Two and a half years ago I had written an article for this publication entitled “The USD – why is it so High?” Yet here we are in 2015 and the situation hasn’t changed; in fact it gotten much worse. There is a race to the bottom in terms of currencies and no one wants … “A Race to the Bottom”

Month: October 2015

Euro Weaker During ECB Week

The euro was weaker across the board during the past trading week as comments from European Central Bank’s President sounded very dovish and included hints at probable addition of monetary stimulus. The shared 19-nation currency started the week on a weak footing, and its attempts to rally were feeble. But it was on Thursday when things started to look really bearish. While the ECB left interest rates unchanged, the President Mario Draghi … “Euro Weaker During ECB Week”

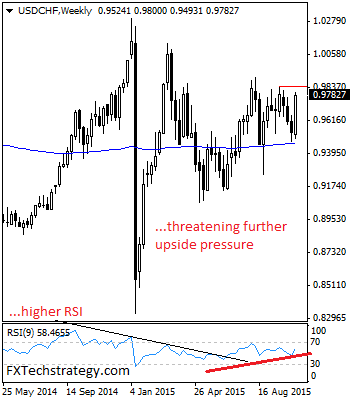

USD/CHF Pressure Set Towards The 0.9843 Zone

USDCHF: The pair strengthened the past week taking back its three-week losses to close higher. This development has opened the door for more strength towards its key resistance at the 0.9843 level. This level if broken will set the stage for a run at the 0.9900 level. A breather may occur here and turn the … “USD/CHF Pressure Set Towards The 0.9843 Zone”

CAD Falls with Canadian Inflation

The Canadian dollar fell against its US peer today as Canada experienced deflation last month. The currency was little changed against the Japanese yen and gained on the very soft euro. Canada’s Consumer Price Index dropped 0.2 percent in September from the preceding month while experts had promised a smaller drop by 0.1 percent. The core components of the index actually rose, but the increase trailed analysts’ expectations. Unlike yesterday, … “CAD Falls with Canadian Inflation”

Draghi eyeing up the full menu – but will he

Draghi hinted at more action in December, talking down the EUR, but does QE actually work for the markets?, watch today’s discussion with Michael Hunter, Market Reporter for Financial Times. Key points Draghi hinting at more action in December French industrial data getting better, bodes well for Eurozone? QE doesn’t work, seen in Japan Draghi … “Draghi eyeing up the full menu – but will he”

Australian Dollar Attempts to Rally After Good News from China

The Australian dollar attempted to rally today on the back of good news from China. The currency had been successful at first but has pared gains after the initial surge, losing them almost completely against the US dollar. The People’s Bank of China announced today: The one-year RMB benchmark loan interest rate and deposit interest rate will both be lowered by 0.25 percentage points, to 4.6 percent and 1.75 percent, respectively. … “Australian Dollar Attempts to Rally After Good News from China”

US Dollar Index Extends Rally and Erases October Losses

US dollar index is extending its recent rally, and between yesterday and today has erased its earlier losses in October. Thanks to expectations for a Federal Reserve rate hike sometime in late 2015 or early 2016, plus policy divergence expectations, the greenback is surging against its major counterparts. There is a great deal of support for the US dollar right now. Thanks to recent comments from Mario Draghi, and the fact … “US Dollar Index Extends Rally and Erases October Losses”

Euro Continues to Lose Ground After ECB Meeting

Euro is still losing ground after yesterday’s ECB meeting. And now, some analysts say that the euro could end up in parity with the US dollar by the end of the year. Yesterday’s ECB meeting brought out comments from Mario Draghi to the effect that the central bank is willing to do what it takes in an effort to stimulate the eurozone economy. The remarks from policymakers are encouraging the idea that if … “Euro Continues to Lose Ground After ECB Meeting”

FOMC ahead: Fed needs to move on from the outdated

The Federal Reserve has to give markets something for a December hike in next week’s FOMC, says Jeremy Stretch, Head of G10 FX Strategy at CIBC, as he speaks on the US rate hike scenario and Fed communication in today’s Tip TV Finance Show. Yellen: Problem with communication Stretch notes that Yellen’s communication to the … “FOMC ahead: Fed needs to move on from the outdated”

Draghi opens door for EUR/USD at 1.05 – Goldman Sachs

The ECB is dead serious to fight deflation with Draghi using his top verbal skills and showcasing the best of his weaponry to hit the euro hard. This may be only the beginning. The team at Goldman Sachs lays out scenarios for EUR/USD reaching down to 1.05: Here is their view, courtesy of eFXnews: “ECB … “Draghi opens door for EUR/USD at 1.05 – Goldman Sachs”