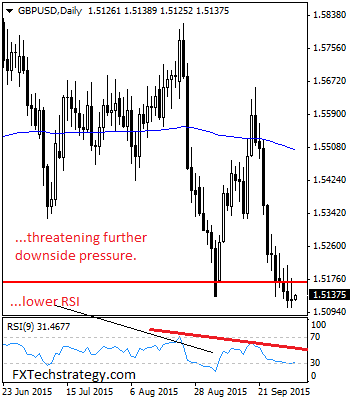

GBPUSD: GBP will have to break and hold below its support located at the 1.5133 level to trigger further weakness. That level continues to hold as support for almost the whole week. Support comes in at 1.5100 level with a follow-through lower seeing it targeting more weakness towards the 1.5050 level. A break if seen … “GBPUSD Looks To Overcome Key Support”

Month: October 2015

Canadian Dollar Rallies for Second Day

The Canadian dollar gained for the second consecutive session on Thursday as the weakness of US dollar, the rally of crude oil and positive economic data supported the currency. The softness of the greenback was helping other currencies, and the loonie was one of the strongest against its major counterpart. While experts and US policy makers talk about a December interest rate hike, markets clearly do not believe them, adding to the weakness of the US currency. Crude oil … “Canadian Dollar Rallies for Second Day”

Dollar Soft Ahead of Non-Farm Payrolls

The US dollar was soft during Thursday’s trading as economic data from the United States was not particularly favorable. Losses were not big, though, and the currency may yet bounce if non-farm payrolls turn out to be good. Institute for Supply Management reported that manufacturing Purchasing Managers’ Index fell from 51.1 percent in August to 50.2 percent in September. Claims for unemployment benefits rose by 10,000 to 277,000 … “Dollar Soft Ahead of Non-Farm Payrolls”

Brazilian Real Drops amid Political Uncertainty

The Brazilian real dropped against the US dollar today as political uncertainty and turmoil in the country were not helping to make the currency attractive to overseas investors. Brazilian Congress was pushing for legislation that would prevent an increase of public spending, but President Dilma Rousseff vetoed the move. Congress may yet vote to overrun the veto. Otherwise, further downgrade of the country’s credit grade by rating agencies is not unlikely. USD/BRL gained … “Brazilian Real Drops amid Political Uncertainty”

Russian Ruble Gains as Manufacturing Slows Decline, Erases Rally

The Russian ruble gained today as a report released during the current trading session showed that the nation’s slowed its decline last month. The currency has not been able to keep gains, though, and trades below the opening level currently. Markit manufacturing Purchasing Managers’ Index for Russia climbed 47.9 in August to 49.1 in September. While the reading below 50.0 still indicates contraction of the sector, it was the slowest decline since … “Russian Ruble Gains as Manufacturing Slows Decline, Erases Rally”

5 Most Predictable Currency Pairs – Q4 2015

Currency pairs differ quite a lot in their volume of trade, range of movement and predictability. A predictable currency pair pays respect to clear lines of support and resistance, either slowing down and retreating when approaching them or making a clear break and leaving only dust behind them. At the other end of the spectrum … “5 Most Predictable Currency Pairs – Q4 2015”

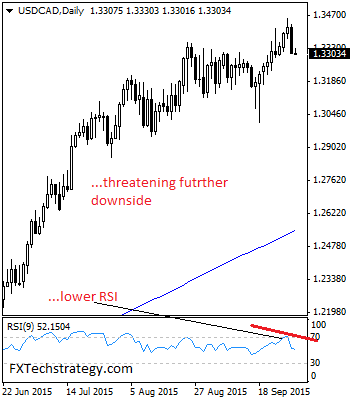

USDCAD Drops Lower On Corrective Weakness

USDCAD: USDCAD sold off strongly on Wednesday leaving risk of further decline on the cards. With that said, we look for more weakness to occur in the days ahead. On the downside, support lies at the 1.3250 level followed by the 1.3200 level. Further down, support resides at the 1.3150 level and then the 1.3100 … “USDCAD Drops Lower On Corrective Weakness”

EUR/USD: Trading the US NFP Oct 2015

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Update: Non-Farm Payrolls only 142K – USD Dives Published … “EUR/USD: Trading the US NFP Oct 2015”