The Great Britain pound fell today due to concerns that the struggling economy will not allow the nation’s central bank to raise interest rates as soon as was expected. Mark Carney, Governor of the Bank of England, sounded somewhat cautious during his speech today. Earlier, BoE Chief Economist Andy Haldane said: I see the balance of risks around UK GDP growth and inflation as skewed materially to the downside, more so than … “UK Sterling Down on Diminishing Prospects for Rate Hike”

Month: November 2015

Turkish Lira Weakens on Monetary Policy & Risk Aversion

The Turkish lira fell against the US dollar today after the nation’s central bank kept interest rates unchanged, refraining from monetary tightening. The crash of the Russian warplane, shot by Turkish military forces, fueled risk aversion and thus the weakness of the currency. The Central Bank of the Republic of Turkey kept its borrowing costs stable, leaving its Marginal Funding Rate at 10.75 percent and the borrowing rate at 7.25 percent. Experts say that … “Turkish Lira Weakens on Monetary Policy & Risk Aversion”

EUR/USD: In Thrall Of Fed & ECB; 1.05 Is The

EUR/USD seems to be entrenched in a lower range. What’s next? The team at NAB lays out the battle lines ahead of the Fed and the ECB: Here is their view, courtesy of eFXnews: How much is December Fed rates ‘lift-off’ now in the price of the dollar? How much is intensification of ECB easing … “EUR/USD: In Thrall Of Fed & ECB; 1.05 Is The”

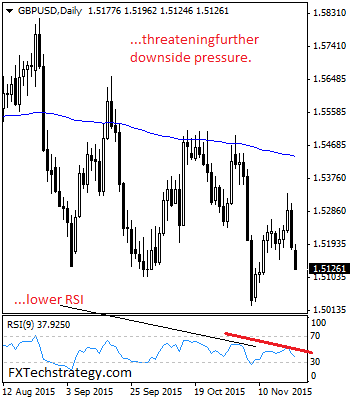

GBPUSD Declines With Eyes On 1.5026 level

GBPUSD: Having GBP extended its weakness during Monday trading session, it looks for further decline in the days ahead towards the 1.5026 level. This is consistent with its downside pressure triggered off the 1.5309 level, its Nov 20 2015 high. Support lies at the 1.5100 level where a break will turn attention to the 1.5050 … “GBPUSD Declines With Eyes On 1.5026 level”

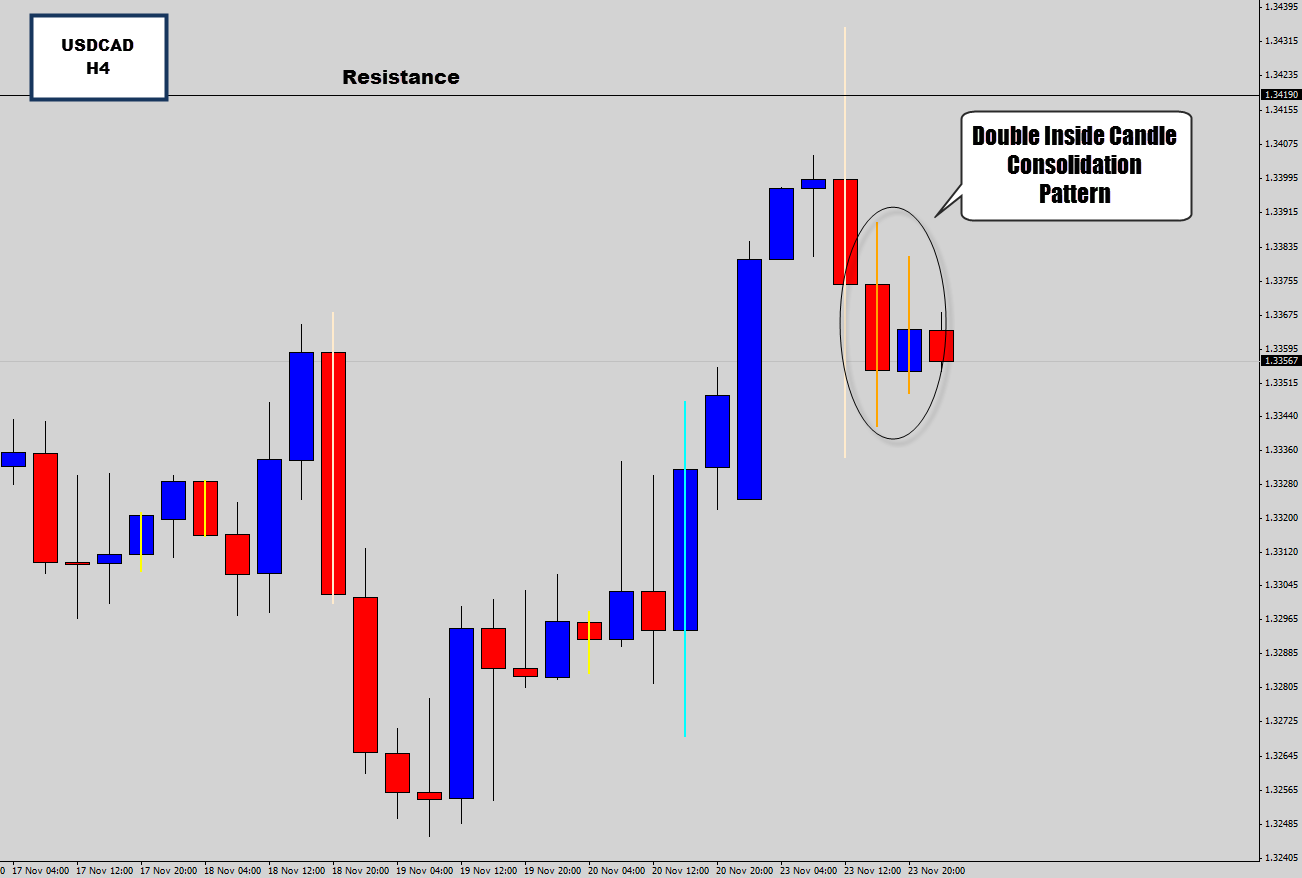

USDCAD Double Inside Day as Price Stalls @ Resistance –

Looking at the USDCAD which has got my attention here as it hits a potential turning point here. Last time the market failed at this level we seen a 500 pip drop on the daily chart. The market tested this level last session, but higher prices were rejected again for a second time at this … “USDCAD Double Inside Day as Price Stalls @ Resistance –”

Euro Off Daily Lows, Remains Subdued

The euro bounced from its daily lows with the help of positive economic data. Still, the currency was on a defensive due to the outlook for stimulus from the European Central Bank. Markit economics released several positive reports during the Monday’s trading session. Among them was the one that showed an unexpected increase of Germany’s manufacturing index to the highest level in three months. Indicators of the whole eurozone were good as well. The positive reports … “Euro Off Daily Lows, Remains Subdued”

Dollar Strong During Monday’s Trading

The US dollar was strong during the Monday’s session despite some worse-than-expected reports released from the United States. The greenback trimmed its gains but was trading above the opening level. The dollar continues to receive support from the outlook for a December interest rate lift-off from the Federal Reserve. The CME FedWatch shows a 74 percent probability of the rate hike next month. San Francisco Fed President John Williams reinforced … “Dollar Strong During Monday’s Trading”

EUR/USD: Trading the US Preliminary GDP Nov 2015

US Preliminary GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity, and publication of Preliminary GDP could have a significant impact on the movement of EUR/USD. A reading which is better than the market forecast is bullish for the dollar. Update: US GDP revised … “EUR/USD: Trading the US Preliminary GDP Nov 2015”

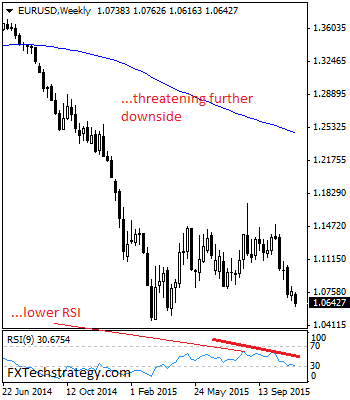

EURUSD Maintains Bear Pressure

EURUSD: With the pair failing to follow through higher on the back of its previous gains the past week, further downside pressure is likely in the new week. This development now leaves EUR eyeing its key support located at the 1.0519 level. However, immediate risk comes in at 1.0600 level where a break will expose … “EURUSD Maintains Bear Pressure”

Sell EUR/USD On Any Squeeze Higher Into ECB Dec Meeting

EUR/USD is showing fresh weakness in the new trading week. If it rises, the team at Barclays suggests selling the pair, especially as the December decision looms. Here is their view, courtesy of eFXnews: Barclays Capital expects the USD to trade sidelines during the next week as markets wait for policy action coming from the FOMC … “Sell EUR/USD On Any Squeeze Higher Into ECB Dec Meeting”