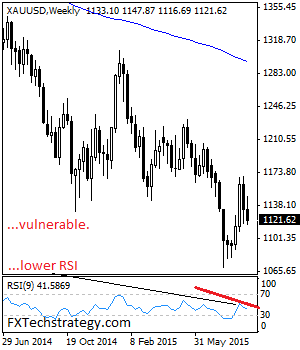

GOLD: GOLD declined further the past week leaving risk of more weakness on the cards. However, while it trades above its key support zone located at 1,109.00/1,117.00, we may see it head higher in the new week on recovery. On the downside, support comes in at the 1,110.00 level where a break will aim at … “GOLD Sees Second Week Of Declines”

Month: September 2015

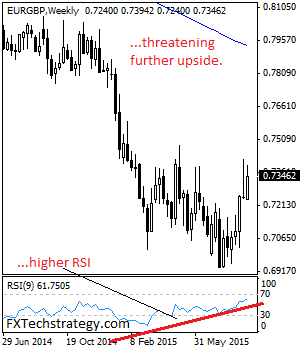

EURGBP Pushes Higher On Further Bull Pressure

EURGBP- With the cross strengthening further the past week, it looks to move further higher towards its key resistance seen at 0.7421 level. On the upside, resistance lies at the 0.7450 level where a violation if seen will turn risk towards the 0.7500 level. On further upside, the 0.7550 level comes in as the next … “EURGBP Pushes Higher On Further Bull Pressure”

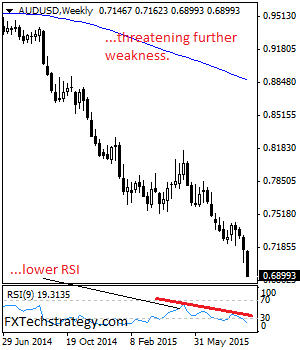

AUDUSD Sees Huge Sell Off, Retains Bearish Tone

AUDUSD: With AUDUSD selling off at the end of the week to follow through lower on the back of its previous week losses, more bear pressure is envisaged. On the downside, support resides at the 0.6800 level where a breach will aim at the 0.6750 level. Below that level will set the stage for a … “AUDUSD Sees Huge Sell Off, Retains Bearish Tone”

Canadian Dollar Fails to Rally as US Employment Overshadows Canadian

The Canadian dollar attempted to rally today on the back of the relatively positive domestic employment report but failed and logged significant losses. The reason for the unimpressive performance was non-farm payrolls. Canadian employment rose by 12,000 in August, almost two times the July’s growth of 6,600 and nowhere near the pessimistic analysts’ predictions of a drop by 4,800. Yet this did not prevent the unemployment rate from unexpectedly increasing by 0.2 percentage point to 7.0 percent. … “Canadian Dollar Fails to Rally as US Employment Overshadows Canadian”

Dollar Gains as Jobs Report Suggests Possibility of September Rate Hike

US dollar is heading higher today as analysts consider that the latest jobs data could point to a rate hike by the Federal Reserve this month. Speculation that the Fed would put off the rate hike has been rampant, but now it appears that a hike could be coming sooner than expected. The latest unemployment data from the United States shows that the economy added 173,000 nonfarm … “Dollar Gains as Jobs Report Suggests Possibility of September Rate Hike”

Stock market outlook: Volatility indicators point towards further downside

Paul Rodriguez – Director of ThinkTrading.com – joined Zak Mir in the Tip TV studio to discuss the equity markets, and how volatility indicators might be pointing to another large downside. FTSE set for a sharp down leg Rodriguez believes that the FTSE 100 is entering a period of consolidation, and believes that the bear … “Stock market outlook: Volatility indicators point towards further downside”

Draghi Comments Send Euro Lower

Euro is heading lower today, thanks in large part to the latest comments from ECB President Mario Draghi. With the European Central Bank adopting a dovish stance and talking about more easing, it’s little surprise that the 19-nation currency is heading lower against the greenback today. Euro is trading mixed today, dropping against currencies like the dollar and the yen, but gaining against the sterling and the loonie. The latest … “Draghi Comments Send Euro Lower”

NFP Analysis: 7 reasons why the Fed is likely to

The NFP report gave a little for everybody: weak headline number with 173K but positive revisions and annual wage growth rising to 2.2%. Also other factors are mixed: US data such as GDP looks good but the world looks weak, especially China. So what will the Fed do? Perhaps go ahead but make it “the most dovish … “NFP Analysis: 7 reasons why the Fed is likely to”

GBP Falls for Ninth Session vs. USD

The Great Britain pound dropped for the ninth consecutive day against the US dollar today. The currency was dragged down both by domestic reports and news from abroad. Released yesterday, the Markit/CIPS UK Services PMI came out at 55.6 in August, far below expectations. Moreover, it was the weakest reading in more than two years. Mario Draghi, President of the European Central Bank, made rather dovish comments yesterday, fueling … “GBP Falls for Ninth Session vs. USD”

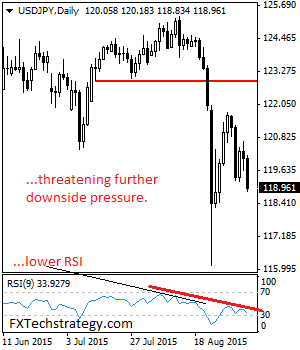

USDJPY Sells Off, Targets Further Downside Pressure

USDJPY: The pair followed through lower on the back of its Thursday weakness during early trading on Friday. This leaves risk of more weakness. On the downside, support comes in at the 118.50 level where a break will target the 118.00 level. Below here if seen will aim at the 117.50 level followed by the … “USDJPY Sells Off, Targets Further Downside Pressure”