The euro has rallied yesterday as Mario Draghi, President of European Central Bank, downplayed expectations of expanded quantitative easing. The currency retained its gains today for the most part, though it is sliding back against the Japanese yen. Draghi talked yesterday about the possibility of additional QE: Should some of the downwards risks weaken the inflation outlook over the medium term more fundamentally than we project at present, we would … “Euro Retains Gains After Mario Draghi Downplays QE”

Month: September 2015

Mexican Peso Near Weakest Rate in Month

The Mexican peso followed other risky currencies of emerging markets in decline today as wide-spread risk aversion made investors prefer safer options. The Mexican peso hit the lowest level in almost a month today. The reason was basically the same as for the decline of other riskier currencies (like the Brazilian real) — the concerns over global economic slowdown and a potential interest rate hike from the Federal Reserve. The drop sparked speculations that the Mexican … “Mexican Peso Near Weakest Rate in Month”

Brazilian Real at Record Low

The Brazilian real crashed to the record low level against the US dollar today following the earlier attempt to rally. The real had surged 1 percent after the Brazilian Congress voted for legislation that prevents an increase of public expenditures. Yet the currency has reversed its rally, falling 1.9 percent, amid concerns about global economic slowdown. Moreover, Brazilian policy makers are yet to vote for the key presidential veto that … “Brazilian Real at Record Low”

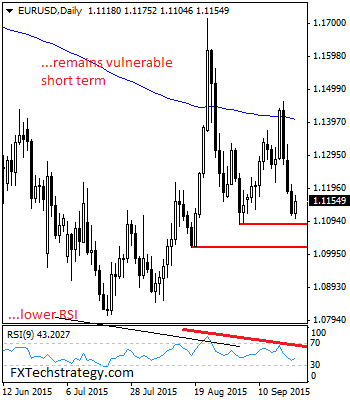

EURUSD: Price Hesitation Sets In Ahead Of 1.1086 Level

EURUSD: With EUR now seen recovering ahead of its key support at the 1.1086 level, some kind of a correction could occur. But as long as that move is capped by the 1.1259/58 zone, its short term weakness triggered from the 1.1459 level remains intact. Support lies at the 1.1100 level where a violation will … “EURUSD: Price Hesitation Sets In Ahead Of 1.1086 Level”

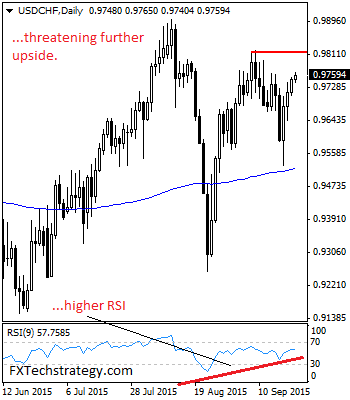

USD/CHF On The Upbeat, Pressure Builds Up On The 0.9823

USDCHF: The pair remains on the offensive and looks to recapture its key resistance located at the 0.9823 level. On the upside, resistance lies at the 0.9900 level with a breach targeting the 0.9950 level. A breather may occur here and turn the pair lower. But if taken out, expect a push further higher towards … “USD/CHF On The Upbeat, Pressure Builds Up On The 0.9823”

Dollar defies doves – on the Fed, Greece and more

No hike didn’t mean no dollar drive higher. What’s going on? We digest the dovish Fed from all angles, before looking at the implications of the Greek elections and looking at the never resting markets. You are welcome to listen, subscribe and provide feedback. After the Fed: The Fed did NOT raise rates and went dovish in … “Dollar defies doves – on the Fed, Greece and more”

US Dollar Mostly Higher Today Against Its Major Counterparts

US dollar is mostly higher today, gaining ground as Forex traders look forward to the possibility of a rate hike from the Federal Reserve. Additionally, there are indications that the role of the US dollar on the Forex market might be changing. Even though the US Federal Reserve kept its benchmark the same last week, the greenback is on the rise, thanks in large part to expectations for a rate hike in the relatively near future. Even … “US Dollar Mostly Higher Today Against Its Major Counterparts”

QE Talk Weighs on Euro/Dollar Pair in Forex Trading

Euro is struggling against the US dollar again as talk of quantitative easing continues. With the idea that more money needs to be circulated through the system, and the idea that eurozone rates aren’t heading higher any time soon, it’s little surprise that the euro is down against the dollar. There is speculation that the European Central Bank will need to keep its bond-buying program in place longer … “QE Talk Weighs on Euro/Dollar Pair in Forex Trading”

Forex trading in a modern world

With the Fed adding to the uncertainty in the market, Ryan Littlestone from ForexLive, shares tips to trade these volatile markets. Fed driving the trade Littlestone speaks on the rates and the Fed added uncertainty, noting that this confusion around the interest rate hike is bad for trading. While patience remains the key, Littlestone prefers … “Forex trading in a modern world”

Great Britain Pound Slumps After UK Budget Deficit Widens

The Great Britain pound slumped against the major peers today. Domestic macroeconomic data was detrimental to the currency, showing that the budget deficit widened last month. UK net public borrowing increased by £1.4 billion to £12.1 billion in August from a year ago, far above the median analysts’ forecast of £9.0 billion. It was the biggest shortage for the month of August since 2012. The negative data made traders question the Bank … “Great Britain Pound Slumps After UK Budget Deficit Widens”