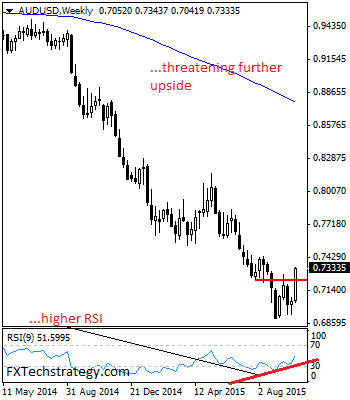

AUDUSD: AUDUSD closed strongly higher the past week leaving risk of further strength in the new week. While it can trade and hold above its broken resistance turned support at 0.7279 level, we think more gain should occur. On the upside, resistance lies at the 0.7400 level. A cut through here will turn attention to … “AUDUSD Climbs Above The 0.7279 Zone, Looks For More”

Month: October 2015

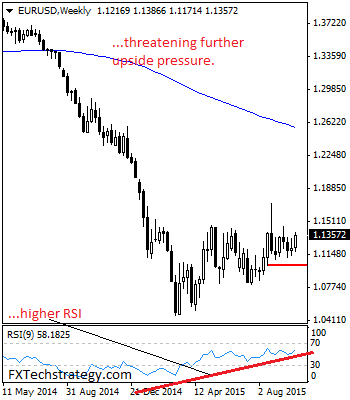

EURUSD: Threats Builds Up Pressure On The 1.1459 Zone

EURUSD: Having EUR closed strongly higher the past week, it now looks to extend that strength towards its key support zone at 1.1459. We may see price hesitation at this level or even a pullback. Support lies at the 1.1300 level where a violation will aim at the 1.1250 level. A break of here will … “EURUSD: Threats Builds Up Pressure On The 1.1459 Zone”

Doubts About Interest Rate Hike Make US Dollar Underperform

The US dollar demonstrated an unimpressive performance during the past trading week. While the currency ended trading little changed versus the Japanese yen, it sank against other majors and commodity currencies. The Federal Reserve was the main perpetrator in the greenback’s slump. The Fed released minutes of its September meeting on Thursday. Initially, the dollar was reacting positively to the release, but this changed very quickly. Traders digested the announcement and decided that … “Doubts About Interest Rate Hike Make US Dollar Underperform”

Dollar Mixed amid Speculations About Delay of Interest Rate Lift-Off

The dollar remained weak versus the euro on Friday as traders continued to speculate that the Federal Reserve is going to postpone the planned interest rate hike. Yet such speculations did not prevent the dollar from bouncing versus the Great Britain pound and from gaining on the Japanese yen. The Fed minutes, released yesterday, had been supportive for the dollar initially. This did not last long, though, as traders digested the news and decided that the tone … “Dollar Mixed amid Speculations About Delay of Interest Rate Lift-Off”

Canadian Dollar Mixed After Employment Data

During Friday’s trading, the Canadian dollar demonstrated the same performance as most other currencies, rising against the US dollar and the Japanese yen while falling versus the euro. Domestic data was mixed, giving the loonie little help in finding direction. Canada’s employment rose by 12,100 in September from the preceding month. At the same time, the unemployment rate ticked up by 0.1 percentage point to 7.1 percent while analysts had promised a drop … “Canadian Dollar Mixed After Employment Data”

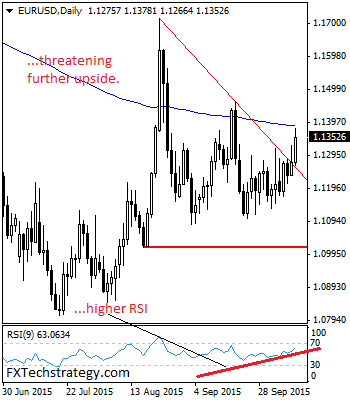

EURUSD: Bull Pressure Leaves Risk Towards Key Resistance.

EURUSD: EUR rallied strongly during Friday trading session leaving risk on further upside. It faces a bigger overhead resistance standing at the 1.1433 level, representing its September 18 2015 high. However, immediate resistance resides at the 1.1400 level. On the upside, resistance is seen at 1.1450 level with a cut through here opening the door … “EURUSD: Bull Pressure Leaves Risk Towards Key Resistance.”

Euro Heads Higher on Speculation More Stimulus Might Not Be Needed

Euro is heading higher today, gaining ground as Forex traders consider that more stimulus might not be needed for the eurozone economy. The 19-nation currency is being helped by factors that could lead to economic growth without the need for additional ECB intervention. Earlier, the Vice President of the European Commission, Valdis Dombrovskis, said that an expansion of the stimulus program might not be needed due to factors contributing to eurozone … “Euro Heads Higher on Speculation More Stimulus Might Not Be Needed”

Japanese Yen Lower as Traders Wait for Next Week’s Data

Japanese yen is lower today, dropping after yesterday’s Eco watchers survey offered mixed results. Yen moved briefly higher against the dollar, but the currency is down again, and losing ground to all its major counterparts. Traders are looking forward to next week’s data. Yesterday, the Eco watchers survey for future expectations for the Japanese economy rose to 49.1 in September, beating an expected reading of 48.3 and rising from … “Japanese Yen Lower as Traders Wait for Next Week’s Data”

AUD Rises to Highest Since August vs. USD & JPY

The Australian dollar rallied to the highest level since August against the US dollar and the Japanese yen. Worse-than-expected domestic economic data did not prevent the currency from rising. Yesterday, the Federal Reserve released minutes of its September policy meeting. While the release was positive for the US currency initially, the situation has changed later as traders digested the news and decided that the tone of the notes was relatively dovish. This allowed currencies … “AUD Rises to Highest Since August vs. USD & JPY”

Pound Resilient vs. Dollar & Yen, Soft vs. Euro

The Great Britain was strong against the US dollar and the Japanese yen (but not against the euro) today even after the release of disappointing trade data. The trade deficit shrank but not as much as specialists had expected. UK trade balance demonstrated a gap of £11.1 billion in August. While it was smaller than the deficit of £12.2 billion demonstrated in July, the shortage was still above £10.0 billion predicted by analysts. … “Pound Resilient vs. Dollar & Yen, Soft vs. Euro”