EUR/USD has extended its recovery after a few days of consolidating the Draghi Disappointment.

Does it have more room to the upside? The team at Bank of America Merrill Lynch explain:

Here is their view, courtesy of eFXnews:

Buying EUR/USD short-term upside is our top contrarian trade in the year ahead.

It looks much less controversial after the ECB disappointed last week and the Euro squeezed higher. Although we remain bearish EUR/USD in the long term and expect it to weaken to 0.95 by end-2016, our year-ahead report saw upside risks in the short term. The short EUR position ahead of the ECB meeting was not as stretched as it was last March, but it was getting close. Indeed, the price action after Draghi fell far short from market expectations reflected a painful positioning squeeze. Short Euro remains the most crowded trade in G10, suggesting further upside risks in the short term.

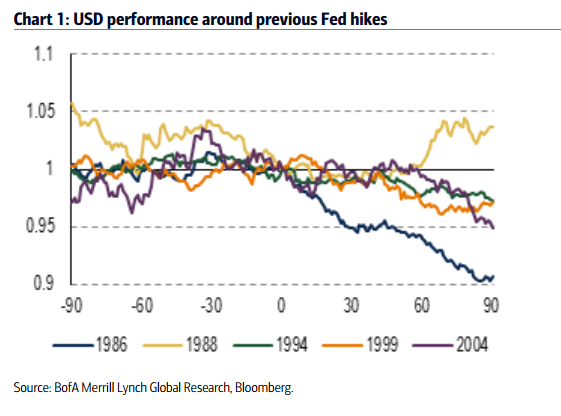

Moreover, a dovish Fed hike, or a risk-off market reaction to the first Fed hike and a sell-off in Eurozone equities could push EUR/USD higher. This is in fact in line with historical performance that has seen USD trade lower four out of the past five times the Fed began a tightening cycle (Chart 1).

Our year ahead recommended buying a EUR/USD 3m 1.10 call with a 16th Dec 1.1050 window KO. This trade is already in the money following the upward EUR positioning squeeze after the ECB disappointed last week. We will revisit this trade after the FOMC.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.