The euro managed to make its way higher amid doubts that the Fed will indeed raise rates.

Can this course change? The team at Goldman Sachs analyzes the next moves:

Here is their view, courtesy of eFXnews:

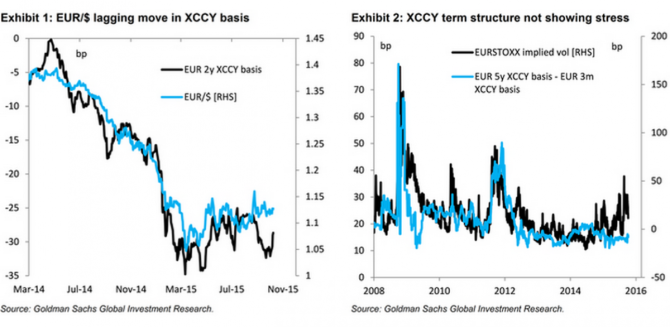

“We analyse in more detail the drift lower in EUR cross-currency basis, in particular to understand the relationship to ECB easing. We find that there is a strong link between the expectations of central bank balance sheets and the level of cross-currency basis, and that the recent move lower is consistent with the ECB’s future expanded balance sheet under its QE programme,” GS argues.

“It is not only in European basis that there have been falls in recent weeks – the falls have in fact been larger in JPY, and have also occurred in other major currencies vs the USD. The commonality across these markets may point to the USD itself – the anticipation of an eventual Fed tightening cycle may be contributing to the drift lower (and September’s dovish FOMC to the latest bounce).

But beyond the near-term moves, what is driving the drift lower in EUR basis? The clearest candidate is the monetary policy divergence between the US and the Euro area,” GS adds.

In particular, GS tests the idea that the relative size of central bank balance sheets can drive movements in the basis, given the substantial shifts in both ECB and Fed balance sheets resulting from unconventional monetary policy in recent years.

“We find that a EUR1trn balance sheet expansion is consistent with a drop in the 2-year cross-currency basis of around 10bp. Moreover, our expectation of an extension to ECB QE in coming months is consistent with potentially even lower levels of EUR cross-currency basis,” GS argues.

“An important caveat is the risk from a delay to the Fed rate hike beyond December 2015, which would also signal a delay to Fed balance sheet normalisation, pushing upwards on cross-currency basis. Following the September FOMC minutes, we pushed out our expectation for the ending of reinvestments of the Fed’s security holdings – and thus the shrinking of the Fed’s balance sheet – from late-2016 to mid-2017.

But our base case continues to be further monetary policy divergence between the Fed and the ECB, which in our view will also lead to further falls in EUR/$ towards our 12-month target of 0.95,” GS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.