In the statement following the recent Monetary Policy Board meeting of the Reserve Bank of Australia, Governor Glenn Stevens announced the continuation of the RBA policy stance held since the May 2015 meeting. The statement was more telling than the cash rate being held at 2.00%.

As far as central bank statements go, the board was rather direct on several points. First, it was noted that, “…The global economy is expanding at a moderate pace, with some further softening in conditions in the Asian region… … Key commodity prices are much lower than a year ago, in part reflecting increased supply, including from Australia…” ; thus directly referring to the RBA’s concerns over the domestic Aussie economy.

The second point of interest was the board’s concern over the strong possibility of a strengthening US Dollar, perhaps expressing a slight perplexity over the US Fed’s expected future interest rate policy: “… The [US] Federal Reserve is expected to start increasing its policy rate over the period ahead, but some other major central banks are continuing to ease monetary policy…”

Guest post by Mike Scrive of Accendo Markets

The statement also expressed optimism, noting the moderate expansion of the domestic economy, an increase of employment and business optimism. It all summed up to its decision of maintaining its accommodative policy stating, “…Inflation is low and should remain so, with the economy likely to have a degree of spare capacity for some time yet. Inflation is forecast to be consistent with the target over the next one to two years, but a little lower than earlier expected…”

The statement’s inflation expectations might be the result of a continuing contraction in the Asia-Pacific region and the potential for Yuan disinflation. Analysts expect the PBOC to create a much more accommodative policy. It should be noted that Australia’s two largest export destinations are China, at 36% of total and Japan, at 17% of total. A weaker Yuan would have a negative effect on Aussie commodity exports. Further, at the 30 October policy meeting, the Bank of Japan noted that, “…The Bank will purchase Japanese government bonds (JGBs) so that their amount outstanding will increase at an annual pace of about 80 trillion yen [£427.1 billion]. With a view to encouraging a decline in interest rates across the entire yield curve, the Bank will conduct purchases in a flexible manner in accordance with financial market conditions…” The statement went on to note that purchases would include ETFs, REITS and Corporate Bonds, i.e., further Yen weakening.

Lastly, Australia’s third largest export destination, South Korea at 7.4% of total, maintained its accommodative policy at its 2 November meeting, citing, “…We plan to keep our monetary policy accommodative as the ongoing recovery is steady and as inflation is expected to remain low…” Interestingly, the BOK also noted that, “…Our market interest rates may rise after the [US]Fed hikes interest rates, regardless of our monetary policy. However, they will probably rise at a limited pace as we plan to keep rates accommodative enough to support economic growth…” The US is 11% of the South Korean export market, Australia, 1.6%.

What it all adds up to is that the RBA may have to weaken the Aussie as its top trading partners weaken, especially so if the US Fed decides to strengthen the US Dollar.

The smaller New Zealand economy has also been feeling the effects of the Asia-Pacific economic contraction, as well as the region’s ‘low-flation’. New Zealand’s top four export destinations are China at 20% of total, Australia at 17%, the US at 8.5% and Japan at 6.4%. New Zealand’s top exports to China and Japan are dairy based; to Australia high grade crude oil and to the US bovine meat products. New Zealand also exports a sizable portion of raw aluminium to Japan. With the exception of bovine meats fetching record high prices in the US, oil, metals and dairy have all experienced steep price declines. It should also be noted that a sizable portion of New Zealand’s government revenues are derived from its crude oil exports.

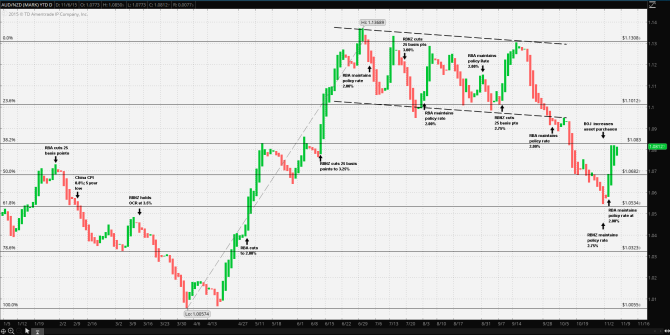

The effect of policy easing on the AUD/NZD cross is demonstrated in the above chart. With a very high quality triple credit rating and with overnight rates at 3.5% towards the end of March 2015, capital inflows drove to Kiwi to a virtual parity with the Aussie. However, the pressures from collapsing oil and dairy prices caused the RBNZ to signal a rate reduction cycle, sending the Kiwi from Aussie parity, to a year-to-date low of 1.13689 Kiwi per Aussie; a 13.68% decline in just about 90 days. Contributing to the decline were expectations that the RBA had completed its rate reduction cycle at the 5 May meeting leaving the OCR at 2.00%. Those expectations would prove to be correct.

The concerns of the RBNZ were expressed by the statements following the meetings at which the OCR was reduced. From the 11 June statement: “…the fall in export commodity prices that began in mid-2014 is proving more pronounced… …Inflation has been low due to falling import prices and the strong growth in the economy’s supply potential… …the exchange rate has declined from its recent peak in April, but remains overvalued…”

From the 23 July statement: “… the growth outlook is now softer than at the time of the June Statement… …inflation is currently below the Bank’s 1 to 3 percent target range, due largely to previous strength in the New Zealand dollar and a large decline in world oil prices… …currency depreciation will provide support to the export and import competing sectors, further depreciation is necessary…”

From the 10 September statement: “…While the lower exchange rate supports the export and import-competing sectors, further depreciation is appropriate… … some further easing in the OCR seems likely…”

Lastly, from the 29 October statement , Governor Graeme Wheeler noted the lack of inverse correlation between lower rates and Kiwi weakening : “…Global economic growth is below average and global inflation is low despite highly stimulatory monetary policy… ….Financial markets are also uncertain about the timing and effects of monetary policy tightening in the United States and possible easings elsewhere… …To ensure that future average CPI inflation settles near the middle of the target range, some further reduction in the OCR seems likely…”

There seems to be a common thread among the central banks in the Asia-Pacific region. Concerns about the recalibrating China economy, concerns about the lack of inflation response as a result of central bank policy and last, but by no means least, is the uncertainty over US Fed policy.

It should be obvious that the absent correlation between policy and inflation must be the result of external causes common to the Asia-Pacific export economies. (The situation in Europe is similar). Further, it seems that the respective central banks must save their remaining leverage if an ‘offsetting response’ to US Fed actions is needed in December.

With the next RBNZ meeting scheduled 10 December, the next RBA meeting scheduled for 1 December and the US Fed statement scheduled for 16 December, it’s not unreasonable to expect AUD/NZD to trade within a range NZD$ 1.05 support to NZD$ 1.10 resistance, barring unexpected events, until that time.

Mike Scrive

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”