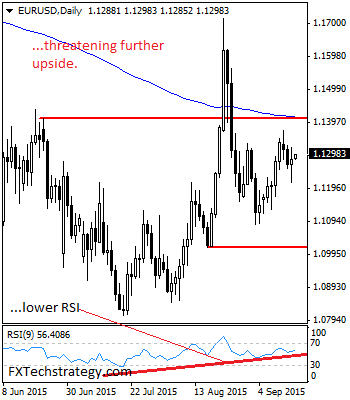

EURUSD: Having EUR halted its two-day corrective weakness to close higher on a rejection candle on Wednesday, further strength cannot be ruled out. On the upside, resistance comes in at 1.1350 level with a cut through here opening the door for more upside pressure towards the 1.1409 level. Further up, resistance is seen at the … “EURUSD: Recovery Tone Intact, Targets The 1.1372 Level”

Month: September 2015

Yen Dips as S&P Downgrades Japan

The Japanese yen dropped against other most-traded currencies today as Standard & Poor’s reduced Japan’s sovereign credit rating due to disappointment in the policy makers’ attempts to revive economic growth. S&P announced on Wednesday: We are lowering our sovereign credit ratings on Japan to ‘A+/A-1’ from ‘AA-/A-1+’. -The outlook on the long-term rating is stable. The agency cited the following reason for the decision: Economic support for Japan’s sovereign creditworthiness has continued … “Yen Dips as S&P Downgrades Japan”

Great Britain Pound Lifted by UK Employment Data

The Great Britain pound climbed against its major peers today as employment data for July released from the United Kingdom was well-received by the Forex market, fueling talks about an interest rate hike from the Bank of England in a relatively near future. There was a negative piece of data in the form of the unexpected increase of the number of unemployment claims. Yet the market focused on the good parts of the report. Among them were the surprise decrease of the unemployment … “Great Britain Pound Lifted by UK Employment Data”

Fed decision: buy USD/CAD on a hike, buy AUD/JPY on

The Fed decision is coming soon, and markets remain tense. While there are at least 4 scenarios, the initial reaction will come down to the question of the rates: to hike or not to hike? The team at Citi suggests two different trades with two different currency pairs: Here is their view, courtesy of eFXnews: The … “Fed decision: buy USD/CAD on a hike, buy AUD/JPY on”

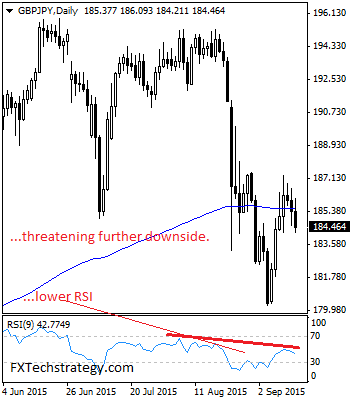

GBPJPY: Weakens, Further Corrective Pullback Envisaged

GBPJPY: With the cross weakening following its failed intra attempts on the upside, we see further weakness in the days ahead. This view remains valid while the 187.31/47 zone remains as resistance. On the downside, support comes in at the 183.50 level where a violation will aim at the 182.50 level. A break below here … “GBPJPY: Weakens, Further Corrective Pullback Envisaged”

Euro Mostly Lower as Economic Sentiment Deteriorates

The euro dropped today against most major currencies, including the US dollar and the Japanese yen, as the economic sentiment deteriorated in Germany as well as in the whole eurozone. Yet the shared 19-nation currency managed to gain against the Great Britain pound and the Swiss franc. The ZEW Indicator of Economic Sentiment for Germany dropped from 25.0 to 12.1 in September. The report said: The weakening economic development in emerging markets dampens the economic outlook for Germanyâs export-oriented economy. While … “Euro Mostly Lower as Economic Sentiment Deteriorates”

Brazilian Real Retreats After Monday’s Gains

The Brazilian real dropped against the US dollar today as market participants were skeptical about the ability of President Dilma Rousseff to push for the planned austerity measures. Uncertainty about the upcoming policy meeting of the US Federal Reserve also affected the currency negatively. The real demonstrated its biggest daily gain in a month during the Monday’s trading session amid hopes that Rousseff will be able to convince the Congress in necessity of tax increases … “Brazilian Real Retreats After Monday’s Gains”

UK Consumer Prices Bring Down Pound

UK consumer prices were disappointing last month, and that is weighing on sterling today. With this latest news, it is increasingly unlikely that the Bank of England will raise rates anytime soon. According to the Office for National Statistics, there was a slowdown in core inflation in the United Kingdom last month, dropping to 1 per cent from 1.2 per cent. While mostly expected, the stagnation emphasizes the concerns about … “UK Consumer Prices Bring Down Pound”

Aussie Dips After RBA Releases Policy Minutes

Today, the Reserve Bank of Australia released the minutes of its September policy meeting. The Australian dollar reacted negatively to the event, sinking after the release. The comments of the central bank were considered by market participants to be rather dovish. The minutes discussed in detail the recent crash of the Chinese stock market, concluding: The weakening in Chinese economic activity combined with developments in Chinese financial markets had led to sharp declines in global equity prices. Nevertheless, … “Aussie Dips After RBA Releases Policy Minutes”

Dollar Performance Steady Ahead of Fed

The US dollar is holding mostly steady ahead of tomorrow’s decision from the Federal Reserve. While the dollar index is a little lower today, the greenback itself is trading mixed against its major counterparts. US dollar is higher against the pound and the euro today, although gains are rather small. Greenback is down against the yen, though, as the Bank of Japan remains steady. Speculation about what’s next for the Federal … “Dollar Performance Steady Ahead of Fed”