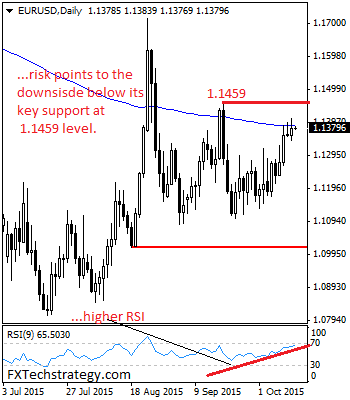

EURUSD: With EUR continuing to trade below the 1.1396 level and its major resistance at the 1.1459 zone, our bias remains to the downside. This suggest its upside risk is now limited while maintaining below the 1.1459 level and downside threat remains the immediate bias. On the downside, support lies at the 1.1300 level where … “EURUSD: Risk Points Lower Below The 1.1459 Level”

Month: October 2015

Short-Term Outlook for US Dollar

The holiday period in the United States has ended, and economic data from the USA will be released to the markets again. Let us see what factors will be affecting the US dollar over the next few days and what can be expected by traders from the US currency. There will be several important reports released during this trading week. Among them retail sales data, jobless claims … “Short-Term Outlook for US Dollar”

Canadian Dollar Follows Crude Oil in Decline Yet Again

The Canadian dollar yet again followed crude oil price in decline. Yet the currency’s losses were not big as the decline of oil was limited itself. Crude oil extended yesterday’s decline today due to persisting concerns about oversupply on the market. Bad economic data from China was not helping the commodity either. It is not surprising that under such circumstances crude dropped, dragging the loonie down … “Canadian Dollar Follows Crude Oil in Decline Yet Again”

Dollar Mixed in Tuesday’s Trading

The US dollar demonstrated a mixed performance during Tuesday’s trading. The currency slid against some majors, like the euro and the Japanese yen, but gained on the Great Britain and was firm versus commodity currencies. The dollar got limited support from risk aversion caused by poor Chinese trading data, allowing the currency to gain against its growth-related counterparts. Meanwhile, falling consumer prices in Britain drove the sterling down against the greenback. … “Dollar Mixed in Tuesday’s Trading”

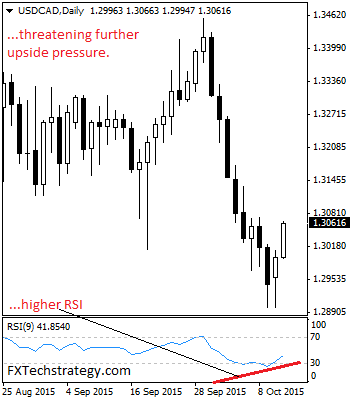

USDCAD Builds Up On Strength, Recovers Higher

USDCAD: USDCAD remains on the offensive on the back of its long-tailed candle print triggering corrective recovery on Monday. This price action development leaves risk higher in the days ahead. On the upside, resistance resides at the 1.3100 level where a break will target the 1.3100 level. Further out, resistance comes in at the 1.3150 … “USDCAD Builds Up On Strength, Recovers Higher”

Euro Gains Ground Despite Draghi’s Willingness to Ease

After some struggles yesterday, the euro is gaining ground again, rising against most of its major counterparts. Even though ECB President Mario Draghi continues to say he’s willing to ease monetary policy further, the euro is currently heading higher — and it’s 1.8 per cent higher against the dollar. Even though the euro has periods of struggle against its major counterparts, particularly the US dollar, the 19-nation … “Euro Gains Ground Despite Draghi’s Willingness to Ease”

Britain’s Pound Hit Hard by Deflation

The Great Britain pound was hit hard by today’s inflation data. Britain’s consumer prices went into deflation territory last month even though analysts had promised them to stay almost unchanged. Office for National Statistic reported today that UK consumer prices fell 0.1 percent in September from a year ago after showing no change in August. Most other indicators released from the United Kingdom … “Britain’s Pound Hit Hard by Deflation”

China’s Trade Data Weighs on Aussie

The Australian dollar halted its impressive rally today, falling 1 percent against the Japanese yen, after the release of China’s trade data. Positive domestic data was unable to aid the Australian currency. China’s imports sank 17.7 percent in September from a year ago, worse than market participants had anticipated. The Asian nation is the biggest trading partner of Australia, making its economic performance have a big impact … “China’s Trade Data Weighs on Aussie”

GBP/USD: Trading the British Wages Oct 2015

British Average Earnings Index, released each month, is a leading indicator of consumer inflation. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Wednesday at 8:30 GMT. Indicator Background The Average Earnings Index is closely watched by analysts, and as a … “GBP/USD: Trading the British Wages Oct 2015”

Canadian Dollar Tracks Moves of Crude Oil

As it often happens, the Canadian dollar was following moves of crude oil. Today, this meant that the currency was rising at the first half of the trading session and was falling in the second half. Initially, crude was rising on the back of the US dollar’s weakness. Yet the commodity slumped following the Monthly Oil Market Report from the Organization of Petroleum Exporting Countries that showed that the OPEC increased its output despite the falling … “Canadian Dollar Tracks Moves of Crude Oil”