Many suspect that the expected Fed hike is already priced in, leading to a “buy the rumor, sell the fact” reaction. Is it really so?

Here is the view from BNP Paribas:

Here is their view, courtesy of eFXnews:

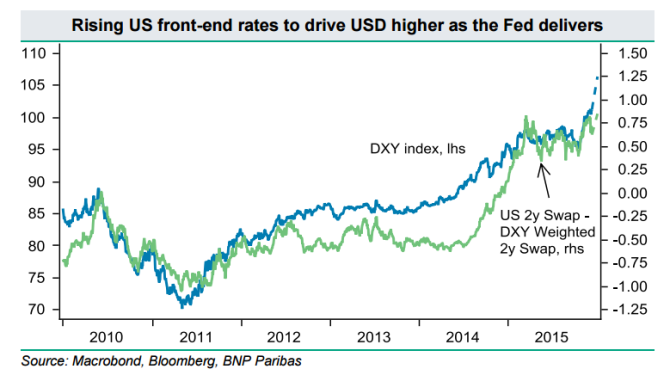

BNP Paribas expects the US Federal Reserve to hike rates by 25bp on Wednesday (16 December) and thinks current FX levels are attractive for putting on long USD positions.

“Our rate strategists expect a rise of around 50bp in US 2y yields by early 2016 to provide substantial support to the USD.

Furthermore, BNP Paribas FX Positioning Analysis suggests long USD positioning is relatively neutral at +6 (on a scale of +/-50).

This leaves room for long USD positions to be built up ahead of the FOMC meeting and reduces the risk of a post-FOMC squeeze on the USD, particularly as recent USD weakness lowers the risk of the Fed sounding overly concerned about FX levels next week,” BNPP argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.