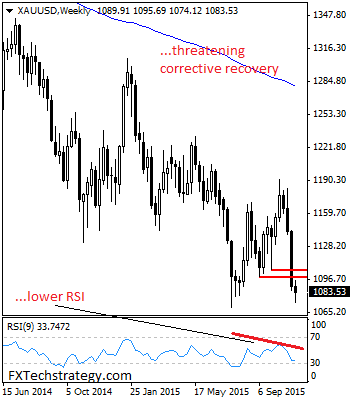

GOLD: The commodity may have closed lower the past week, but faces a recovery risk in the new week. While it holds above the 1069.46 level, a recovery higher is expected. On the downside, support comes in at the 1075.00 level where a break will turn attention to the 1060.00 level.

Further down, a cut through here will open the door for a move lower towards the 1050.00 level. Below here if seen could trigger further downside pressure targeting the 1045.00 level. Its weekly RSI is bearish and pointing lower suggesting further weakness. Conversely, resistance resides at the 1100.00 level where a break will aim at the 1115.00 level. A turn above there will expose the 1130.00 level. A violation of here will turn attention to the 1145.00 level. All in all, GOLD looks to push higher on corrective recovery following its rejection candle formation (see daily chart) ahead of its key support at the 1069.46 level.

In our latest podcast we discuss the December decision driving the dollar, declining oil and more:

Follow us on Sticher or on iTunes