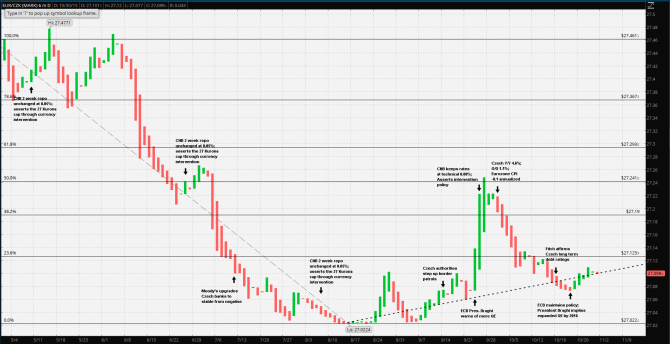

At the previous Czech National Bank meeting, 24 September, it was decided to maintain a zero rate policy. More importantly “…The Bank Board also decided to continue using the exchange rate as an additional instrument for easing the monetary conditions and confirmed the CNB’s commitment to intervene on the foreign exchange market if needed to weaken the koruna so that the exchange rate of the koruna is kept close to CZK 27 to the euro…” Further, the CNB asserted that it would act as needed without any meetings of the board.

The Czech Republic is a non-Euro area member; however, CNB policy keeps a ‘floor’ under the Koruna. Officially, the intent is to keep the Koruna ‘around’ 27 to the Euro. It’s worth noting, here, the European Union’s ±15% ERMII criteria, which is a transitionary mechanism towards adopting the Euro: the transitionary currency must be maintained within a ±15% fluctuation band above or below a central rate. It just so happens that the Koruna has been well within this band during the previous two years; ±2.4%, using the average of the 2 year high and the floor as a central rate. The CNB intends to keep the policy exchange rate in place until “…at least until mid-2016…”

Guest post by Mike Scrive of Accendo Markets

However, the CNB has not signaled any intent to enter into ERMII. There are many reasons for this. For example, once a signatory to ERMII, the applicant central bank gives up some of its independence, in particular, “…no longer have recourse to currency appreciation or depreciation to manage their economies and respond to economic shocks… …Instead, they must use budgetary and structural policies to manage their economies prudently…” An export economy might hesitate at this requirement.

It should be noted that the Czech Republic’s top 14 export destinations account for 80% of total exports; almost all of it inter-EU trade. Other countries include Russia, USA and Turkey. Similarly almost 90% of imports are from the Czech Republic’s top 21 partners. The larger portion of which originates from the EU and the rest from Asia-Pacific, Russia, USA, Chile, and Turkey. The point being is that the Czech economy is far more integrated with the EU economy, than any other.

The CNB has done a remarkably good job of keeping the Koruna-Euro exchange within a ‘virtual’ ERMII range. This doesn’t necessarily imply ERMII compliance. The CNB has emphasized its intent to keep the Koruna on the weak side vs the Euro which makes sense considering its trade with the Western members. And herein lies the problem. At the 22 October ECB press conference, President Draghi made it all but certain that the ECB would review the results of its QE policy this December and likely expand the program to obtain more satisfactory results. When one looks at the bigger picture, the contraction in Asia, positive but slow UK and US economic growth and the nearly flat EU growth, there’s a very high likelihood that the ECB will indeed pursue a more aggressive policy. In other words, the Euro may weaken, significantly, perhaps driving the Koruna to the floor.

The Czech National Bank has proven its ‘virtual’ ERMII ability but still keeps a public polite distance from the Eurozone. It also should be noted that CNB FX intervention to date is in the same league as the Swiss National Bank. Might this arms-length but determined effort of CNB policy be indicative of a long simmering divide between the EU and the CEE states? In particular, keeping the Koruna in a narrow band in practice, but not giving the slightest public hint of ever adopting the Euro? A weakening of the Euro would make the CNB’s floor more difficult to maintain, but not impossible. However, Czech President Milos Zeman as well as both parliamentary house leaders has been pressuring the CNB to ‘scrap’ the floor policy since the 2014 elections, in spite of CNB Governor Singer’s intent to carry it out.

A recent Czech GDP report indicated year over year growth at 4.6%; above expectations. However, an important factor of the expansion is the Czech auto manufacturing industry and domestic auto sales. The Volkswagen scandal is expected to subtract 1% to 1.5% from future GDP growth.

The point of the narrative is this: the CNB has managed its currency with respect to the Euro rather well for over two years. However, there is a growing divergence of political policy occurring along the former Warsaw Pact boundary states and increasing populist party power, even to the point of circumventing the key EU Schengen agreement. This is evidenced recently by the Czech Republic entering into a border patrol agreement with Hungary and Poland. The next CNB policy meeting is 5 November. When it comes to monetary policy alone, the CNB may be forced to ‘get out in front’ of the ECB. However, although the bank has stubbornly maintained independence, pressure to let the Euro weaken shouldn’t be discounted.

Mike Scrive

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”