Did EUR/USD find a bottom? Perhaps for now, but the future is more complicated.

The team at Danske analyze the moving parts behind the pair:

Here is their view, courtesy of eFXnews:

Flows. Speculators have increased their bearish EUR/USD positions substantially over the past few weeks and positioning looks increasingly stretched from an historical point of view.

Valuation. PPP is around 1.24 and our MEVA model suggests 1.28 is ‘fundamentally’ justified; thus, the cross is undervalued on both metrics.

Risks. With both the ECB and the Fed priced to deliver in December, the biggest short-term risk factor is that one, or both, central bank backtracks on its ‘promises’.

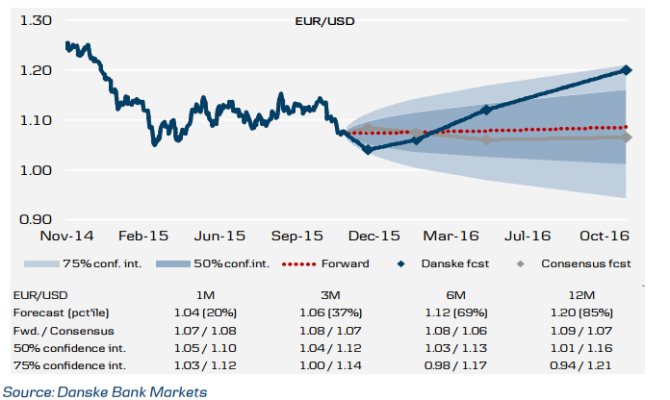

Forecast: 1.04 (1M), 1.06 (3M), 1.12(6M), 1.20 (12M).

Conclusion. We now look for the Fed to deliver the first rate hike in December and for the ECB to ease substantially before year-end and we lower our 1M and 3M forecast as the cross has further to fall on relative rates. We look for a temporary break below the March low at 1.0458 in December, forecasting EUR/USD at 1.04 in 1M (previously 1.10).

We do not think the cross is headed for parity and we see little potential for the market to price sustained divergence in Fed-ECB policy beyond December as (i) the market is already pricing a good deal in terms of Fed-ECB divergence, (ii) the impact of relative rates on EUR/USD is waning and (iii) the bearish EUR/USD positioning looks increasingly stretched. Thus, we target 1.06 in 3M (was 1.08). Longer term, we still expect to see a gradual move higher in the cross towards the levels warranted by medium- to long-term fundamentals. We keep our 6M and 12M forecast unchanged at 1.12 and 1.20, respectively

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.