The US dollar suffered a short squeeze despite an advance in the odds for a rate hike. Does this build into a rise on the Fed December Decision?

The team at Goldman Sachs makes the case for staying bullish:

Here is their view, courtesy of eFXnews:

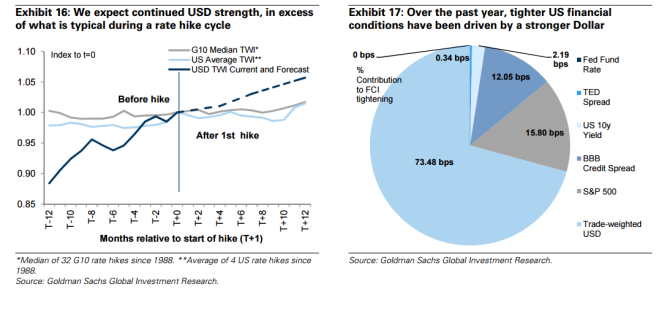

“Next week, we expect the Fed to announce its first rate hike in over a decade. Historically, rate hike cycles are anticipated by markets, lead to slowly evolving economic shifts and are well digested by markets. The upcoming rate hike fits this template in some aspects, but there are elements of the current landscape that may make this time different on several fronts.

…With Fed hikes looming, easing elsewhere, and low inflation priced, we are bullish the USD and bearish rates, given that inflation risks seem to be overly discounted by markets. US equities may be stuck somewhere in the middle, with growth low and level, rates rising and financial conditions tightening. The data flow has not been encouraging either. Even if the Fed is mindful of not overtightening financial conditions, it will be equally careful not to get too far behind the curve. And if the data do pick up, it may need to rein in growth expectations.

Although the ECB disappointed markets in early December, we continue to be USD bulls. In large part this is because of how differentiated the US policy path is and how much more hiking we expect relative to the market, and because both Japan and Europe are still in easing mode. Of course, much of this has been reflected in markets already, and to some extent this is why the market reaction to the ECB communication was so dramatic.

But from here, we still expect the USD to strengthen in 2016, with a revised year-end forecast of parity vs. the Euro and an unchanged forecast of 130 versus the Yen. And we continue to recommend a Top Trade to go long the USD against an equally weighted basket of Yen and Euro.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.