Following the rate hike and the resulting USD rally, the team at SocGen sees more potential, even if this may occasionally see bumps.

Here is their take:

Here is their view, courtesy of eFXnews:

“The focus will now be on the timing of the next Fed move, the pace thereafter, and the implications for commodity prices, capital flows out of emerging markets and China’s currency policy.

If the Fed raises rates by 1% next year – in line with the path implied by the FOMC’s forecasts – the dollar will be significantly stronger by December 2016. In practise, they’ll tighten less, in part because of further dollar strength.

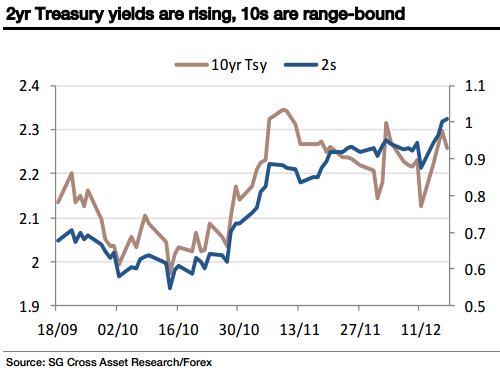

At 161bp, the 10-year Treasury/Bund spread remains in its recent range and until we see the Treasury market selloff, the downside to EUR/USD will probably be limited. I referred yesterday to the bullish DXY outlook highlighted by a Technical Strategists and I remain mindful both of that and of the fact that monetary policy divergence is likely to take EUR/USD to parity in due course. Still, progress towards that level may, at least initially, be choppy and slow.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.