The eurozone once again missed estimates for GDP and officials continue to talk about more stimulus. As a result, the euro is once against struggling against many of its major counterparts in Forex trading. The results for the third quarter economic reports are in for the eurozone, and once again the 19-nation currency region has disappointed analysts. GDP rose by 0.3 per cent for the third quarter, after seeing 0.4 per cent growth in the previous quarter. … “Euro Continues to Struggle on Stimulus Expectations”

Month: November 2015

Greenback Clings to Gains After Retail Sales Data

US dollar is clinging to earlier gains following the release of disappointing retail sales data. The dollar index is higher today, even with the disappointing news and disappointment in the lack of stronger signals from the Federal Reserve. Even though many expect the Federal Reserve to begin raising rates in December, stronger signals of this policy are lacking right now. On top of that, the latest retail sales data has disappointed investors … “Greenback Clings to Gains After Retail Sales Data”

EUR/USD shows us it’s vulnerable

Yet another disappointing retail sales report was not good enough: EUR/USD initially advanced, but this didn’t last too long. While other currencies also failed to rally against the dollar, the euro shows that it is the weakest: falling fast and falling the hardest. While the pair is still in range, this reaction shows that it … “EUR/USD shows us it’s vulnerable”

Yen Pares Losses vs. Dollar & Pound

The Japanese yen pared its earlier losses against other majors, including the US dollar and the Great Britain pound, today. Economic data released over the Friday’s session from Japan was good but did little to help the currency. Japan’s industrial production rose 1.1 percent in September on a seasonally adjusted basis according to the revised estimate, which was a bit above the preliminary figure of 1.0 percent. Yet the report had … “Yen Pares Losses vs. Dollar & Pound”

Australian Dollar Gains for Third Session

The Australian dollar continued to rise today for the third consecutive trading session. Yesterday, the currency demonstrated substantial gains due to an amazing jobs report from Australia. Australian employers added as much as 58,600 jobs in October compared to the median forecast of 14,800. The unemployment rate fell unexpectedly from 6.2 percent to 5.9 percent. The Aussie slowed its rally today but was still trading near the highest level in a week against its … “Australian Dollar Gains for Third Session”

Orbex presents Scientific FX Training Series

Cyprus based forex broker Orbex launches a new series of geometric trading webinars as part of the scientific FX training series. All the details from the press release are below: Orbex is always on the edge of market knowledge. Now we are bringing to our clients a revolutionary and scientific way of trading– Geometric Patterns Trading. … “Orbex presents Scientific FX Training Series”

A Sluggish Economy Keeps the Yen Lower

Sluggish economic news is keeping the yen lower in Forex trading on the currency market. With economic news indicating a slow recovery, there is no reason to expect policymakers to quit easing anytime soon, and that could mean more weakness in the yen. The latest flash machine tools orders showed a decline of 23.1 per cent year over year in October, and there are other signs that the economy is moving … “A Sluggish Economy Keeps the Yen Lower”

Draghi Stimulus Hint Sends Euro Lower in Forex Trading

ECB President Mario Draghi has signalled that there is a good chance that policymakers will add stimulus to the eurozone economy in December and that is sending the 19-nation euro down today. Also dropping are commodities. Earlier, Mario Draghi addressed the European Parliament, expressing his disappointment in current inflation dynamics and insisting that they are week. He said that normalizing a desired level of inflation could … “Draghi Stimulus Hint Sends Euro Lower in Forex Trading”

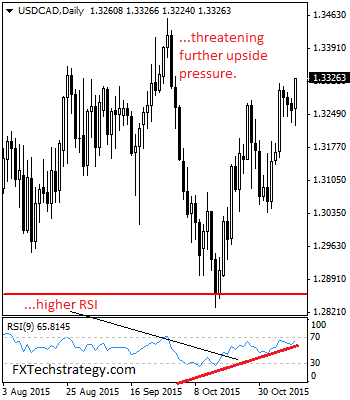

USDCAD Strengthens On Intra-Day Price Reversal

USDCAD: The pair reversed its intra day losses to trigger its trend resumption during Thursday trading session. This price action now leaves USDCAD targeting more bullish offensive towards the 1.3350 level. A break of here will open the door for more strength towards the 1.3400 level. Further out, resistance comes in at the 1.3450 level … “USDCAD Strengthens On Intra-Day Price Reversal”

What Stands In The Way Of A Relentless Fall In

EUR/USD dropped a lot on recent monetary policy divergence expectations, but still hesitates. What’s holding it back? The team at Credit Suisse provides answers: Here is their view, courtesy of eFXnews: In its weekly note to clients today, Credit Suisse discusses its outlook for EUR/USD heading into the Fed and ECB December meetings. CS outlines … “What Stands In The Way Of A Relentless Fall In”