The Fed surprised with a hawkish tone including implying a rate hike in December in a more specific manner. The team at BofA Merrill Lynch see room for more rises from here. Here is their logic: Here is their view, courtesy of eFXnews: Going into the October FOMC meeting, markets were pricing the first Fed rate hike … “USD has more room to rise post Fed – BofA Merrill”

Month: October 2015

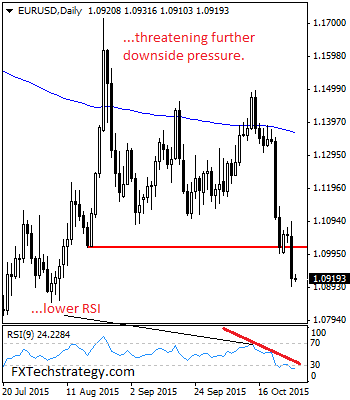

EURUSD Cuts Through The 1.1016/17 Zone, Remains Susceptible

EURUSD: With pair weakening strongly following its sell off through the 1.1016/17 levels on Wednesday, further downside pressure is envisaged. While EUR holds below the mentioned broken support, we look for weakness the 1.0850 level where a violation will aim at the 1.0800 level. A break of here will turn risk to the 1.0750 level … “EURUSD Cuts Through The 1.1016/17 Zone, Remains Susceptible”

USD/JPY: Trading The BoJ – RBS, Goldman Sachs

After we’ve certainly heard from the Fed, the next move in USD/JPY depends on the Bank of Japan. Here are forecasts from RBS and Goldman Sachs: Here is their view, courtesy of eFXnews: As attention is turning to the BoJ at the end of the week, RBS and Goldman Sachs examine the potential response of USD/JPY to … “USD/JPY: Trading The BoJ – RBS, Goldman Sachs”

NZ Dollar Falls After RBNZ & Fed

The New Zealand dollar fell today following the monetary policy announcement from the Reserve Bank of New Zealand made by the end of the Wednesday’s trading session. Of course, the policy announcement from the US Federal Reserve has also played its part in the currency’s decline. RBNZ Governor Graeme Wheeler left the main interest rate unchanged at 2.75 percent. He mentioned that “financial market volatility has eased in recent weeks” but … “NZ Dollar Falls After RBNZ & Fed”

US Dollar Soars as December Hike Remains Possible

The US dollar surged against other most-traded currencies on Wednesday after the Federal Reserve mentioned that a December rate hike remains in the cards. Unsurprisingly, the announcement made a tremendous impact on the market. The Fed made no changes to its monetary policy, surprising no one. Yet it said in uncharacteristically bold language that a rate lift-off at the next meeting remains a possibility: In determining whether it will be appropriate to raise the target … “US Dollar Soars as December Hike Remains Possible”

December Liftoff Remains On The Table – Nordea

The Fed not only put a Fed hike off the table put put it firmly on, also seeing the US economy with relatively rosy glasses. This led to a crash in EUR/USD on striking monetary policy divergence. Th team at Nordea provides a quick analysis of the event and its implications: Here is their view, … “December Liftoff Remains On The Table – Nordea”

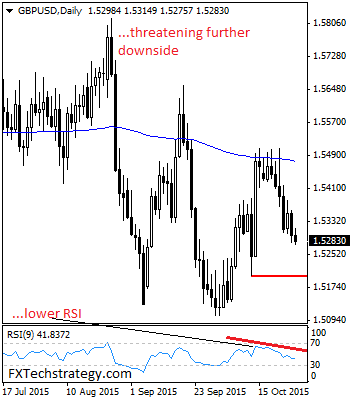

GBPUSD Bearish Risk Turns Attention To The 1.5199 Zone

GBPUSD: GBP continues to face downside pressure taking back its Monday gains to close lower on Tuesday. With more weakness underway, it could see further decline towards its key support located at 1.5199 level. On the downside, immediate support lies at the 1.5250 level with a break of here turning attention to the 1.5200 level. … “GBPUSD Bearish Risk Turns Attention To The 1.5199 Zone”

Australian Dollar Falls as Consumer Inflation Misses Expectations

The Australian dollar dipped 1.2 percent against the US dollar and the Japanese yen during the Wednesday’s trading session as Australia’s consumer inflation trailed economists’ forecasts. The Australian Bureau of Statistics reported that Consumer Price Index rose 0.5 percent in the September quarter from the June quarter. Analysts had predicted inflation to stay at the same 0.7 percent level as in the previous reporting period. Excluding the most volatile components, the CPI rose 0.3 … “Australian Dollar Falls as Consumer Inflation Misses Expectations”

Swedish Krona Dips After Riksbank Announcement, Bounces Later

Sweden’s central bank decided at today’s meeting to leave its interest rates unchanged but to expand the size of the asset purchase program. The Swedish krona dipped initially after the announcement but bounced as of now. The Riksbank left its main interest rate at -0.35 percent. Yet policy makers still expanded monetary stimulus by extending the size of asset purchases, announcing: Overall, the Executive Board’s assessment is that monetary policy needs … “Swedish Krona Dips After Riksbank Announcement, Bounces Later”

EUR/USD: Trading the US Advance GDP

US Advance GDP is a key release and is published each quarter. Advance GDP measures production and growth of the economy, and is considered by analysts as one the most important indicators of economic activity. A reading which is higher than the market forecast is bullish for the dollar. Update: US GDP at 1.5% – USD seems … “EUR/USD: Trading the US Advance GDP”