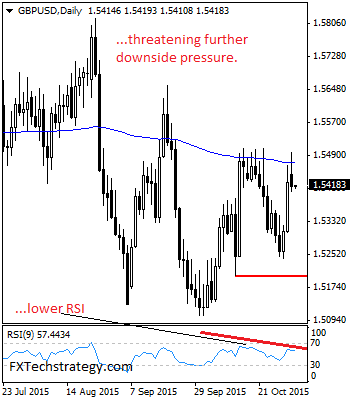

GBPUSD: Having GBP capped its intra day gains at the 1.5505/07 zone to close lower on a rejection candle on Monday, risk of a follow through lower continues to build. On the downside, support lies at the 1.5350 level with a break of here turning attention to the 1.5300 level. Further down, support lies at … “GBPUSD: Risk Of Bear Pressure Builds Up Below The”

Month: November 2015

Prospects & Targets For CAD Into 2016 – Soc Gen

The Canadian dollar was certainly not a winner in 2015. A lot has to do with oil. What lies ahead for the loonie? The team at SocGen weighs in: Here is their view, courtesy of eFXnews: The outlook for the Canadian dollar (CAD) into mid-2016 is for further depreciation against the US dollar, but likely outperformance … “Prospects & Targets For CAD Into 2016 – Soc Gen”

NZD/USD: Trading the New Zealand Employment Change

New Zealand Employment Change is released on a quarterly basis. It is one of the most important New Zealand indicators and an unexpected reading can have a strong effect on the movement of NZD/USD. A reading which is higher than the market forecast is bullish for the New Zealand dollar. Here are the details and 5 possible outcomes for NZD/USD. Published on … “NZD/USD: Trading the New Zealand Employment Change”

Loonie Continues to Fall as Money Flows Out of Canada

Canadian dollar is falling today after a relatively successful run last week. With the oil boom over for Canada, though, there is a lot of money flowing out of the country and the loonie is dropping as a result. Last week, loonie had a relatively successful week. This week, though, most of that success is gone as oil prices continue their drop and as Forex traders take profits. With concerns about … “Loonie Continues to Fall as Money Flows Out of Canada”

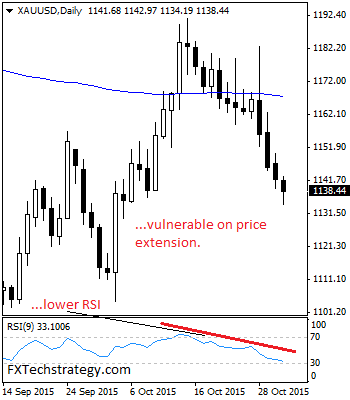

GOLD Remains On The Defensive On Price Extension.

GOLD: With GOLD weakening further on the back of its past week losses during Monday trading session, additional decline is envisaged. On the downside, support comes in at the 1125.00 level where a break will turn attention to the 1110.00 level. Further down, a cut through here will open the door for a move lower … “GOLD Remains On The Defensive On Price Extension.”

Manufacturing Data, Draghi Comments Lift Euro

Euro is heading higher today, enjoying a rally as the latest news out of the eurozone supports the 19-nation currency. Manufacturing data and the latest comments from ECB President Mario Draghi are providing support. Euro is getting a little help today from the latest economic data out of the eurozone. According to Markit Economics, a Purchasing Managers’ Index rose from 52.0 to 52.3 in October. This improvement was unexpected, and is helping … “Manufacturing Data, Draghi Comments Lift Euro”

Australian Dollar Higher After Australian & Chinese Data

The Australian dollar gained today after the release of mixed economic data from China and the positive report from Australia itself. The manufacturing Purchasing Managers’ Index released by the China Federation of Logistics and Purchasing was flat at 49.8 in October, indicating contraction of the sector, while analysts had promised an increase to the neutral 50.0 level. At the same time, the Caixin manufacturing PMI climbed to 48.3 in October from 47.2 in September, exceeding the median forecast of 47.7. … “Australian Dollar Higher After Australian & Chinese Data”

When Fed doves cry – MM #74

The Fed adopted a more hawkish stance and this has implications for the USD, stocks and commodities all the way to the December. We begin by analyzing the statement, continue with discussing US growth in a new light, looking at China and preparing for the big events coming up. You are welcome to listen, subscribe and provide … “When Fed doves cry – MM #74”

EUR/CZK: From floor to Ceiling?

At the previous Czech National Bank meeting, 24 September, it was decided to maintain a zero rate policy. More importantly “…The Bank Board also decided to continue using the exchange rate as an additional instrument for easing the monetary conditions and confirmed the CNB’s commitment to intervene on the foreign exchange market if needed to … “EUR/CZK: From floor to Ceiling?”

What does the Fed Decision Mean for Emerging Market

The Fed FOMC meeting wrapped up on Wednesday 28 October 2015. While no interest-rate hike was introduced, the Fed made no mention of slowing global growth in its statement. A December rate hike is a very real possibility! The Latest Fed FOMC Decision Accelerates EM Currency Declines The Fed FOMC meeting held on the 27/28 … “What does the Fed Decision Mean for Emerging Market”