The US dollar surged 1.5 percent versus the euro and soared against other major currencies as well today after the release of very strong non-farm payrolls. Now, the market is pricing in a December rate hike that looks very probable. US non-farm payrolls jumped by 271,000 in October, demonstrating the far bigger rate of growth than the predicted 181,000 and the previous month’s 137,000. The unemployment rate ticked down by 0.1 percentage point … “Dollar Soars After NFP, Market Readies for December Hike”

Month: November 2015

Warnings Against Brexit Continue as UK Pound Trades Mostly Lower

UK pound is mostly lower today, thanks to yesterday’s rate news from the Bank of England. Also, concern that the UK might leave the European Union is affecting the sterling a little bit. UK pound is mostly lower against its major counterparts today, struggling after yesterday’s Bank of England information. Once again, most of the policymakers at the BOE aren’t ready to raise interest rates. Even though there … “Warnings Against Brexit Continue as UK Pound Trades Mostly Lower”

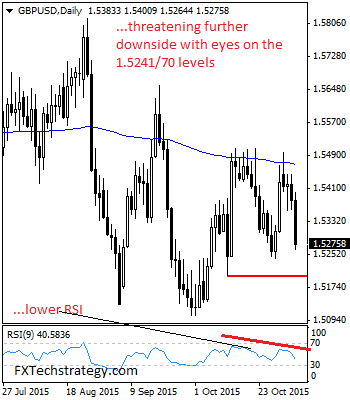

GBPUSD Plunges; Eyes 1.5241/00 Zone

GBPUSD: GBP tumbled further lower during Thursday trading session leaving risk of more weakness on the cards. It now eyes a move lower towards its nearby support located at the 1.5241 level. On the downside, support lies at the 1.5200 level with a break of here turning attention to the 1.5150 level. Further down, support … “GBPUSD Plunges; Eyes 1.5241/00 Zone”

Loonie Struggles After Scotiabank Forecast

Canadian dollar has been struggling recently in Forex trading, and the latest forecast from Scotiabank isn’t helping matters. With predictions for a weak loonie through 2017, the currency is once again heading lower. The latest forecast from Scotiabank calls for the Canadian dollar to possibly bottom out near 73 cents on the US dollar by the end of the year, and then fall even further during 2016. In fact, Scotiabank doesn’t expect the loonie … “Loonie Struggles After Scotiabank Forecast”

EUR/USD: Trading the US NFP Nov 2016

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background Job … “EUR/USD: Trading the US NFP Nov 2016”

Euro Clings to Recent Gains on European Commission Forecasts

Euro is clinging to some earlier gains — but only just. With the ECB due to make a policy announcement and the European Commission making forecasts that expect to see slower growth, many expect the 19-nation currency to slip more against the US dollar. So far today, the euro is managing to hold on to some of its recent gains. However, even though EUR/USD has managed to move about the 1.10 level, many … “Euro Clings to Recent Gains on European Commission Forecasts”

Dollar Soars After Yellen Talks About Possibility of December Rate Hike

The US dollar jumped on Wednesday and retained it gains today after Federal Reserve Chairwoman Janet Yellen confirmed the possibility of an interest rate hike in December. US economic data was also supportive for the greenback. Yellen was testifying on Wednesday in her first public speech since the last week’s policy announcement from the Fed. She said: If the incoming information supports that expectation then our statement indicates that … “Dollar Soars After Yellen Talks About Possibility of December Rate Hike”

EUR/USD – 1.08 key for parity, AUD/USD divergence trade;

In today’s Forex Forecas, we offer the technical outlook for AUD/USD, EUR/USD, GBP/USD and Gold prices, with Craig Erlam, Senior Market Analyst for Oanda. AUD/USD: favouring the downside Erlam maintains a bearish bias on the AUD/USD, explaining that the Aussie remains in its long-term bearish trend. Breaking above 0.73 will signal a big fundamental change. … “EUR/USD – 1.08 key for parity, AUD/USD divergence trade;”

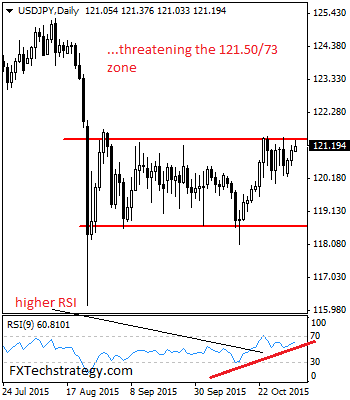

USDJPY: Risk Turns To 121.50/73 Zone On Bull Pressure

USDJPY: With a second day of recovery seeing the pair closing higher on Tuesday, further bullishness is envisaged. It was seen following through higher during early trading today. Beware of the 121.50/73 area because it is key to any full blown bullish offensive. On the upside, resistance resides at the 121.50 level where a cap … “USDJPY: Risk Turns To 121.50/73 Zone On Bull Pressure”

On the morning show, trading and favorite pairs –

I had the pleasure of being interviewed by Maud Gilson of FXStreet around the launch of the morning show (available here). The show is live every morning at 8:00 GMT where we curate the most important events, set the agenda for the upcoming events, dive into charts and most importantly, dive into your questions. In the interview … “On the morning show, trading and favorite pairs –”