Euro is eking out gains against the US dollar today, but many are unsure of how long that will last. With policy divergence becoming a bigger expectation, there is speculation that euro could be at parity with the dollar by the end of the year. Euro is mostly lower today against its major counterparts, although it has managed to carve out very small returns against … “Euro Ekes Out Gain Against Dollar”

Month: November 2015

NZD Recovers vs. USD, Gains vs. Other Peers

The New Zealand dollar recovered against its US counterpart today following the big drop on Friday. The currency also rose against its other major rivals. The Zealand dollar has sank together with other currencies against the US greenback on Friday after the release of amazing non-farm payrolls. The kiwi recovered a bit on Monday even though the news from China could have been detrimental to the currency. Now, traders wait … “NZD Recovers vs. USD, Gains vs. Other Peers”

Australian Dollar Opens Sharply Lower, Moves Higher Afterwards

The Australian dollar opened sharply lower today following the release of poor trade data from China over the weekend. The Aussie moved higher after the start of trading as economic data from Australia itself was rather positive. While China’s trade surplus reached the record level of $61.64 billion in October, the report was not good at all. The increase of trade excess was a result of the fact that imports were falling faster … “Australian Dollar Opens Sharply Lower, Moves Higher Afterwards”

Trading the euro printing machine – MM #75

This show is all about the ECB’s policy: what’s going on and preparing you for the huge December decision with two trade ideas: EUR/USD and German bunds. You are welcome to listen, subscribe and provide feedback. What the ECB did so far: A negative deposit rate and QE have helped but not enough. We discuss the … “Trading the euro printing machine – MM #75”

Is USD Still At Buy At Current Levels? – BNPP

The US dollar raged across the board following the excellent NFP report. Can it continue rising? The team at BNP Paribas weighs in: Here is their view, courtesy of eFXnews: BNP Paribas positioning analysis signals USD positioning was very light heading into last Friday’s jobs release, implying plenty of scope for positions to build in … “Is USD Still At Buy At Current Levels? – BNPP”

EUR/USD: To 1.05, Parity, And Beyond – Goldman Sachs

After the overwhelmingly strong NFP report, EUR/USD has dropped quite a bit. There may be lots more to come. Here is the view from Goldman Sachs: Here is their view, courtesy of eFXnews: In a note to clients today, Goldman Sachs follows-up on its high-conviction call that the period of indecision for the Dollar from the March … “EUR/USD: To 1.05, Parity, And Beyond – Goldman Sachs”

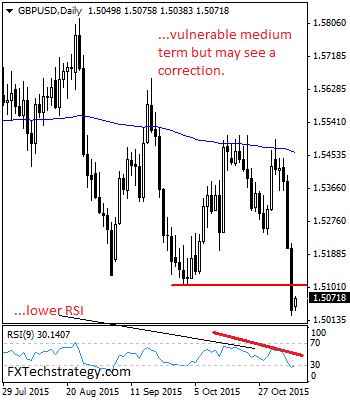

GBPUSD: Vulnerable But Faces Corrective Risk

GBPUSD: The pair sold off to resume its broader downside pressure the past week leaving risk of further weakness on the cards. This view remains valid while GBP can trade and hold below the 1.5133/22 zone. However, we may see price consolidation or even a recovery higher in the new week. Note that the 1.5000 … “GBPUSD: Vulnerable But Faces Corrective Risk”

63 Top Forex Twitter Accounts

Forex trading is fast, very fast, and Twitter fits like a glove to any forex trader’s hand. There’s lots of quick and useful information coming in the form of tweets and sometimes too much information. Here is a list of my top forex twitter accounts, each one coming with different characteristics, to suit traders interested in different … “63 Top Forex Twitter Accounts”

US Dollar Ends Week with Huge Gains After Non-Farm Payrolls

The US dollar soared during this week, climbing more than 2 percent against its major counterparts, thanks to the impressive non-farm payrolls. The positive employment data fueled expectations of a December interest rate hike from the Federal Reserve. The greenback was rising gradually over the week in an anticipation of non-farm payrolls. Yet the market had not been quite prepared to how good the actual report was. Ahead of the data, the US … “US Dollar Ends Week with Huge Gains After Non-Farm Payrolls”

CAD Drops vs. USD, Supported vs. Other Majors by Employment

The Canadian dollar fell more than 1 percent against the US dollar after the release of US employment data. The loonie performed better against its other most-traded peers as the employment report from Canada itself was also good. Canadian employers added 44,000 jobs in October. That is compared to the forecast increase of 9,500 and the previous month’s growth of 12,100. Moreover, the unemployment rate ticked down by 0.1 percentage point … “CAD Drops vs. USD, Supported vs. Other Majors by Employment”