Gross Domestic Product (GDP) indicator is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Wednesday at … “EUR/USD: Trading the German GDP”

Month: November 2015

EUR/USD: Buy The Rumor, Sell The Fact – SEB

EUR/USD is lower on monetary policy divergence, but is still hesitant. The team at SEB explains the next phases: Here is their view, courtesy of eFXnews: In its weekly note to clients, SEB Group discusses its projection, forecast, and strategy for EUR/USD heading the FOMC December meeting and going into Q1 of 2016. December Liftoff A … “EUR/USD: Buy The Rumor, Sell The Fact – SEB”

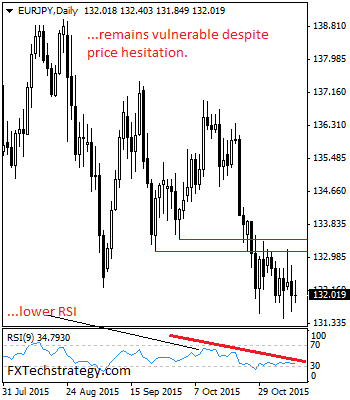

EURJPY Retains Downside Bias Despite Price Hesitation

EURJPY: The cross saw downside pressure on Tuesday though taking back some of those gains. It still remains weak and vulnerable to the downside. We continue to look for more weakness. Support comes in at the 131.50 level. Further down, support stands at the 131.00 level where a violation will aim at the 130.50 level. … “EURJPY Retains Downside Bias Despite Price Hesitation”

USD to rally into 2016 – Credit Suisse

The US dollar certainly had a good 2015, at least so far. The team at Credit Suisse sees further gains into 2016: Here is their view, courtesy of eFXnews: “In January 2015 we noted that the main common trait of structural USD bull markets at the balance of payments level was that any current account … “USD to rally into 2016 – Credit Suisse”

Canadian Dollar Flat, Feels Pressure from Crude Oil

The Canadian dollar was little changed during Wednesday’s quiet trading. Markets in several countries, including Canada and the United States, are closed today due to holidays. Canadian markets were closed due to Remembrance Day while US markets were not working because of Veteran Day. The loonie has been flat during the past few sessions versus the Japanese yen but was slowly rising against the US dollar … “Canadian Dollar Flat, Feels Pressure from Crude Oil”

Dollar Pulls Back on Uncertainty Over Fed

Expectations for the US dollar are dwindling today as Forex traders question the impact of a Fed rate hike in December, and as uncertainty over whether or not December’s rate hike will lead to further hikes sets in. The US dollar has been rallying the last couple of days, heading higher as December — and the expected Federal Reserve rate hike — draws near. However, now some glimmers of uncertainty are showing through in trading and the greenback … “Dollar Pulls Back on Uncertainty Over Fed”

EUR/USD to parity, GBP/USD: USD shining through, USD/JPY: 135.00

Divergence in central bank policy is making trading currency pairs easier, noted Craig Erlam, Senior Market Analyst for Oanda, on the Tip TV Finance Show when he joined Nick Batsford and Zak Mir to discuss the EUR/USD, GBP/USD and USD/JPY. Parity on the cards for the EUR/USD Erlam outlined that if the ECB acts alongside … “EUR/USD to parity, GBP/USD: USD shining through, USD/JPY: 135.00”

Australian Dollar Ignores Negative Chinese Data Again

The Australian dollar gained today, ignoring yet again disappointing economic data from China. Supporting the currency was news from Australia itself, being quite positive. China’s industrial production grew 5.6 percent in October, year-on-year, disappointing economists who had predicted a 5.8 percent increase. On the bright side, The Westpac Melbourne Institute Index of Consumer Sentiment rose by 3.9 percent in November from October. The Aussie trimmed its … “Australian Dollar Ignores Negative Chinese Data Again”

Pound Rises, Shrugs Off Negative Jobs Data

The Great Britain pound rose even though UK employment data released today was detrimental to the currency for the most part. The number of people claiming unemployment related benefits rose by 3,000 in October from September, two times the forecast number of 1,600. Average weekly earnings grew 3.0 percent in the period from July to September compared to the same period a year ago, trailing the analysts’ estimate of 3.2 percent growth. The only positive … “Pound Rises, Shrugs Off Negative Jobs Data”

Fade Rallies In NZD/USD – BNPP

NZD/USD was hit by several factors, mostly a strong US jobs report contradicting a poor one in New Zealand. What’s next for the kiwi? BNP Paribas weighs in: Here is their view, courtesy of eFXnews: In New Zealand, the main takeaway from RBNZ’s latest financial stability report is the increased concerns over loans to dairy farms … “Fade Rallies In NZD/USD – BNPP”