The Non-Farm Payrolls report was disappointing and with no real silver lining.

Nevertheless, the team at Goldman Sachs sees gains for the US dollar and provides two reasons:

Here is their view, courtesy of eFXnews:

There were no redeeming features to last week’s employment data, notes Goldman Sachs.

“Even the decline in labor market slack – arguably the one bright spot – came from a drop in the participation rate, with employment in the household survey falling sharply,” GS adds.

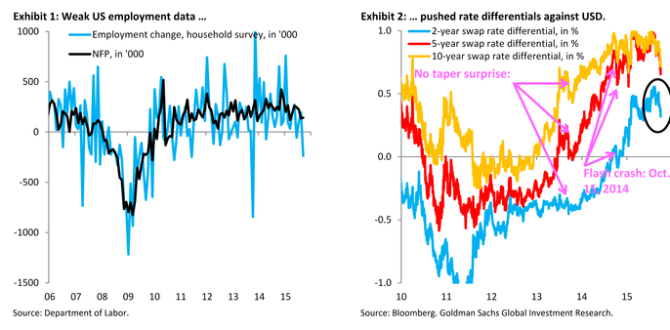

“USD fell versus the majors and the 2-year interest differential, the main driver of the Dollar versus the G10, is back to May levels when weak Q1 data gave us the last growth scare. Back then, cold weather and seasonal adjustment issues were plausible excuses and growth bounced back in the second quarter,” GS notes.

In light of this, GS analysts discuss what they think the two main questions in the wake of the payrolls disappointment.

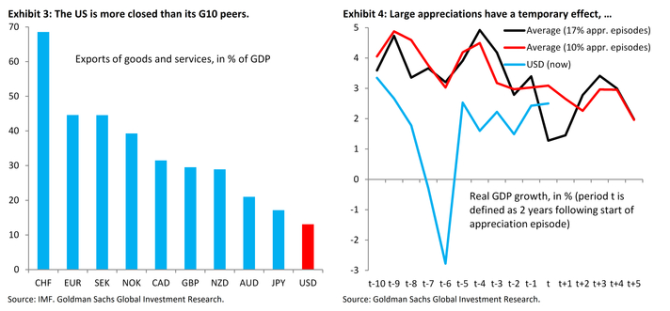

First, has the rise in the Dollar been too much for the economy to support?

“We screen history for large appreciation episodes similar to that experienced by the Dollar recently and look at the growth fall-out. While that analysis certainly points to a negative growth hit that should be centered on 2015, the economies in question are also smaller and more open than the US. We remain optimistic that the economy can support a stronger Dollar,” GS answers.

Second, how will G-3 central banks react to the possibility of slowing growth?

“While our US economists now see December lift-off as a closer call, we think weaker growth is raising the odds of additional BoJ and ECB stimulus at coming meetings…Both central banks will need to provide additional stimulus in fairly short order to meet their inflation forecasts. Meanwhile, the Fed – faced with a new round of data uncertainty – can at best delay lift-off. That is a distant second to the rising odds for additional stimulus elsewhere,” GS argues.

“We therefore maintain our strong view for EUR/$ downside and $/JPY upside in coming months,” GS concludes.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.