Economic news from New Zealand released over the weekend was good for the most part. Yet it did not prevent the New Zealand dollar from falling during Monday’s trading. New Zealand retail sales grew 1.6 percent during the September quarter of 2015, exceeding analysts’ expectations. Yet market participants were not in the mood to buy risky assets after the last week’s terrorist attacks in France. As a result, … “NZD Falls Despite Positive News from New Zealand”

Month: November 2015

Yen Retreats After Opening Sharply Higher

The Japanese yen opened sharply higher due to risk aversion caused by terrorist attacks in France. Yet the currency pared back gains after data released on Monday showed that Japan’s economy slipped into recession. According to the preliminary estimate, Japan’s gross domestic product contracted 0.2 percent in the third quarter of this year compared to the predicted fall by 0.1 percent. GDP shrank during the previous three months as well, meaning … “Yen Retreats After Opening Sharply Higher”

Turning Point for Aussie, RBA?

Before the terror attacks in Paris, the Aussie was turning in a strong performance following better than expected economic data. As a result, some feel that the Reserve Bank of Australia will soon reduce its dovishness. Risk aversion is the general trend today on the Forex market, due to the tragic terror attacks in Paris at the end of last week. As a result, high beta currencies like the Australian dollar are mostly lower today. However, … “Turning Point for Aussie, RBA?”

EUR/USD: Trading the German ZEW Nov 2015

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Update: Gernan ZEW recovers to 10.4 Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday … “EUR/USD: Trading the German ZEW Nov 2015”

December Decision Drives Dollar – #76

We start off with discussing the upbeat US figures and what it means for December, continue with tumbling oil prices and preview the upcoming events. You are welcome to listen, subscribe, provide feedback and pledge support on Patreon. December rate hike?: An upbeat NFP including wage hikes as well as some other positive developments (consumer focused) raise expectations for … “December Decision Drives Dollar – #76”

When Will The USD Peak? – SocGen

The USD is showing a lot of strength, but nothing lasts forever. The team at SocGen asks when we’ll see the peak of the greenback: Here is their view, courtesy of eFXnews: The FOMC will raise rates in December, unless put off by softer economic data, falling commodity prices, a strong dollar or emerging market volatility, … “When Will The USD Peak? – SocGen”

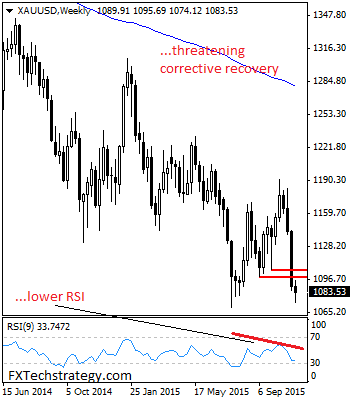

GOLD Looks To Push Higher

GOLD: The commodity may have closed lower the past week, but faces a recovery risk in the new week. While it holds above the 1069.46 level, a recovery higher is expected. On the downside, support comes in at the 1075.00 level where a break will turn attention to the 1060.00 level. Further down, a cut … “GOLD Looks To Push Higher”

Maintaining EUR/USD shorts targeting 0.99 – Barclays

EUR/USD consolidated its losses and stayed at the 1.07 handle. What’s next for the pair? The team at Barclays Capital was short and it now revises its targets considering a wider range of policy outcomes: Here is their view, courtesy of eFXnews: Barclays Capital continues to see significant further downside in EUR/USD but expects the extent … “Maintaining EUR/USD shorts targeting 0.99 – Barclays”

Dollar in Consolidation Mode During Week After NFP

The US dollar halted its rally this week after the previous week’s huge gains caused by the very positive employment report. The greenback was flat against some currencies and down against others. The dollar demonstrated an impressive rally during the previous week but was in a consolidation mode during this week. Several US policy makers delivered speeches over the week, but they did not provide any new … “Dollar in Consolidation Mode During Week After NFP”

Canadian Dollar Mixed Close to End of Trading

The Canadian dollar was mixed today, falling against the US dollar, rising versus the euro and staying flat against the Japanese yen. The Canadian dollar showed no clear trend during Friday’s trading. The currency fell against the strong greenback, gained on the vulnerable euro and moved little versus the yen. Over the longer term, crude oil remains a negative factor for the currency. Prices for the commodity dropped more than 2 percent today. … “Canadian Dollar Mixed Close to End of Trading”