Euro is heading lower today, falling against the sterling and greenback as policy divergence comes into play. Euro is still higher against the yen, but with expectations for higher rates in the United States and the United Kingdom, the 19-nation currency is falling behind. Even though the data out of the eurozone was reasonably encouraging this week, leaders are still far from ready to start changing policy in the 19-nation currency … “Euro Drops as Policy Divergence Takes Center Stage”

Month: September 2015

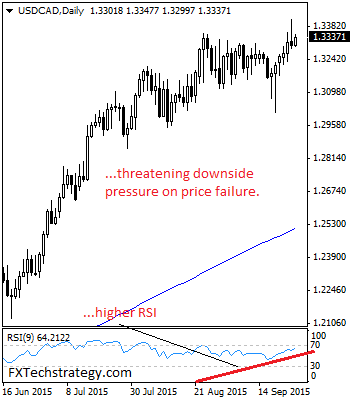

USDCAD Rejects Higher Prices, Prints Negative Candle

USDCAD: With USDCAD turning off its intra day high at 1.3416 level to close lower on Thursday, further downside pressure is likely. While the 1.3416 level caps, our view on the pair remains lower. Resistance resides at the 1.3400 level where a break will target the 1.3450 level. Further out, resistance comes in at the … “USDCAD Rejects Higher Prices, Prints Negative Candle”

Dollar Lifted by Remarks from Janet Yellen

The US dollar was falling for the most part of Thursday’s trading session yet trimmed its losses after the head of the US central bank made unexpectedly hawkish remarks. Today, the currency is rising. Janet Yellen, Chairperson of the Federal Reserve, delivered a speech in University of Massachusetts, Amherst, closer to the end of yesterday’s session. In particular, she said: Most of my colleagues and I anticipate that it will likely be appropriate to raise the target range … “Dollar Lifted by Remarks from Janet Yellen”

Interest Rate Cut Pushes Taiwan Dollar Lower

Today, Taiwan’s central bank cut interest rates for the first time in six years. This pushed the Taiwan dollar lower versus the US dollar, though the fall was not very big. The Central Bank of Taiwan cut its interest rate by 12.5 basis points, including the benchmark discount rate that has been reduced to 1.75 percent. The central bank offered following explanation for its decision: In sum, the global economy … “Interest Rate Cut Pushes Taiwan Dollar Lower”

Norwegian Krone Slumps After Central Bank Cuts Key Rate

The Norwegian krone slumped today after the nation’s central bank unexpectedly cut the key policy rate and signaled that another rate decrease is probable. Norges Bank slashed its main interest rate 25 basis points to 0.75 percent at today’s policy meeting. Such decision was not expected by the majority of market participants and analysts. Governor Oeystein Olsen cited following considerations for the move: Growth prospects for the Norwegian economy … “Norwegian Krone Slumps After Central Bank Cuts Key Rate”

Safe Haven Demand Sends Japanese Yen Higher

Japanese yen is heading higher against its major counterparts today as safe haven demand increases. A number of concerns are causing a bit of risk aversion and the yen is in demand as Forex traders look for a bit of safety. The latest PMI data is in for Japan, and it was lower than forecast. Preliminary data suggests a reading of 50.9 when many had expected to see a print of 51.2. However, the disappointing PMI isn’t … “Safe Haven Demand Sends Japanese Yen Higher”

Public Borrowing Weighs on the UK Pound

UK pound is struggling against the euro right now, heading lower following disappointing data about borrowing. However, the pound is higher against the US dollar. An increase in public borrowing in the United Kingdom has been expected by analysts, but the figures reported for August were higher than predicted. As a result of the higher than expected expansion of UK debt level, the sterling is down against the euro. Even though news coming … “Public Borrowing Weighs on the UK Pound”

USD/JPY: Trading the US Final GDP

US Preliminary Gross Domestic Product (GDP) measures production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the dollar. Here are all the details, and 5 possible outcomes for USD/JPY. Published on Friday at 12:30 GMT. … “USD/JPY: Trading the US Final GDP”

Tradable features TradingView Charts – can be traded directly

TradingView, which provides a social charting platform, and Tradable, which enables aps for traders, have collaborated to enable traders a smooth trading experience. Here is more data from the official press release: 24 September 2015 – embargoed until 8.30am BST – Tradable has added the TradingView Chart app to its App Store, allowing Forex traders to trade … “Tradable features TradingView Charts – can be traded directly”

Canadian Dollar Remains Soft After Disappointing Retail Sales

The Canadian dollar dropped yesterday due to lackluster retail sales data. Today, the currency remains soft against other most-traded counterparts. Retail sales rose 0.5 percent in July from the previous month, exactly as was expected. The problematic part of the report was the downward revision of June’s increase from 0.6 percent to 0.4 percent. What is more, the core components of July sales showed no increase while markets had … “Canadian Dollar Remains Soft After Disappointing Retail Sales”