EUR/USD is showing fresh weakness in the new trading week.

If it rises, the team at Barclays suggests selling the pair, especially as the December decision looms.

Here is their view, courtesy of eFXnews:

Barclays Capital expects the USD to trade sidelines during the next week as markets wait for policy action coming from the FOMC and the ECB during the first half of December.

“It is going to be difficult to see a shift in sentiment next week as we only get inflation data and durable goods. We anticipate a quiet week due to the Thanksgiving holiday,” Barclays adds.

On the EUR front, Barclays notes that the ECB further prepared markets for additional policy easing last week.

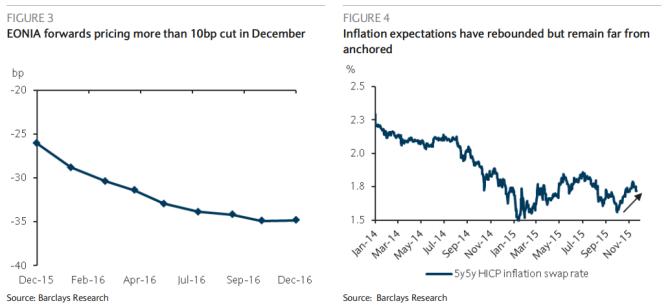

“President Draghi re-iterated the ECB’s “whatever it takes” commitment, emphasizing that it possesses the necessary tools to bring inflation back to target and reanchor inflation expectations. We continue to expect an extension of the current QE program and a 10bp deposit rate cut to -30bp. Yet, with EONIA forwards pricing more than a 10bp cut in December we see a risk for EURUSD to squeeze higher should the ECB disappoint,” Barclays argues.

“We argue that the ECB will not want to risk an unwinding of the recent rebound in inflation expectations and a squeeze higher in the EUR, which would ultimately tighten financial conditions through the rates and FX channels,” Barclays adds.

On this week’s data front, Barclays thinks that they will likely provide little impetus for the EUR to strengthen.

‘We look for euro area flash composite PMI (Monday) to moderate in November as manufacturing posts a slight drop and services confidence holds firm. We should see some decline in German confidence (Tuesday) due to the emerging market slowdown, disappointing latest activity data and the VW scandal and expect German final GDP (Tuesday) to remain unchanged at 0.3% q/q,” Barclays projects.

“We expect EURUSD to remain relatively choppy as we approach the December ECB event risk and see any squeeze higher as an opportunity to re-initiate short EURUSD positions ahead of the meeting,” Barclays advises.

Barclays maintains a short EUR/USD position from 1.1278 with a revised stop at cost and a revised target at 0.99.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.