The Japanese yen back off today following yesterday’s rally as markets calmed somewhat and demand for safety abated. Worse-than-expected macroeconomic reports from Japan also contributed to the retreat of the currency. Recently, concerns about China’s slowdown, timing of an interest rate hike in the United States and the drop of Glencore stocks led to high volatility on markets. Today, markets calmed a bit, especially after Glencore rebounded. Most analysts think that the calm will … “Yen Backs Off as Volatility Abates”

Month: September 2015

NZ Dollar Demonstrates Small Gains

The New Zealand dollar ticked up today as the rally of raw materials helped commodity currencies. Still, volatility on the Forex market does not make it easy for risky currencies of emerging markets to rally. The rally of commodity prices helped mitigate risk aversion among traders. The bounce of Glencore shares also proved helpful to currencies linked to raw materials. Nevertheless, the current volatile trading environment and the outlook for monetary tightening in the United States … “NZ Dollar Demonstrates Small Gains”

Positive Data Doesn’t Help Pound to Rally

The Great Britain pound moved lower against its major counterparts today even though macroeconomic data from the United Kingdom was supportive for the currency. Distributive Trades Survey released by Confederation of British Industry demonstrated a positive balance of +49 percent in September, double the previous value and far above market expectations. The positive data should increase pressure on the Bank of England to normalize its monetary policy. The sterling gained a bit after … “Positive Data Doesn’t Help Pound to Rally”

UK Pound Continues to Struggle in Forex Trading

UK pound is still struggling in currency trading on the FX market today. The UK pound has had a downside for several days now, and it is likely to continue to struggle, until new data can shed some light on what’s next, and what might result in a change in policy. Right now, the UK pound is down against the US dollar as policy divergence remains the focus. The Federal Reserve is expected to boost … “UK Pound Continues to Struggle in Forex Trading”

Better Eurozone Sentiment Helps Euro Pare Some of Its Losses

Euro was struggling a great deal earlier in the session, but the 19-nation currency has since pared some of its losses. Better news out of the eurozone, with an improved confidence reading, is helping the euro, although it is still mostly lower against its major counterparts. Economic confidence in the eurozone unexpectedly rose in September, helping the euro pare some of the losses seen earlier today. The index of executive and consumer confidence … “Better Eurozone Sentiment Helps Euro Pare Some of Its Losses”

EUR/SEK: The Downside of Success

While the world’s attention has been focused on ECB this year, Sweden has kept a ‘low profile’. However, Sweden seems to be caught in the same persistent disinflation as the rest of the EU, Eurozone or not. What then distinguishes the Swedish Krona from the Euro? According to Eurostat, Sweden’s real GDP year over year … “EUR/SEK: The Downside of Success”

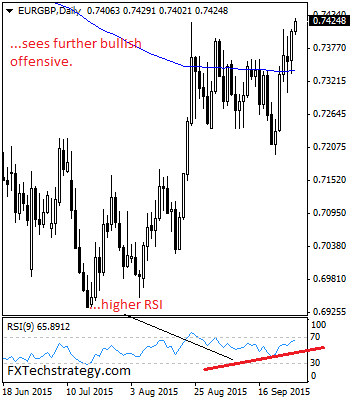

EURGBP- Remains On The Offensive, Aims At 0.7482 Level

EURGBP- With the cross remaining on the offensive, we look for more strength to build up. While it holds above the 0.7360 zone, expect more strength possibly towards the 0.7482/0.7500 region. On the upside, resistance lies at the 0.7450 level where a violation if seen will turn risk towards the 0.7500 level. On further upside, … “EURGBP- Remains On The Offensive, Aims At 0.7482 Level”

GBPCHF Weakness Continues – Bearish Rejection Sell Signal

Recently we looked at a few bearish candles coming off weekly resistance here on the GBPCHF daily chart, speculating future weakness. There was a bit of sideways chop here around this major level, which is to be expected. Now price has broken free of the consolidation structure and pushed into lower lows. The last two … “GBPCHF Weakness Continues – Bearish Rejection Sell Signal”

USD/CAD: Trading the Canadian GDP Sep 2015

Canadian GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the Canadian dollar. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Wednesday at 12:30 … “USD/CAD: Trading the Canadian GDP Sep 2015”

EUR/USD: Trading the CB Consumer Confidence

US CB Consumer Confidence is based on a monthly survey of about 5,000 U.S. households regarding their opinion of the economy. Traders should pay close attention to its release, which always has a strong impact on market prices. A higher reading than the market forecast is bullish for the dollar. Here are all the details, and … “EUR/USD: Trading the CB Consumer Confidence”