The US dollar was hit hard following the Fed’s decision not to raise rates and to maintain a dovish tone via its forecasts and lack of confidence in general. No rush to raise rates meant a rush to sell the dollar, even if markets were leaning towards a “no hike” decision. But wait, the main reason … “The Fed was dovish and the rest will follow –”

Month: September 2015

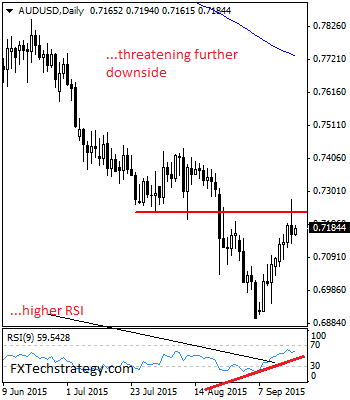

AUDUSD Prone To Downside Pressure On Price Failure

AUDUSD: AUDUSD took back all of its intra day gains to close lower on Thursday leaving risk of further move lower on the cards. With the formation of a pin bar, it faces the possibility of bear threats while holding below the 0.7275 level. On the upside, the 0.7214/33 zone comes in as the upside … “AUDUSD Prone To Downside Pressure On Price Failure”

Canadian Dollar Weak Against Major Peers

The Canadian dollar was weak against its major counterparts today and was not able to rally even against the extremely soft US dollar. The most likely perpetrator responsible the currency’s decline was the drop of crude oil prices. While many commodities rallied during the Thursday’s trading session, crude oil was not one of them. Prices for crude dropped and dragged the Canadian currency along with them. The Canadian economy … “Canadian Dollar Weak Against Major Peers”

Dollar Dips After Fed Refrains from Action

The US dollar slumped against its major peers after today’s policy announcement of the Federal Reserve. Not only the US central bank kept interest rates unchanged, but it also released a statement that was considered rather dovish by economists and market participants. The Fed said that it “is monitoring developments abroad,” likely referring to the recent crash of global stocks. The statement also revealed that policy makers … “Dollar Dips After Fed Refrains from Action”

USDJPY Retains Recovery Tone, Pressures 121.32 Level

USDJPY: With the pair remaining on recovery path, we look for more upside pressure to occur in the days ahead. This leaves the 121.32 level, its Sept 10 2015 high as the next upside target. A cut through here will set the stage more strength towards the 121.73 level, its Aug 28’2015 high. On further … “USDJPY Retains Recovery Tone, Pressures 121.32 Level”

Fed preview: hawkish talk or dovish hike? 4 scenarios

September 17th is right around the corner and tension in markets is rising. Will the Fed raise rates or not? It is a very hard decision for the world’s No. 1 central bank. And it’s not the only factor, as this decision is accompanied by a press conference and updated Fed forecasts. Updates Fed does not hike … “Fed preview: hawkish talk or dovish hike? 4 scenarios”

Fed: Is a Presser in October going to be the

According to market pricing and recently also according to a small majority of economists, the Federal Reserve will not raise rates today. This leaves the question open on the tone: a hawkish stance or a dovish one? Here are our 4 detailed scenarios. Updates Fed does not hike – USD initially slides Yellen live blog And what … “Fed: Is a Presser in October going to be the”

Is a Fed “no hike” already priced in?

So far, there was a divide between economists and pricing in markets: while markets reflected a chance of between 20% and 30% for a rate hike, various surveys of economists have shown a majority for a rate hike in the September 17th meeting. Updates Fed does not hike – USD initially slides Yellen live blog … “Is a Fed “no hike” already priced in?”

New Zealand Dollar Drops as Economic Growth Disappoints

The New Zealand dollar dropped today after nation’s economic growth disappointed market participants, resulting in speculations about additional interest rate cuts from the Reserve Bank of New Zealand. New Zealand gross domestic product grew 0.4 percent in the second quarter of this year while economists were counting on at least 0.5 percent growth. Moreover, the pace of economic expansion on year-over-year basis was the slowest since the fourth quarter … “New Zealand Dollar Drops as Economic Growth Disappoints”

Swiss Franc Flat After SNB Keeps Negative Rates in Place

The Swiss franc traded sideways during the Thursday’s trading session. The currency has jumped after the Swiss central bank made a policy announcement, but the Swissie but backed off almost immediately. The Swiss National Bank kept interest rates unchanged in the negative territory and signaled that it is going to keep them at the record low level in the foreseeable future. The central bank acknowledged the impact of its policy on the Swissie: The negative interest … “Swiss Franc Flat After SNB Keeps Negative Rates in Place”