The US dollar ended trading lower across the board as economic data released from the United States on Friday did not provide incentive for the Federal Reserve to start monetary tightening soon. US economic data released today was below market expectations for the most part. Both personal income and spending rose 0.1 percent last month while analysts had promised a 0.2 percent increase. The University of Michigan Consumer Sentiment … “US Dollar Ends Friday Lower”

Month: October 2015

NZ Dollar Climbs on Supportive News

The New Zealand dollar gained today with the help of positive news, both domestic and from abroad. The currency jumped 1 percent against the US dollar. The ANZ Business Confidence climbed back into positive territory, demonstrating the reading of 10.5 in October after logging -18.9 in September. The report said that one of the main reasons for the improvement was the rebound of dairy prices. Talking about dairy, some analysts speculated that demand … “NZ Dollar Climbs on Supportive News”

Yen Climbs as BoJ Refrains from Adding Stimulus

The Japanese yen climbed against its major rivals today as the Bank of Japan made no changes to monetary policy, refraining from expanding already extensive monetary stimulus. The BoJ kept its monetary policy the same at today’s meeting, leaving interest rates near zero and the asset purchase program at ¥80 trillion. It was a bit of a surprise to some market participants who were anticipating additional stimulus. At the same time, the central … “Yen Climbs as BoJ Refrains from Adding Stimulus”

Bullion Capital appoints Bill Hubard as Chief Economist

Bill Hubard, the renowned economist, has joined the ranks of Bullion Capital as Chief Economist. The firm recently expanded its reach to South America. Here is more on the appointment from the official press release: 26 October 2015 — The world’s leading electronic exchange for allocated physical precious metals, Bullion Capital, has announced the appointment … “Bullion Capital appoints Bill Hubard as Chief Economist”

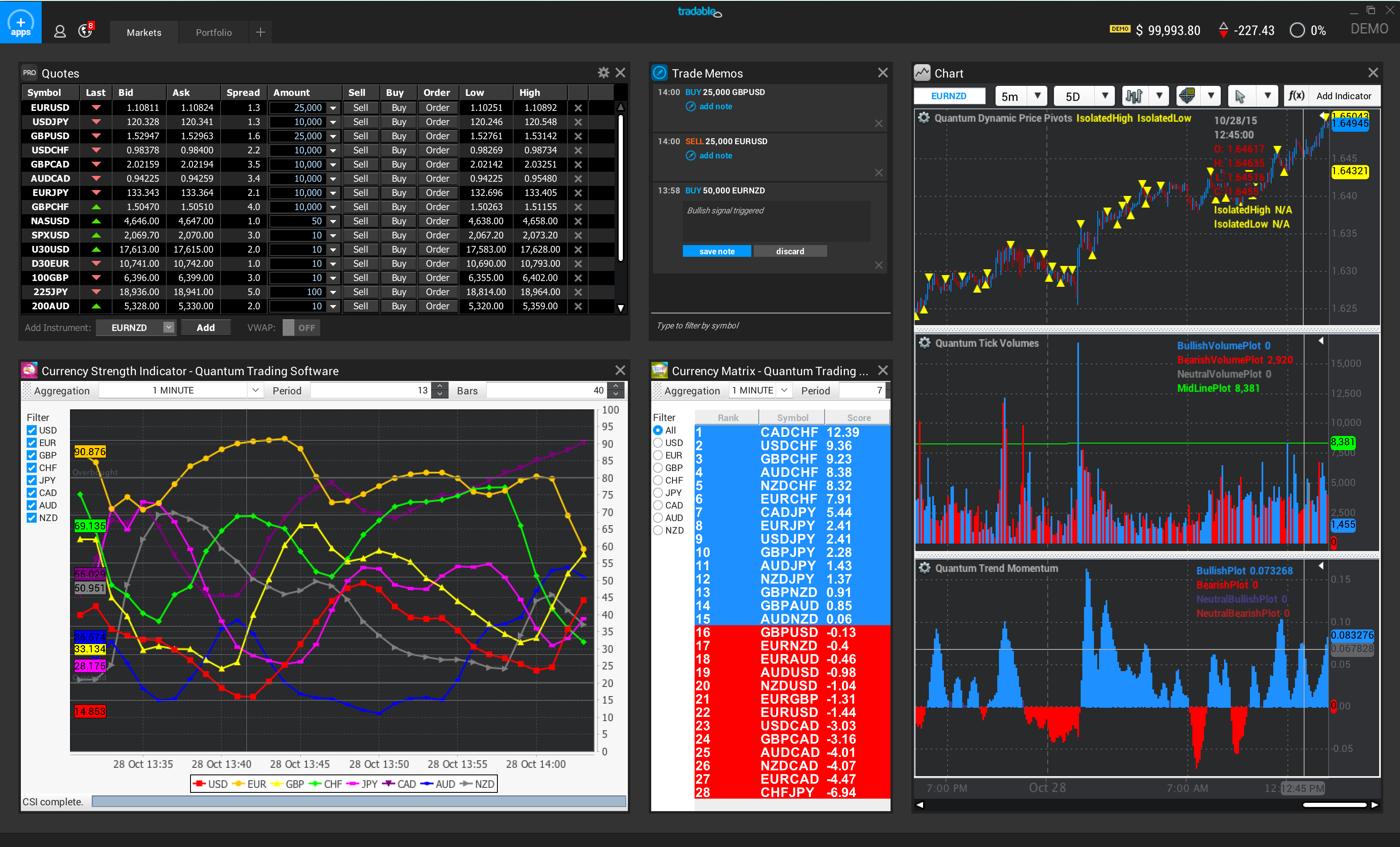

Quantum Trading tools available inside Tradable

Quantum Trading tools are now available for traders inside the Tradable platform. Tradable recently featured TradingView charts. For more on Quantum Trading, here is the official press release: 29 October 2015 -Tradable has added Quantum Trading tools to its App Store, allowing Forex traders to benefit from the “Three Dimensional Approach of Trading” methodology created … “Quantum Trading tools available inside Tradable”

Japanese Yen Mixed Ahead of BoJ Announcement

The Japanese yen was relatively firm against the US dollar today but fell versus the euro and the Great Britain pound ahead of the monetary policy announcement from the Bank of Japan. The BoJ will release a monetary policy statement later today. Many market participants and analysts wait for the announcement because it is expected that the central bank may expand its already substantial monetary stimulus. As for economic data, Japan’s core … “Japanese Yen Mixed Ahead of BoJ Announcement”

Crude Oil Prices Help Loonie Yet Again

The Canadian dollar gained against the US dollar and the Japanese yen, though it was unable to beat the euro. Analysts say that crude oil prices helped the currency yet again. Experts said that crude oil is responsible for the fairly decent performance of the loonie today. It is true that crude did not rise too much today (and the Brent grade actually dipped). Yet the commodity had demonstrated … “Crude Oil Prices Help Loonie Yet Again”

Dollar Retreats as Data Doesn’t Support Fed Hike Outlook

The US dollar dropped against other major currencies today following yesterday’s economic data. Today’s US economic data, including the GDP report, played its part in the currency’s decline. Gross domestic product rose 1.5 percent in the third quarter of 2015. The increase was a bit smaller than 1.6 percent predicted by analysts and far below the previous quarter’s growth of 3.9 percent. On top of that, pending home sales dropped … “Dollar Retreats as Data Doesn’t Support Fed Hike Outlook”

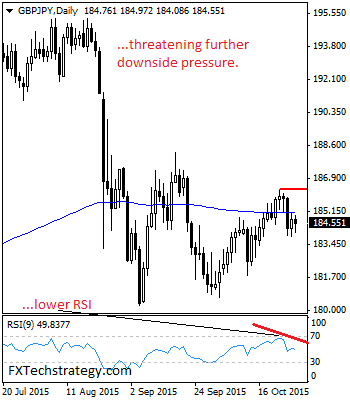

GBPJPY Hesitates But Remains Weak Below The 186.30 Level

GBPJPY: The pair remains weak and vulnerable to the downside. While it holds and trades below its resistance at 186.30 level, immediate bias remains to the downside. On the downside, support comes in at the 184.00 level where a violation will aim at the 183.00 level. A break below here will target the 182.00 level … “GBPJPY Hesitates But Remains Weak Below The 186.30 Level”

Eurozone Confidence Fuels Euro Rally

Better news out of the eurozone is fueling a rally for the euro today. A surprise increase in confidence is helping the 19-nation currency gain against its counterparts as Forex traders speculate on whether or not the ECB will really need to add stimulus. Just last week, Mario Draghi and other ECB policymakers were talking about the possibility of more economic stimulus for the eurozone. Today, though, there is speculation that maybe drastic … “Eurozone Confidence Fuels Euro Rally”