The Canadian dollar has been rocking and rolling on oil prices and things become complicated. Regarding the euro: what does Draghi know?

Here is the view from CIBC:

Here is their view, courtesy of eFXnews:

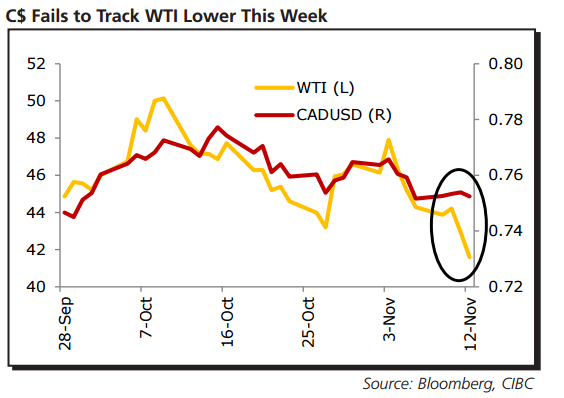

CAD: Oil Off a Loonie’s Back. The 30, 60 and 120 day correlations between oil prices and movements in the C$ remain fairly elevated

However, this week the loonie failed to ease against the greenback even as WTI prices reached their lowest level since late August. In part that was due to some broader based weakness in the US$ over that period, as a number of Fed speakers reminded markets that rate hikes would be very gradual once they start.

However, if oil prices fail to recover this week’s lost ground, or markets start to price in more Fed interest rate hikes again, there’s probably still scope for the loonie to lose a couple of cents before year-end.

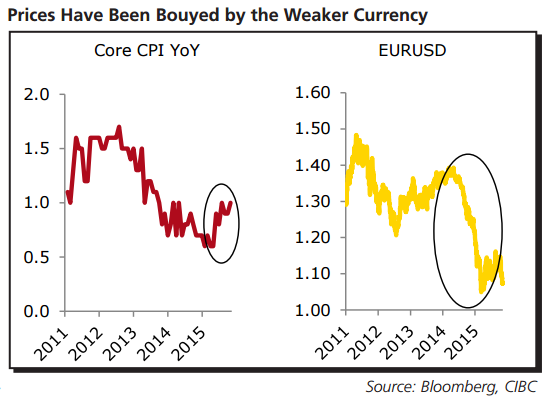

EUR: Does Draghi Know Something We Don’t? There have been a number of people questioning ECB President Draghi’s bias toward further easing, those questions have even come from others on the central bank’s Governing Council. With both headline and core CPI perking up recently, some wonder why he’s so certain that additional easing is necessary.

Does he know something we don’t? Not really. Core prices are perking up largely because of the precipitous drop in the level of the exchange rate with the USD. That means import prices have been buoyed by a one-time shift. The problem is that this type of support for prices is unsustainable. So, with underlying inflation likely barely a quarter of its target, it’s easy to see why Draghi is reloading his bazooka.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.