Chinese Caixin Flash Manufacturing PMI is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in China, and a reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes … “AUD/USD: Trading the Chinese PMI Nov 2015”

Month: November 2015

Euro Ends Week Mixed, Waits for ECB

During the past trading week, the euro was down against the US dollar and the Japanese yen, mostly flat versus the commodity currencies, but managed to gain on the Great Britain pound and the Swiss franc. The euro continued to suffer from anticipation of monetary easing from the European Central Bank that may happen as soon as the next week. Meanwhile, market participants continued to expect monetary tightening from the Federal Reserve. The policy outlook divergence … “Euro Ends Week Mixed, Waits for ECB”

Staying Long USD/CAD Targeting 1.40 – Morgan Stanley

The Canadian dollar was saved from lower ground thanks to the Saudis and their talking up of oil prices. Will this last? Not so fast? Here is their view, courtesy of eFXnews: The rates market is barely pricing in any probability of BoC easing, a major disconnect given still low energy prices and signs of … “Staying Long USD/CAD Targeting 1.40 – Morgan Stanley”

Swiss Franc Sinks to 10-Month Low vs. Dollar & Yen

The Swiss franc slumped to the lowest level in ten months against the US dollar and the Japanese yen today. The currency also sank against its other major peers. The reason for the drop were speculations that if the European Central Bank eases monetary policy then the Swiss National Bank is going to follow suit. Speculations that the ECB would stimulate the struggling European economy even more have been persisting for a while … “Swiss Franc Sinks to 10-Month Low vs. Dollar & Yen”

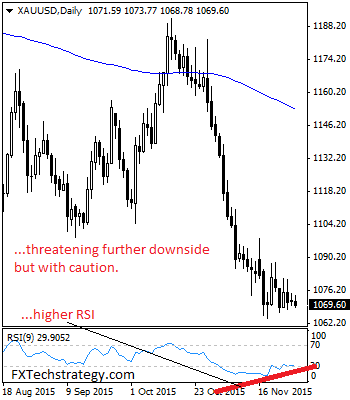

GOLD: Eyes More Bear Pressure, Targets 1064.23

GOLD: Having remained weak and vulnerable, GOLD eyes more bear pressure. It looks to move lower towards its key support located at the 1064.23 level. Price hesitation or a recovery may occur ahead or at that level if it remains unbroken. On the upside, resistance resides at the 1081.00 level where a break will aim … “GOLD: Eyes More Bear Pressure, Targets 1064.23”

Yen Mixed amid Divergent Economic Data

The Japanese yen was mixed today, falling against the US dollar but rising against some other major rivals, like the euro. The divergent performance could be explained by the varying economic reports released today. On the negative front, household spending dropped 2.4 percent in October from a year ago while analysts had expected no change. On the positive side, the Tokyo core Consumer Price Index was unchanged, in contrast … “Yen Mixed amid Divergent Economic Data”

Yuan Drops as Regulators Expand Probe on Brokerages

The Chinese yuan dropped against the US dollar today as the Chinese stock market crashed after regulators expanded their probe on brokerage firms. According to Reuters, Chinese regulators extended their probe to Haitong Securities, China’s fourth biggest securities firm. This led to a more than 5 percent drop of Chinese stocks. Meanwhile, the International Monetary Fund is going to discuss on Monday whether to include the yuan in its basket of currencies. … “Yuan Drops as Regulators Expand Probe on Brokerages”

Canadian Dollar Flat, Can Potentially Go Lower

The Canadian dollar was little changed during Thursday’s quiet trading. The currency fell versus the US dollar intraday but is trading near its opening level currently. Falling prices for crude oil coupled with poor economic data from Canada suggest that the currency may go lower once trading recovers after the holiday in the United States. Profits of Canada’s corporations were down 5.4 percent in the third … “Canadian Dollar Flat, Can Potentially Go Lower”

Euro Continues to Drop as Stimulus Speculations Persist

The euro fell against the US dollar and the Japanese yen and erased its earlier gains versus the Great Britain pound during the Thursday’s quiet trading session as speculations about monetary stimulus from the European Central Bank continue to undermine the currency’s strength. Market participants continue to anticipate that the ECB would ease its monetary policy in December (actually as soon as the next week). At the same time, most of them also expect monetary … “Euro Continues to Drop as Stimulus Speculations Persist”

Economic Data Stops Aussie’s Rally

The Australian dollar dropped today as Australia’s economic data released during the current trading session was not impressive at all. The currency fell for the first day in three against its other major peers. Australia’s private capital expenditure slumped as much as 9.2 percent in the September quarter from the previous three months. This is compared to the forecasts that had promised a much smaller drop by 2.8 percent. The Aussie declined due … “Economic Data Stops Aussie’s Rally”