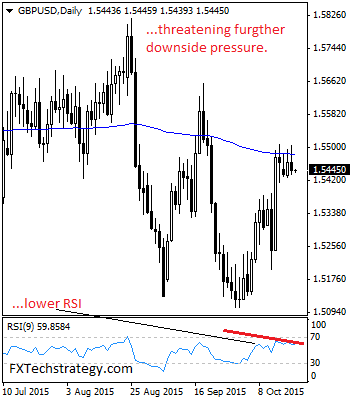

GBPUSD: GBP continues to hold on to its downside bias failing at the 1.5505 level to close lower on a rejection candle on Tuesday. While it remains below the 1.5508 level and its 200 EMA, our bias remains to the downside. Resistance resides at the 1.5508 level. A violation of here will clear the way … “GBPUSD: Faces Further Bear Pressure, Eyes 1.5382 Level”

Month: October 2015

UK Pound Gets Help From Better Economic Data

UK pound is getting a little help from better economic data recently, and that is allowing it to gain against the dollar and the yen for now. While the pound is lower against the euro today, sterling is doing well against other major currencies. However, there is speculation that the pound will soon drop back against the dollar. For today, sterling is heading higher against the US dollar … “UK Pound Gets Help From Better Economic Data”

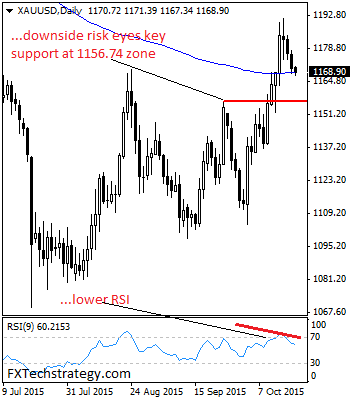

GOLD: Bear Risk Builds Up On The 1156.74 Zone

GOLD: The commodity declined further on Monday opening the door for more weakness. GOLD continues to hold on its weakness triggered off the 1183.80 level on Oct 15 2015. On the downside, support comes in at the 1160.00 level where a break will aim at the 1150.00 level. A cut through here will open the … “GOLD: Bear Risk Builds Up On The 1156.74 Zone”

FXStreet offers Forecast Poll and Trading Positions as widgets

The offering from FXStreet to third parties has grown: the forecast poll and the trading position tools are now available as widgets. Here is more information from the official press release: Barcelona, October 19th 2015 – FXStreet has announced that two of its most famous tools, the Currencies Forecast Poll and the Current Trading Positions, … “FXStreet offers Forecast Poll and Trading Positions as widgets”

Canada’s Changing Of The Guard And Its Economic Implications

Justin Trudeau was swept into power in Canada, winning an outright majority and beating the decade long PM Stephen Harper. This implies changes of policy: Avery Shenfeld of CIBC World Markets explains: Here is their view, courtesy of eFXnews: The ballot counting will continue late into the night, but Canada’s federal election looks to be … “Canada’s Changing Of The Guard And Its Economic Implications”

AUDUSD: Weak, Risk Builds On The 0.7197 Level

AUDUSD: AUDUSD took back its intra day gains to close slightly lower on Monday leaving risk of more weakness on the cards. While the pair can trade and hold below the 0.7363/81 levels, we think more weakness should occur towards its support at 0.7197. On the upside, resistance lies at the 0.7300 level. A cut … “AUDUSD: Weak, Risk Builds On The 0.7197 Level”

US Dollar Broadly Stronger, Unable to Beat UK Pound

The US dollar was broadly stronger against its most-traded counterparts today as disappointing news from China damped risk appetite among Forex traders. Saying that, the greenback was not able to beat all the major rivals, falling a little against the Great Britain pound. China’s macroeconomic releases were in the spotlight during the Monday’s trading session. While nation’s economic growth was not as slow as analysts had predicted, … “US Dollar Broadly Stronger, Unable to Beat UK Pound”

Canadian Dollar Suffers Together with Commodities

The Canadian dollar slumped today as China’s not-so-good macroeconomic data dragged prices for raw materials down, hurting commodity-linked currencies along with them. Economic reports released from China on Monday were mixed but mostly disappointing to investors. Poor economic news from the world’s second largest economy and a major consumer of raw materials certainly had its negative impact on the commodity market. Crude oil was among the losers … “Canadian Dollar Suffers Together with Commodities”

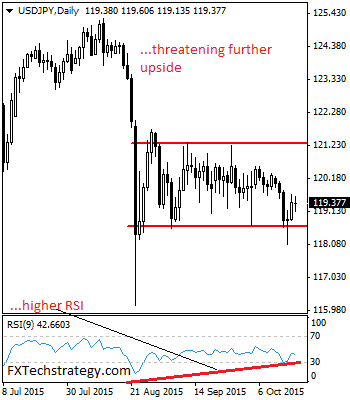

USDJPY: Risk Points Higher On Further Bullish Offensive

USDJPY: With USDJPY halting its weakness to close higher the past week, it looks to move higher in the new week. We envisage a possible move towards its range top at the 121.32 level. On the upside, resistance resides at the 120.00 level with a turn above here aiming at the 120.50 level. A break … “USDJPY: Risk Points Higher On Further Bullish Offensive”

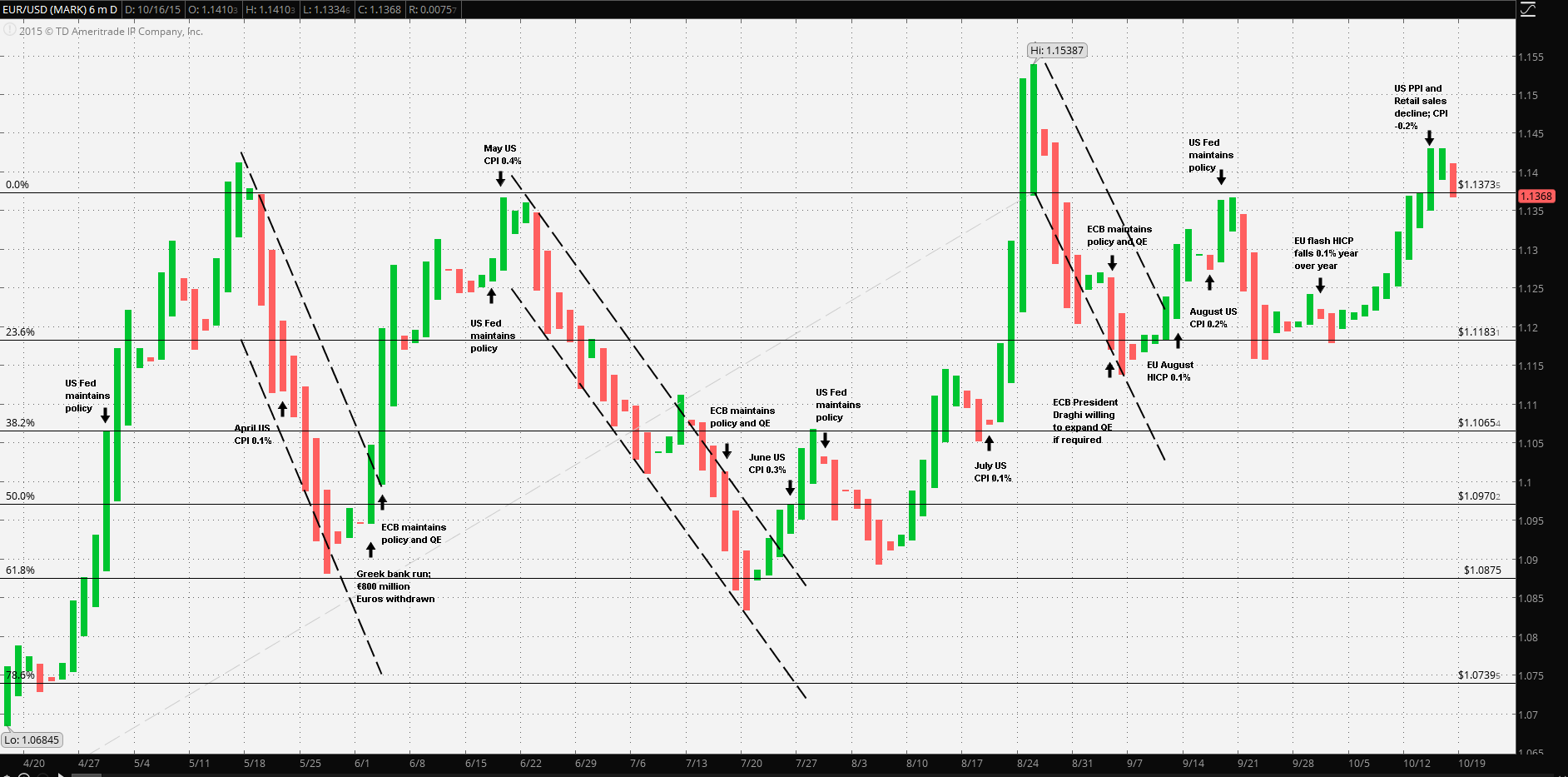

EUR/USD: The Best Laid Plans…

In June of 2014, the ECB began increasing its monetary easing policy by first lowering the overnight deposit rate to -0.10% followed by a second reduction in September of 2014 to -0.20%, where they have remained since. The results of the low rate policy, plus the implementation of the monthly target of €60 billion … “EUR/USD: The Best Laid Plans…”