EUR/USD consolidated its losses and stayed at the 1.07 handle. What’s next for the pair?

The team at Barclays Capital was short and it now revises its targets considering a wider range of policy outcomes:

Here is their view, courtesy of eFXnews:

Barclays Capital continues to see significant further downside in EUR/USD but expects the extent of that downside to depend critically on how much policy divergence accompanies the economic divergence at the core of its forecasts.

EUR/USD: A Wider Range Of Policy Outcomes.

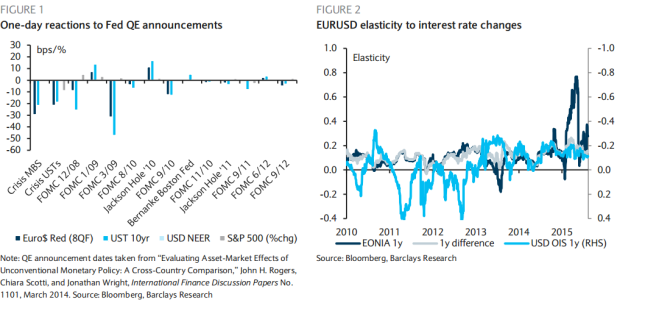

“The focus of policy divergence increasingly is driven by the ECB, as further easing has become our base case and more negative rates become more likely. The wider range of possible policy outcomes implies a wider range of potential FX outcomes, a range that we see as skewed to the downside,” Barclays argues.

“President Draghi’s ECB consistently has delivered more than markets expected, underscoring his repeated commitment to do “whatever it takes” to return inflation to its mandated level. With us now expecting the Fed to raise rates at its December meeting, EURUSD may be hit by a “double whammy” heading into year-end.

Regardless, over the coming year, the paths of both central banks’ policy rates are set to move in opposite directions, adding the potential for large policy divergence to the already large economic divergence. How much policy divergence occurs will determine the pace of EURUSD depreciation, a range that we believe is both wide and skewed to the downside,” Barclays projects.

EUR/USD: Scenarios & Forecasts.

-We have kept our EURUSD forecast profile the same, reaching 0.95 by Q3 2016. However, we see a wide range around these forecasts.

-For instance, if both the ECB and the Fed disappoint expectations in December, we have little difficulty seeing EURUSD as high as 1.12.

-Conversely, if the ECB surprises with a whole suite of policies and the Fed hikes in December, we would expect a challenge of parity by year-end.

-Similarly, if the ECB cuts rates more than once over the year ahead – if inflation continues to disappoint – and the Fed hikes at the once-per quarter pace we expect, a EURUSD rate nearer 0.90 is feasible, while intransigence by both central banks may limit EURUSD’s downside over the year ahead roughly to parity,” Barclays projects.

EUR/USD: Strategy.

Barclays maintains a short EUR/USD position from 1.1278, with a revised stop at cost (from 1.1562), and a revised target at 0.99 (from 1.0460).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.