The Brazilian real dropped today after data that showed an increase of the current account deficit. Yesterday’s decision of the nation’s central bank to keep monetary policy unchanged was also unsupportive to the currency. The current account gap widened from $3.076 billion in September to $4.166 billion in October. Close to the end of the previous session, the Central Bank of Brazil announced that it is leaving its main interest rate at 14.25 percent. The central … “Brazilian Real Falls as Current Account Deficit Widens”

Month: November 2015

GBP/USD: Trading the British Second GDP Nov 2015

British Second GDP, one of the most important economic releases, is published each quarter. GDP measures production and growth of the economy, and is considered by analysts as one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the pound. Update: It’s 0.5% as expected – GBP/USD still … “GBP/USD: Trading the British Second GDP Nov 2015”

5 Reasons To Stay Short EUR/USD – Citi

EUR/USD dipped to lower ground but bounced back to a higher range. The team at Citi explains why staying short is the way to go, with 5 reasons: Here is their view, courtesy of eFXnews: There are 5 good reasons all round for the EUR to weaken with particular focus on EUR/USD, says CitiFX in a … “5 Reasons To Stay Short EUR/USD – Citi”

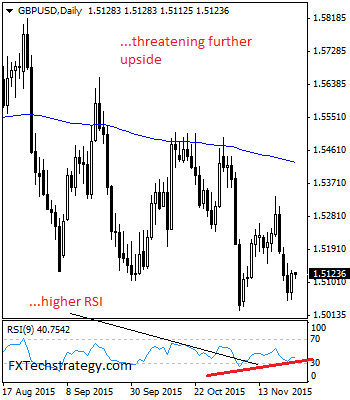

GBPUSD Targets Further Price Build Up

GBPUSD: GBPUSD targets further price build up following its temporary bottom on Wednesday. It looks to extend its recovery towards the 1.5196/99 zone. leaving risk of further move higher. On the downside, support lies at the 1.5100 level where a break will turn attention to the 1.5050 level. Further down, support stands at the 1.5000 … “GBPUSD Targets Further Price Build Up”

Euro Slumps to Fresh 7-Month Low vs. Dollar

The euro slumped on Wednesday and retained its losses during the early Thursday’s trading session, staying near the lowest level since April versus the US dollar. The currency suffered from the outlook for monetary easing from the European Central Bank and risk aversion on the Forex market. Many market participants speculate that the ECB is going to add stimulus on its December policy meeting. Reuters fueled such speculations, reporting that “the European … “Euro Slumps to Fresh 7-Month Low vs. Dollar”

Dollar Mixed During Wednesday’s Quiet Trading

The US dollar gained on the euro and the Japanese yen during Wednesday’s trading but fell against the Great Britain pound. The session was rather quiet as US markets were preparing for the holiday. Economic data released from the United States on Wednesday was somewhat mixed but mostly positive. On Tuesday, a report showed that the third quarter’s growth of the US economic was revised higher compared to the initial estimate. The positive indicators continued … “Dollar Mixed During Wednesday’s Quiet Trading”

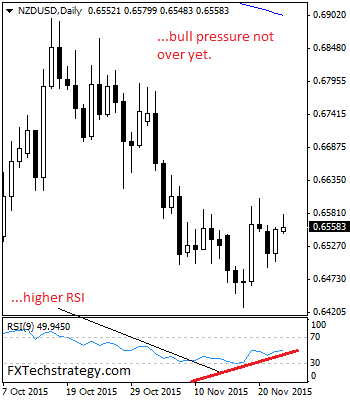

NZDUSD Targets Further Strength On Correction

NZDUSD: With the pair reversing its Monday losses to close higher on Tuesday, NZDUSD targets further bullishness. This view is in line with its loss of downside momentum on the weekly chart the past week. Support lies at the 0.6500 level where a break will aim at the 0.6450 level. Further down, the 0.6400 level … “NZDUSD Targets Further Strength On Correction”

Australian Dollar Attempts to Rally on Steven’s Comments & China

The Australian dollar attempted to rally today on the relatively hawkish remarks from the central bank’s chief and on the news from China. The Aussie pared its initial gains versus the greenback but managed to hold ground against some other majors, including the euro. Glenn Stevens, Governor of the Reserve Bank of Australia, damped prospects for an interest rate hike in the near future. He said: We’ve got Christmas. We should just chill out, … “Australian Dollar Attempts to Rally on Steven’s Comments & China”

Yen Mixed After BoJ Minutes

The Japanese yen rallied against the euro but fell against some other majors, including the US dollar, today. The currency received some support from risk aversion caused by tensions between Turkey and Russia. Minutes of the Japan’s central bank released today left mixed feelings among analysts. The Bank of Japan released minutes of its October meeting, which said: Most members shared the view that, as in the earlier discussion regarding … “Yen Mixed After BoJ Minutes”

EUR/USD On Course To Break 1.0490 – Morgan Stanley

EUR/USD has certainly shown signs of recovery by escaping low ground and looking to rise. However, the team at Morgan Stanley sees the pair en route to break 1.0490: Here is their view, courtesy of eFXnews: The US yield curve has flattened further this week expanding a trend which is now in place for three … “EUR/USD On Course To Break 1.0490 – Morgan Stanley”