The world’s most popular pair attracts many traders and it has many moving parts on both sides of the Atlantic. We begin by discussing the long term fundamentals that move EUR/USD, discuss the recent developments and discuss the future of the pair. This is a recording of a presentation I gave on October 7th in … “EUR/USD Moving Parts – Full Presentation”

Month: October 2015

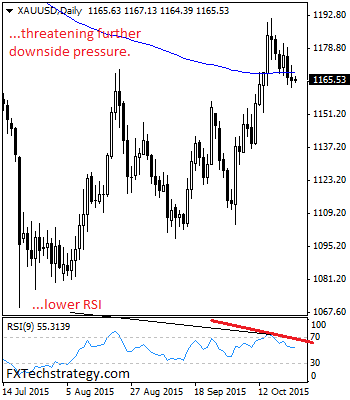

GOLD: Maintain Broader Bias, Vulnerable

GOLD: With the commodity continuing to hold on to its downside pressure, further downside pressure is likely. On the downside, support comes in at the 1155.00 level where a break will aim at the 1140.00 level. A cut through here will open the door for move lower towards the 1130.00 level. Below here if seen … “GOLD: Maintain Broader Bias, Vulnerable”

EUR: How Low Could Draghi Go? 4 Takes – Deutsche Bank

Following Draghi’s 5 blows to the euro, we have seen a huge fall in EUR/USD that extended below uptrend support. How low can it go? The team at Deutsche Bank brings up 4 important points: Here is their view, courtesy of eFXnews: “The implications could be very bearish for the euro and have important implications … “EUR: How Low Could Draghi Go? 4 Takes – Deutsche Bank”

Ruble Gains with Crude Oil Prices

The Russian ruble rose against the US dollar with the help of rising crude oil prices. Comments from Russian President Vladimir Putin perhaps also played a part in the ruble’s rally. Crude oil gained today, helping currencies related to the commodity. The ruble was among them as the Russian economy strongly depends on oil export. Meanwhile, Putin said that the currency has stabilized: The national currency is subject to certain market … “Ruble Gains with Crude Oil Prices”

Canadian Dollar Demonstrates Strong Gains, Ignoring Domestic Data

The Canadian dollar demonstrated big gains against its major rivals today, even against the very strong US currency. The loonie managed to rally even though domestic macroeconomic data was not particularly good. Canada’s retail sales grew 0.5 percent in August from July, beating analysts’ expectations. Yet the big negative was the core part of the indicator, which excludes volatile automobile sales. It was flat … “Canadian Dollar Demonstrates Strong Gains, Ignoring Domestic Data”

Draghi’s 5 blows to EUR/USD

Draghi delivered dovishness. He more than delivered and this dragged down the euro quite strongly. This kind of message was not priced in, to say the least. Here are 5 highlights of what he said to bring the common currency to its knees and some levels to watch. The ECB was expected to hint about an extension … “Draghi’s 5 blows to EUR/USD”

Pound Unable to Beat Dollar, Gains on Battered Euro

The Great Britain pound attempted to rally against the US dollar today on the back of the very good retail sales report but failed as the greenback surged following the European Central Bank policy meeting. Of course, the sterling gained on the vulnerable euro, which had been hurt by the comments of the ECB President. UK retail sales grew 1.9 percent in September from August. It was a far bigger increase than 0.3 percent promised … “Pound Unable to Beat Dollar, Gains on Battered Euro”

US Dollar Index Surges Higher After ECB Announcement

Greenback is heading higher today as the latest ECB announcement is made. Concerns that the Fed won’t raise rates until next year are being overcome by the insinuations that more quantitative easing could be coming for the eurozone by the end of the year. The US dollar index is higher today as the greenback gains against the euro, pound and yen. US dollar is mostly higher today, gaining as Mario Draghi hints … “US Dollar Index Surges Higher After ECB Announcement”

Euro Sinks as Draghi Hints at Additional QE

The euro sank today following the monetary policy meeting of the European Central Bank. While the monetary policy itself remained unchanged, ECB President Mario Draghi sent a stronger signal about the possibility of additional quantitative easing. The ECB left interest rates unchanged at today’s meeting, including the benchmark interest rate on the main refinancing operations that remained at 0.05 percent. But the real downer for the euro was the comments from the President. Draghi … “Euro Sinks as Draghi Hints at Additional QE”

EUR/USD: Trading the German Flash Manufacturing PMI

German Flash Manufacturing PMI (Purchasing Manager Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions. A reading which is higher than expected is bullish for the euro. Update: German manufacturing PMI at 51.6 as expected Here are all the details, and … “EUR/USD: Trading the German Flash Manufacturing PMI”