The Japanese yen rallied today as the Forex market is preparing for the release of US employment data. The currency gained even though economic data from Japan itself was not particularly good. Traders anxiously anticipate the upcoming release of non-farm payrolls scheduled for 12:30 GMT today. A positive report would increase chances for an early interest rate hike, likely increasing risk aversion on the market. This allowed the yen, which is … “Yen Gains as FX Market Focuses on Upcoming US Employment Data”

Month: September 2015

EUR/USD: Trading the US NFP Sep 2016

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Update: Non-Farm Payrolls +173K but other data is positive … “EUR/USD: Trading the US NFP Sep 2016”

Draghi elegantly joins the currency wars – what he did

Draghi dragged down the euro and kept the drama going on. On his 68th birthday, the ECB president gave one of his best shows. He managed to push down the euro with minimal action and no commitment at all. Draghi showed his strength and quickly passed the ball to the others’ courts as if nothing had happened. Here is a … “Draghi elegantly joins the currency wars – what he did”

Services Sector Data Weighs on UK Pound

The latest data from the services sector is weighing on the UK pound, sending it lower against the dollar and the yen. While the pound is gaining against the euro, it is struggling in other areas as concerns about economic cooling impact performance. The latest data from Markit/CIPS shows that the Purchasing Managers’ Index (PMI) for August dropped to 55.6 from the July reading of 57.4. While it is true that anything … “Services Sector Data Weighs on UK Pound”

Dollar Regains Upper Hand on Expectations of Better News

It’s been a choppy few days for the world markets, but things seem to be smoothing out for now. The US dollar, after a few down days, is once again regaining the upper hand. Forex traders are focusing on expectations of better news out of the United States. Greenback is gaining against its European counterparts and the dollar index is higher today as Forex traders improve their expectations about what’s … “Dollar Regains Upper Hand on Expectations of Better News”

ECB Preivew: Draghi to join currency wars? 4 scenarios

The European Central Bank meets on September 3rd to decide on its policy and it has a lot to digest since its last meeting in mid July. Will we hear a more dovish tone from Draghi? Or will he wait for developments in China and the Fed? Here is the preview with everything that has changed … “ECB Preivew: Draghi to join currency wars? 4 scenarios”

Australian Dollar Continues to Struggle

The Australian dollar continued to struggle today, potentially extending the long-term downtrend. Mixed domestic data did little to help the Aussie. Seasonally adjusted retail sales demonstrated an unexpected drop in July, adding to the downside pressure on the Australian currency. As for the positive part of today’s data, the trade balance deficit shrank unexpectedly last month (also on a seasonally adjusted basis). Yesterday, the Aussie attempted to rally and was successful, ending the session with gains. AUD/USD … “Australian Dollar Continues to Struggle”

Lex van Dam introduces trading app tools to a mass

The well known hedge fund manager Lex van Dam is introducing new trading tools via Tradable apps. Here are more details via the official press release: Concerned by the fact that ‘information overload’ and expensive platforms are alienating people from trading, he has simplified access to the markets by devising a series of trading apps covering all … “Lex van Dam introduces trading app tools to a mass”

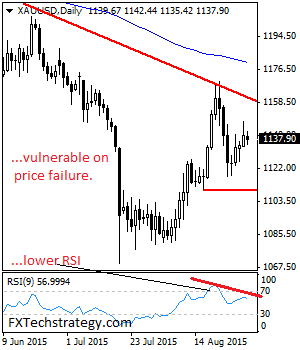

GOLD: Halts Recovery, Vulnerable Below 1,147/50 Zone

GOLD: GOLD looks to has capped its recovery strength at 1,147.87 level following the formation of a rejection candle on Tuesday. This price action suggests bear pressure could be developing. On the downside, support comes in at the 1,120.00 level where a break will aim at the 1,110.00 level. A cut through here will open … “GOLD: Halts Recovery, Vulnerable Below 1,147/50 Zone”

Malaysian Ringgit Suffers from Risk-Negative Sentiment on FX Market

The Malaysian ringgit fell against the US dollar today as concerns about the slowing global growth drove Forex market participants away from risk-geared currencies. Yesterday’s manufacturing reports from all around the world were rather disappointing. This led to a drop of Asian stocks today as the MSCI Asia-Pacific Index, which tracks all Asian shares with the exception of Japan, dropped more than 2 percent today. Unsurprisingly, … “Malaysian Ringgit Suffers from Risk-Negative Sentiment on FX Market”