The Fed hike certainly moved markets and helped the dollar. What’s next for the pound and the euro?

The team at SocGen weighs in:

Here is their view, courtesy of eFXnews:

Undercurrent in GBP/USD continues to remain weak, notes SocGen.

“The pair has confirmed a H&S recently and is now approaching towards previous lows at 1.45/1.42 which also corresponds with a multiyear channel,” SocGen projects.

“Short term recovery, if any is likely to face resistance at 1.5530. Graphical levels at 1.63/1.64 will be key resistance,” SocGen adds.

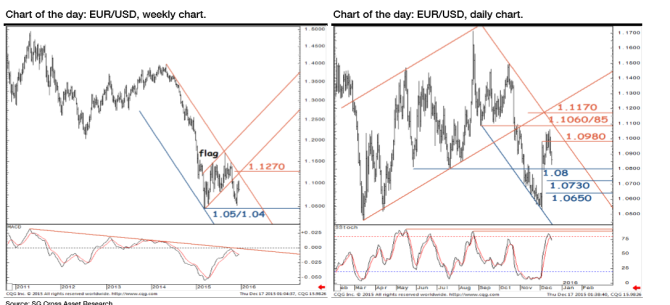

Turning to EUR/USD, SocGen notes its rebound faced first resistance at the advocated level of 1.1060/85 and the pair has drifted towards graphical support at 1.08 which also corresponds with the 50% retracement of recent recovery.

“Weekly indicator still languishes in negative territory and below its trigger level which suggests upside is likely to remain capped. 1.0980 is an immediate resistance while only a move above 1.1060/85 will mean possibility of further recovery. In such a scenario descending channel limit at 1.1170 will be next resistance. Short term, a down move looks more plausible,”SocGen notes.

“A break below 1.08 will lead to test of next retracement levels at 1.0730 and even 1.0650,” SocGen argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.