EUR/USD rallied hard, over 400 pips on Draghi’s disappointment (see 10 points). What’s next?

The team at CIBC examines:

Here is their view, courtesy of eFXnews:

Expectations were set high in advance of this week’s ECB meeting, notes CIBC World Markets.

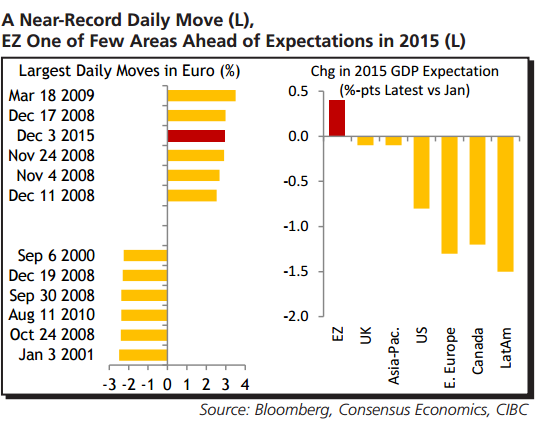

“Too high. Even though Mario Draghi announced an extension to QE, the measures were less than markets had expected and saw the euro soar. Indeed, the gain during that day was the third largest ever, exhibiting a level of volatility not seen since the financial crisis,” CIBC adds.

“However, that doesn’t mean the Eurozone economy will suffer. It’s one of the few areas set to beat consensus expectations this year—an indication that the ECB’s policies were working even before this week’s announcement. And we also think it could top forecasts for 2016 as well,” CIBC argues.

“Look for the euro to hold above parity, albeit falling to 1.04 in Q1 after the Fed starts to hike,” CIBC projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.