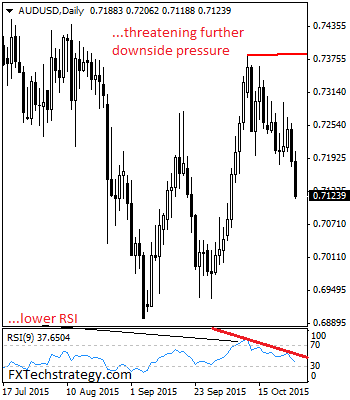

AUDUSD: The pair weakened on Tuesday and was seen weakening further during early trading on Wednesday. On the downside, support comes in at the 0.7100 level where a breach will aim at the 0.7050 level. Below that level will set the stage for a run at the 0.7000 level with a cut through here targeting … “AUDUSD Weakness Sets Up For The 0.7041 Zone”

Month: October 2015

Loonie Continues to Fall in Tandem with Crude Oil

The Canadian dollar slumped on Tuesday as prices for crude oil continued to struggle. Economic data from Canada’s neighbor, the United States, also was not helping the currency much. Crude oil continues to struggle due to the threat of oversupply. The Canadian currency, being tied to the performance of the commodity, suffered as a result. US macroeconomic data also had its negative impact on the loonie as most of Tuesday’s reports were lackluster. Poor data from the USA … “Loonie Continues to Fall in Tandem with Crude Oil”

Sterling Slides as Britain’s Growth Loses Momentum

The Great Britain pound fell today against its other major peers as Britain’s economic growth in the third quarter of this year was disappointing, reducing chances for an interest rate hike in the near future. Office for National Statistics reported that the UK economy grew 0.5 percent in the September quarter from the previous three months. This is compared to the prior quarter’s growth of 0.7 percent and the increase of 0.6 percent forecast by economists. … “Sterling Slides as Britain’s Growth Loses Momentum”

US Dollar Index Moves Higher, But Remains Rangebound

US dollar index is moving higher, but it remains rangebound today ahead of tomorrow’s Federal Reserve announcement. After dipping lower in earlier trading, the dollar index is gaining ground, and the US dollar has regained the upper hand against the euro. Even though the economic data coming out of the United States is a little disappointing, the dollar index is still heading a bit higher today. Indeed, after … “US Dollar Index Moves Higher, But Remains Rangebound”

Euro Mostly Steady in Forex Trading

Euro is mostly steady today in Forex trading, as many currencies await tomorrow’s policy announcement from the Federal Reserve. Without major data releases for the eurozone today, it’s more about waiting and seeing what’s next with US policy. Last week was a big week for the euro. The 19-nation currency was hammered after the ECB policy announcement and remarks by Mario Draghi that more stimulus could be on the way. … “Euro Mostly Steady in Forex Trading”

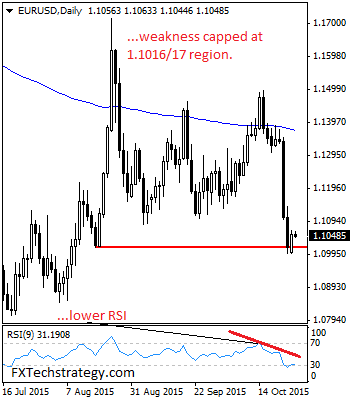

EURUSD: Bounces Off 1.1016/17 Zone, Faces Recovery Threat

EURUSD: The pair halted its weakness and turned higher on Monday leaving risk of more recovery on the cards. While the 1.1016/17 level zone continues to provide support, we should see a move higher on correction. On the downside, support lies at the 1.1000 level where a violation will aim at the 1.0950 level. A … “EURUSD: Bounces Off 1.1016/17 Zone, Faces Recovery Threat”

[EURGBP] Bullish Mean Reversion Opportunity Via Inside Day Breakout

Today I would like to talk about a potential mean reversion situation on the EURGBP daily chart. Price has accelerated away from it’s mean creating the classic price-to-mean gap. The fast moving bearish price action was contained by a support level – where price has stalled and churned to create a bullish body inside day. If … “[EURGBP] Bullish Mean Reversion Opportunity Via Inside Day Breakout”

CAD Little Changed vs. USD Falls vs. Other Majors

The Canadian dollar was flat against its US counterpart on Monday and remained little changed during Tuesday’s trading. The loonie was falling against other majors, including the euro and the Japanese yen. Unlike some other commodity currencies, the Canadian dollar did not get much help from China’s stimulus. The reason for the underperformance was the drop of crude oil — the key commodity for Canada. Movement of the loonie strongly correlates with … “CAD Little Changed vs. USD Falls vs. Other Majors”

AUD/USD: Trading the Australian CPI Oct 2015

Australian CPI (Consumer Price Index), which is released each quarter, is an inflation index which measures the change in the price of goods and services charged to consumers. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published … “AUD/USD: Trading the Australian CPI Oct 2015”

Week Starts with Correction for US Dollar

The US dollar fell against its major peers today, correcting after the last week’s huge jump. Economic data from the United States added to the pressure on the US currency. New home sales were at the seasonally adjusted annual rate of 468,000 in September. It was not only below the previous month’s revised value of 529,000 but also missed the analysts’ projection of 546,000. The dollar has pulled back as a result of the disappointing … “Week Starts with Correction for US Dollar”

![[EURGBP] Bullish Mean Reversion Opportunity Via Inside Day Breakout](https://investinearth.org/wp-content/uploads/2015/10/eg-mean-reversion.png)