Euro is lower today, thanks in large part to easing talk. Even though such talk from ECB President Mario Draghi has done little to weaken the euro in the last month, recent comments from policymaker Ewald Nowotny are having an effect today. Recent gains for the euro are creating an environment in which there are expectations for profit taking and retracement. Euro has been relatively strong from the last … “Easing Talk Catches Up With Euro”

Month: October 2015

NZD Climbs to Highest Since June vs. USD

The New Zealand dollar was rising today on the back of the US dollar’s weakness, reaching the highest level since June against the greenback. Yesterday’s data from the United States was bad, boosting commodities and, by the same token, currencies related to raw materials. US Producer Price Index fell 0.5 percent in September, more than analysts had anticipated. Retail sales grew just 0.1 percent, falling short of market … “NZD Climbs to Highest Since June vs. USD”

Aussie Shrugs Off Negative Employment Data

The Australian dollar was on the rise today even though Australia’s employment demonstrated a surprise drop last month. Still, the Aussie remains one of the weakest major currencies over the week. Australian employment fell by 5,100 in September (seasonally adjusted) instead of rising by 7,200 as had been promised by analysts. On a positive side, seasonally adjusted new motor vehicles sales climbed by 5.5 percent after falling 1.7 percent in August. It looks … “Aussie Shrugs Off Negative Employment Data”

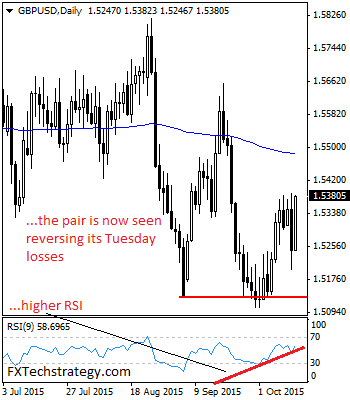

GBPUSD Takes Back Losses, Sets Up For More Strength

GBPUSD: GBP has revered its Tuesday losses and looks to resume its short term uptrend. On continued upside offensive it should target its nearby resistance at the 1.5400 level. On the upside, resistance resides at the 1.5450 level. Further out, resistance resides at the 1.5500 level followed by the 1.5550 level. A cut through here … “GBPUSD Takes Back Losses, Sets Up For More Strength”

Fed December hike fading away – 7 developments

Nobody was expecting a hike in October after the no-hike in September, but Fed officials, including Janet Yellen, repeated the intent to raise rates in 2015, with the December 16th decision circled on everyone’s calendars. Following the weak NFP and disappointing retail sales, chances seem lower, but also Federal Reserve officials are now beginning to warm … “Fed December hike fading away – 7 developments”

Current USD weakness could be only the beginning

The team at HSBC continues challenging the consensus and explains why the US dollar could be on the cusp of a weakening trend. We have certainly seen some weakening today because of the poor retail sales report. Could this get much worse for the greenback. Here is their view: Here is their view, courtesy of eFXnews: “We … “Current USD weakness could be only the beginning”

UK Pound Gains on Lower Unemployment and Higher Wages

Sterling is mostly higher today in Forex trading, thanks in large part to the latest, better than expected, economic data. Unemployment data surprised everyone and wage growth remains strong, prompting hopes that the UK economy will pick up and the BOE will tighten monetary policy. Many analysts had expected unemployment figures in the United Kingdom to worsen, but instead unemployment fell to its lowest rate since the middle … “UK Pound Gains on Lower Unemployment and Higher Wages”

Yen Pulls Back After Yesterday’s Gains

Yen is pulling back a little bit today following yesterday’s gains. While the yen is still higher against an ailing greenback, it is lower against its European counterparts again. Japanese yen is mostly lower against its high beta counterparts today, dropping back against the euro and the pound. However, the yen is still gaining against the US dollar, which is generally struggling today. … “Yen Pulls Back After Yesterday’s Gains”

NZ Dollar Recovers After Wheeler’s Speech

The New Zealand climbed today, recovering from yesterday’s speech of Graeme Wheeler, Governor of the Reserve Bank of New Zealand, who talked about the possibility of additional interest rate cuts. Wheeler was delivering speech yesterday, close to the end of the trading session. He was not pessimistic, saying: Recent economic indicators have been more encouraging. Yet he still believed that additional rate reductions are possible: Some … “NZ Dollar Recovers After Wheeler’s Speech”

Aussie Struggles to Find Direction amid Confusing Fundamentals

The Australian dollar was struggling to find direction during the Wednesday’s trading session amid mixed fundamentals. Domestic economic data was supportive for the currency while overseas news was detrimental. The Westpac-Melbourne Institute Consumer Sentiment improved by 4.2 percent in October. It was a rather good reading even though not good enough to offset the last month’s drop by 5.6 percent. The report said that the recent change in Australia’s government … “Aussie Struggles to Find Direction amid Confusing Fundamentals”