GBPJPY: The cross now faces further weakness after turning lower ahead of its key overhead resistance at 184.42 level during Thursday trading session. Our bias remains lower as long as that level remains unbroken. On the downside, support comes in at the 182.50 level where a violation will aim at the 182.00 level. A break … “GBPJPY: Turns Lower Ahead Of Key Resistance at 184.42,”

Month: October 2015

Canadian Dollar Pushes Higher, Tracing Rally of Crude Oil

The Canadian dollar was strong today, rising against its US counterpart and erasing losses versus the euro. The rally of crude oil undoubtedly contributed to the currency’s strength. Crude oil rallied more than 3 percent today after Chinese markets reopened after the week-long holiday, and the nation’s stocks climbed, following other global shares. The Canadian currency profited from the news as it often follows moves of oil prices. Now, … “Canadian Dollar Pushes Higher, Tracing Rally of Crude Oil”

Fed Minutes Provides Limited Support for US Dollar

The US dollar has been rather soft during today’s trading but the release of Federal Reserve’s policy minutes changed that. While the currency slipped immediately after the release, it quickly bounced and started to move up, though it looks like the currency’s upward momentum has run its course. The minutes demonstrated quite a hawkish rhetoric that suggested that chances for an interest rate hike still remain. The notes … “Fed Minutes Provides Limited Support for US Dollar”

Loonie Remains in Holding Pattern Against Major Counterparts

Canadian dollar is mostly in a holding pattern right now, keeping steady against most of its major counterparts. Even with oil prices getting a little bump today, the loonie is still mostly steady. Right now, the loonie is very connected to the US dollar and the performance related to what’s expected from the Federal Reserve. Policy divergence is doing a great deal to drive the Canadian’s dollar performance, and many Forex … “Loonie Remains in Holding Pattern Against Major Counterparts”

USD/CAD: Trading the Canadian Jobs Oct 2015

Canadian employment change is an important leading indicator which has a significant impact on the markets. Traders and analysts carefully scrutinize employment figures, and a reading higher than forecast is bullish for the Canadian dollar. Update: Canadian jobs report beats with +12.1K, but unemployment rises to 7.1% Here are the details and 5 possible outcomes for USD/CAD. Published … “USD/CAD: Trading the Canadian Jobs Oct 2015”

Euro Recovers from Yesterday’s Disappointing German Data

Euro is higher today, after recovering from yesterday’s disappointing German data. Euro is higher across the board, gaining ground as other major currencies demonstrate weakness. Yesterday, the euro struggled as soft German industrial data caused concern about the economic prospects of the 19-nation currency region. Today, much of that concern is over as Forex traders shift focus to other regions and other currencies. The latest focus is … “Euro Recovers from Yesterday’s Disappointing German Data”

Great Britain Pound Falls After Bank of England Meeting

The Great Britain pound fell following the Bank of England’s monetary policy meeting. The policy minutes were not particularly hawkish, leading to speculations that British policy makers could be forced to leave interest rates at the record low for a prolonged period. The Bank of England left interest rates and the asset-purchase program unchanged at today’s gathering. The minutes (unusually, released immediately after the meeting) did not sound very optimistic, saying: The near-term … “Great Britain Pound Falls After Bank of England Meeting”

Yen Mixed Following Release of Economic Data from Japan

The Japanese yen was mixed during Thursday’s trading session following the release of economic data from Japan. The currency was up against the US dollar but down versus the Japanese yen. Core machinery orders dropped 5.7 percent in August, extending the previous month’s decline, instead of rising 3.3 percent as was predicted by analysts. At the same time, the current account was at ¥1.59 trillion, widening from the previous month while … “Yen Mixed Following Release of Economic Data from Japan”

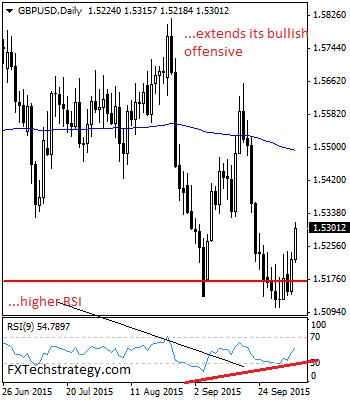

GBPUSD Sees Further Bullish Offensive, Targets 1.5336 Region

GBPUSD: GBP extended its recovery during Wednesday trading session leaving risk of more strength to occur. However, watch out for its overhead resistance located at the 1.5336 zone. This level is significant on the weekly chart. Price hesitation ahead or at that level cannot be ruled out. The pair current bullish price action leaves risk … “GBPUSD Sees Further Bullish Offensive, Targets 1.5336 Region”

Greenback Trades Mixed Against Major Currencies

Even though the greenback is trading mixed against its major counterparts, the dollar index is still higher today, thanks in part to the fact that the euro (which is weighted most heavily in the basket) is lower against the US dollar. As Forex traders and analysts consider what’s next for central banks around the world, trading has become a little interesting. Many are waiting to see what the Federal Reserve will … “Greenback Trades Mixed Against Major Currencies”